In September, the list of countries suffering government debt scares in 2022 gained an unusual member: Lebanon. Zambia. Sri Lanka. The United Kingdom.

One of these things is, as they say, not exactly like the others. The plunging prices and rush to exit U.K. government bonds (known as “gilts”) did not presage an imminent default. The Bank of England had the authority and credibility to avert an immediate financial crisis. An abrupt about-face on policy was enough to quell the panic.

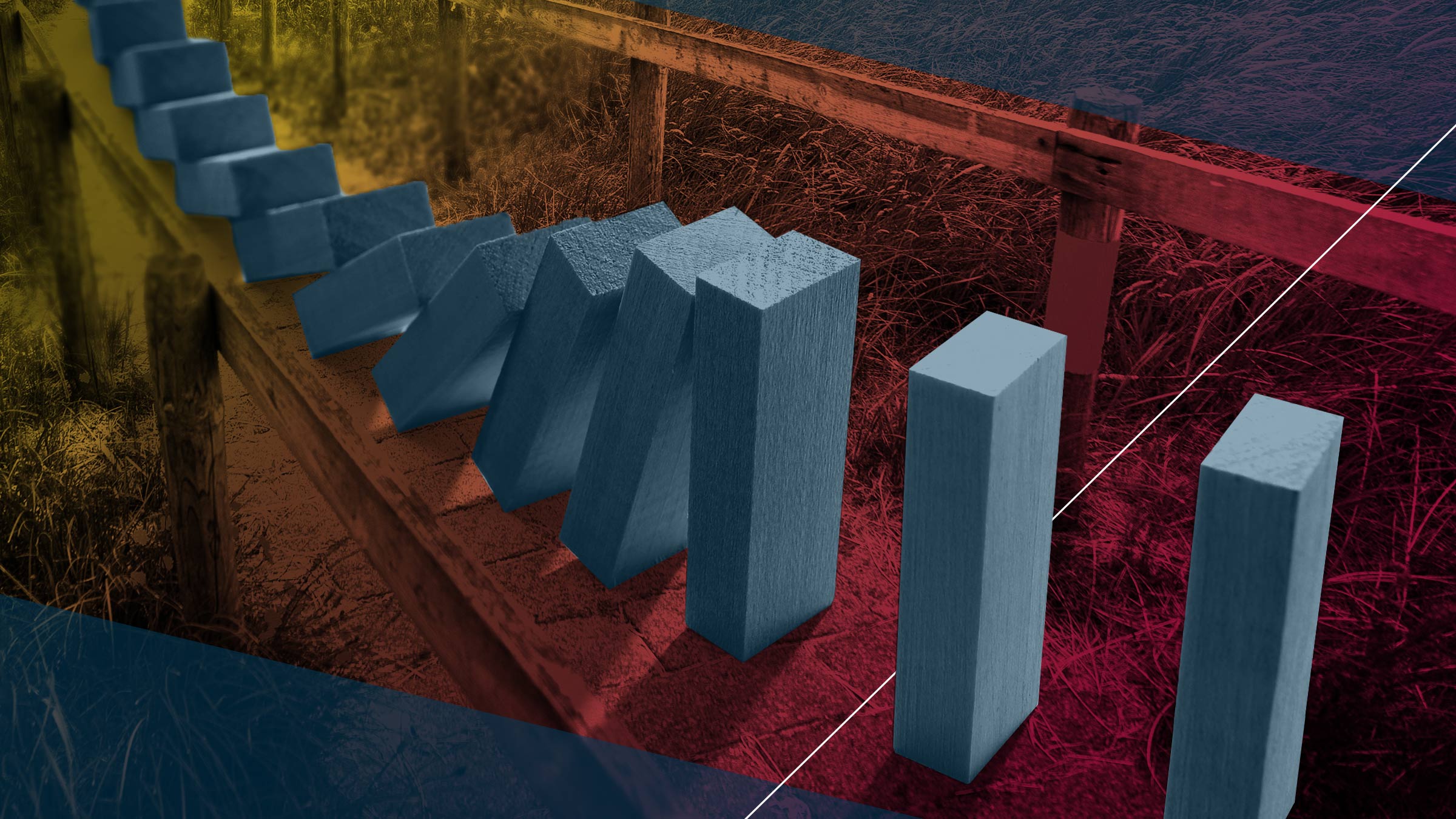

But the “gilt meltdown” of 2022 was a reminder that countries rich, poor, and in-between are loaded with debt following the COVID-19 pandemic (Figure 1). It