Plan Contents

- Section 1: Summary of the Minneapolis Plan to End Too Big To Fail

- Section 2: Recommendations: Key Support and Motivation

- Section 3: General Empirical Approach for the Capital and Leverage Tax Recommendations

- Section 4. Technical Calculations for the Capital and Leverage Tax Recommendations

- Section 5: The Banking and Financial System Post-Proposal Implementation

- Appendix A: The Leverage Ratio in the Minneapolis Plan

- Appendix B: Ending TBTF Initiative Process

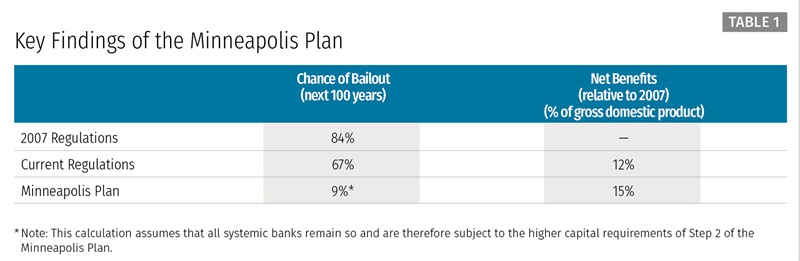

The Minneapolis Plan reduces the risk of a financial crisis, and resultant bailout, over the next 100 years to 9 percent, with the net benefits equaling 15 percent of gross domestic product (GDP), as shown in Table 1.1 The current regulations, put into place after the 2008 financial crisis, are considerably less effective in reducing risk, lowering the 100-year chance of a bailout from 84 percent to 67 percent.2

We carefully assess both benefits and costs of the Plan and, despite the notably higher equity capital requirements, the Minneapolis Plan still passes a benefit and cost test relative to current regulations.

In brief, the Minneapolis Plan will (Step 1) increase the minimum capital requirements for “covered banks3” to 23.5 percent of risk-weighted assets, (Step 2) force covered banks to be no longer systemically important—as judged by the U.S. Treasury Secretary—or face a systemic risk charge (SRC), bringing their total capital up to a maximum of 38 percent over time, (Step 3) impose a 1.2 percent tax on the borrowings of shadow banks with assets over $50 billion for entities considered not systemically important by the Treasury Secretary and a 2.2 percent tax for shadow banks that are considered systemically important, and (Step 4) create a much simpler and less-burdensome supervisory and regulatory regime for community banks. Covered banks and shadow banks will have five years after enactment of the minimum capital requirements and shadow banking tax to come into compliance. The assessment of systemic risk by the Treasury Secretary will begin at this five-year mark.

We come to this recommendation after spending two years reviewing and analyzing the TBTF problem, consulting with a broad range of experts and the greater public, and releasing a draft proposal and responding to comments we received on it.

The main points and findings of our Plan and analysis are the following:

The TBTF problem is one of the U.S. economy's most serious long-term risks.

The TBTF problem arises when the largest and most systemically important banks fail and impose their losses onto other banks. The spread of these losses fuels contagion as turmoil spreads throughout financial markets and into the rest of the economy. As the U.S. economy experienced in the most recent crisis, these spillover losses have the ability to cause massive and widespread economic devastation. When faced with economic catastrophe, government leaders are inevitably compelled to stop the hemorrhaging by bailing out large banks, bank managers, and those who lent money to the banks.

In 2008, the risk of contagion presented by TBTF banks was central to the financial crisis. As a result, trillions of dollars in American wealth was destroyed. Even now, ten years later, the effects of the crisis continue to be felt throughout the economy.

Despite reforms, the TBTF problem persists.

Soon after the crisis, policymakers moved swiftly to approve reforms to the financial system to help move the country in the right direction. These reforms have indeed strengthened the financial system, and we support many of these efforts. However, some experts agree that TBTF still exists today because current plans to address it have not been fully implemented. More importantly, we believe that the government’s current plan, even when fully implemented, will not sufficiently minimize the threat of TBTF.

The current plan fundamentally rests on the belief that the government will, through a complicated scheme, force debt holders of TBTF banks to absorb losses—even when the economy and financial markets appear weak. Yet our experience in the 2008 crisis teaches us that when markets show weakness, even debt holders of TBTF financial firms who were informed that they would bear losses in such times of distress do not actually incur any hit. This recent lesson of history and human behavior in times of market stress makes clear that it is not credible to believe that any scheme, especially a complicated one, would work to impose losses on debt holders of TBTF banks when the next crisis occurs. We have no reason to believe that the government will follow through on its current plan in the next crisis because imposing losses on debt holders of TBTF banks in a weak environment will be viewed as too risky and complex with a high likelihood of intensifying a crisis. In fact, the most recent experience with European debt holders of banks who were supposed to take losses to avoid bailouts confirms our view that debt holders, in general, continue to be protected. (See Kashkari 2017.)

A wide range of transformational reforms to end TBTF were considered.

Within our two-year Ending TBTF initiative, our review included, but was not limited to, breaking up banks, forcing banks to become much safer through higher levels of equity funding, taxing leverage, and improving the resolution regime for banks. In evaluating these various proposals, two guiding principles emerged as the basis of any policy recommendations: Reforms must be simple enough that they can be easily implemented and allowed to work amid the chaos of a crisis, and reforms must pass a benefit and cost test.

As discussed below, our proposal effectively melds ideas from virtually all of these transformative proposals. We advocate for much higher capital requirements for large banks and a tax on leverage for shadow banks. We also believe our Plan will lead covered banks to break themselves up so that they are no longer considered systemically important while funded with much more equity. The societal benefit will be a financial system featuring smaller banks with a much lower chance of failure. If these smaller banks do fail, they will not trigger contagion to other banks and the broader economy.

We do not view improvements to currently proposed resolution schemes as a viable option because they focus on imposing losses on bondholders during a crisis. We also do not support breakup plans that merely separate investment banking from commercial banking. This latter recommendation focuses on the wrong issue and would not prevent future bailouts.

We have also considered proposals for banking reform issued by the Treasury Department and passed by the House of Representatives in 2017. These proposals do not go far enough to limit the exposure of taxpayers to bank bailouts.4

Guiding Principles of the Minneapolis Plan

After two years of study and analysis, we conclude that a higher equity capital requirement is the best reform policy because it is simple to implement and directly addresses the TBTF issue. When covered banks hold more equity capital, their individual likelihood of failure is reduced, and the risk of and magnitude for contagion spreading across banks or throughout the economy is also lower. We stress that the capital must be of high quality. In our Plan, we restrict our definition of capital to be common equity or closely related items.5 We acknowledge that a byproduct of imposing higher capital requirements onto banks may be the migration of risky activity from the banking sector to nonbank financial firms, where capital requirements are lower. We address this unequal treatment across sectors by taxing the borrowings of large nonbank financial firms—also known as shadow banks. This tax would effectively make the cost of funds roughly equivalent between large banks and nonbanks.

In crafting the Minneapolis Plan, one of our concerns was the treatment of community banks. A primary purpose of the Ending TBTF initiative is to reduce the risk of contagion when systemically important banks fail. Community banks, however, do not pose the same level of risk as large banks. It is certainly a traumatic event when a community bank fails. We do not minimize the consequences to those who are forced to take losses in such instances. Such localized failure, however, does not threaten the overall economy. Thus, community banks deserve a separate regulatory and supervisory solvency regime that recognizes their role in the financial system and focuses on the few, but important, factors that truly put them at risk of failure.

The Minneapolis Plan to end TBTF has four steps:

-

Step 1. Dramatically increase common equity capital, substantially reducing the chance of a bailout

We will require covered banks to hold equity capital equal to 23.5 percent of risk-weighted assets, with a corresponding leverage ratio of 15 percent. (See Appendix A for a description of how we derive the corresponding leverage ratio.) This level of capital nearly maximizes the net benefits to society from higher capital levels. This first step reduces the chance of a public bailout relative to current regulations from 67 percent to 39 percent. This substantial improvement in safety has a cost, but the benefits exceed the costs by a considerable margin. Covered banks will have five years to come into compliance with this requirement.

-

Step 2. Call on the U.S. Treasury Secretary to certify that covered banks are no longer systemically important, or else subject those banks to further increases in capital requirements, which may lead many to fundamentally restructure themselves

Once the new 23.5 percent capital standard has been implemented, we will call on the Treasury Secretary to certify that each covered bank is no longer systemically important. Our proposal gives the Treasury Secretary the discretion to make this determination so that the Secretary can rely on the best information and analysis available. We suggest that the Treasury Secretary start by reviewing existing metrics of systemic risk used to determine current surcharges for global systemically important banks (GSIBs). The Treasury Secretary will also have the authority to look beyond covered banks in making the determination. If the Treasury Secretary refuses to certify that a covered bank is no longer systemically important, that bank will automatically face increasing equity capital requirements, an additional 5 percent of risk-weighted assets per year. This process will begin five years after enactment of the Minneapolis Plan. The bank’s capital requirements will continue increasing either until the Treasury Secretary certifies the bank as no longer systemically important or until the bank’s capital reaches 38 percent, the level of capital that reduces the 100-year chance of a crisis to 9 percent.6

Step 2 is a critical step for ending TBTF. Under the current regulatory structure, there is no explicit timeline for ending TBTF, and regulators never have to formally certify that large banks and shadow banks are no longer systemically important. Instead, banks and designated nonbank financial firms can continue to operate under their explicit or implicit status as TBTF institutions potentially indefinitely. The Minneapolis Plan reverses this approach and gives the Treasury Secretary a new mandate with a hard deadline. Five years after enactment of the Minneapolis Plan, either the Treasury Secretary will certify that large banks are no longer systemically important or those banks will face further increases in equity capital requirements.

We believe that these automatic increases in capital requirements will lead banks to restructure themselves such that their failure will not pose the spillovers that they do today and lead to future bailouts. We chose the capital level that reduces the probability of a bailout in Organisation for Economic Co-operation and Development (OECD) countries to 10 percent or below while keeping total costs below benefits. This level of capital is appropriate for the largest banks that remain systemically important, as their failure alone could bring down the banking system.

The only banks that would remain systemically important after the Minneapolis Plan has been fully implemented would have 38 percent equity capital, with a risk of failure that is exceptionally low. This is similar to the approach regulators have taken with nuclear power plants: While not risk-free, plants are so highly regulated that the risk of failure is effectively minimized. Step 2 of the Minneapolis Plan reduces the chance of a future bailout to 9 percent over 100 years.

A wide range of research released in 2017, independent of the Minneapolis Plan and using differing methodologies, supports the levels of equity capital we propose. See Section 3 more details on this work.

-

Step 3. Prevent future TBTF problems in the shadow financial sector through a shadow banking tax on leverage

We discourage the movement of activity from the banking sector to the shadow banking sector by levying a shadow banking tax. The tax equalizes the funding costs between the two sectors. The tax will have two rates. For shadow banks that do not pose systemic risk, as judged by the Treasury Secretary, we would levy a tax on shadow bank borrowing of 1.2 percent. Shadow banks that the Treasury Secretary refuses to designate as not systemically important would face a 2.2 percent shadow banking tax.

Thus, the shadow banking tax regime mirrors our two-tier capital regime. These taxes should reduce the incentive to move banking activity from highly capitalized large banks to less-regulated firms that are not subject to such stringent capital requirements. Nonbank financial firms that fund their activities with equity do not pay the tax. Shadow banks will have five years from enactment of the Minneapolis Plan before they begin paying the shadow banking tax. The Treasury Secretary will start making certifications as to the systemic importance of shadow banks at that point. Here, too, we grant the Treasury Secretary discretion to look across all nonbank financial firms in the certification process.

-

Step 4. Reduce unnecessary regulatory burden on community banks

Ending TBTF means creating a regulatory system that maximizes the benefits from supervision and regulation while minimizing the costs. The final step of the Minneapolis Plan would allow the government to reform its current supervision and regulation of community banks to a system that is simpler and less burdensome while maintaining its ability to identify and address bank risk-taking that threatens solvency.

The rest of this document is organized as follows:

- Section 2 discusses the proposal in more detail, focusing on key support and motivation for our recommendations.

- Section 3 describes the general empirical approach behind our capital and leverage tax recommendations.

- Section 4 describes the more-technical calculations behind the capital and leverage tax recommendations.

- Section 5 provides a very brief vision for the future of the banking system once the Minneapolis Plan is implemented.

- Appendix A explains why we recommend a leverage ratio target and how we calculate it.

- Appendix B describes some but not all of the input we received in the process of engaging with the public and experts on steps to end TBTF.

References are compiled at the end of the document.

Our November 2016 draft Plan, a Summary for Policymakers, and a response to the comments we received on our draft Plan are also available.

Endnotes

1 This Plan is the final version of a draft originally released in November 2016. Much of the November 2016 draft analyzed the benefits and costs of imposing higher capital requirements on select banks. The data and results of the benefit and cost analysis in the final Plan are the same as those used in the November 2016 draft Plan. Specifically, the November 2016 Plan was based on data on returns, loans, and risk-weighted assets through the end of 2015. When we repeated the computational exercises with updated data through the end of 2016, the results remained essentially unchanged, so we have not revised the results and figures.

2 Throughout the Plan, our calculations for Step 2 assume that all banks considered systemically important in Step 1 remain so and are subject to significantly higher capital requirements than those laid out in Step 1. However, covered banks may take action to shed their designation as systemically important.

3 “Covered banks” are bank holding companies in the United States with assets equal to or greater than $250 billion. We choose the $250 billion level as our initial threshold, as this size is consistent with an important definition of systemically important banks. For example, the Federal Reserve requires banks of this size to comply with the Liquidity Coverage Ratio. Covered banks as of the November 2016 draft Plan were Bank of America Corporation, Bank of New York Mellon Corporation, Citigroup, Capital One Financial Corporation, Goldman Sachs Group, HSBC North America Holdings, JPMorgan Chase & Company, Morgan Stanley, PNC Financial Services Group, State Street Corporation, TD Group U.S. Holdings, U.S. Bancorp, and Wells Fargo & Company. We do not address the treatment of financial market utilities in our Plan. Note: As of June 30, 2017, State Street Corporation had dropped below $250 billion.

4 The House of Representatives passed the Financial CHOICE Act on June 8, 2017. The Treasury Department released “A Financial System That Creates Economic Opportunity: Banks and Credit Unions” in June 2017. Both efforts cover a wide range of reforms that exceed the scope of the Minneapolis Plan. That said, the Financial CHOICE Act would create an “off-ramp,” allowing banks with a leverage ratio of 10 percent to not face a host of banking regulations, such as the Comprehensive Capital Assessment and Review (i.e., the “stress test”) and post-financial-crisis liquidity rules. The Treasury report is less definitive, suggesting the consideration of such an off-ramp and referencing, by example, a higher leverage ratio of 10 percent. As we explain in the rest of the Plan, we call for more equity capital to achieve the reduction in bailout probabilities that we think is sufficient. Moreover, if banks do not choose the off-ramp, they will continue to fund themselves with the inadequate levels of equity capital seen today.

5 We are counting as “equity capital” or “capital” the items that are allowed to count in the Common Equity Tier 1 requirement, which is defined as common shares for regulatory purposes, surplus stock, retained earnings, accumulated other comprehensive income, and common shares issued by consolidated subsidiaries. The sum of these elements is subject to a limited set of regulatory adjustments. For more specifics, see Federal Register (2013a). This rule implements the Basel III regulatory capital reforms from the Basel Committee on Banking Supervision and certain changes required by the Dodd-Frank Wall Street Reform and Consumer Protection Act.

6 Our assessment that the probability of a bailout falls to 9 percent is contingent on at least some of the systemically important banks covered under Step 1 remaining systemically important and increasing their capital ratios to meet the 38 percent minimum established in Step 2. In the extreme alternative case in which none of them are officially systemically important and continue to have a minimum capital ratio of 23.5 percent, the probability of a bailout would remain at 39 percent as in Step 1. However, to lose their designations as systemically important, the covered banks would have made changes, such as shrinking or changing their business models. In this case, the probability of a bailout would likely be lower than 39 percent, but we are not able to compute a specific value given our analytical approach.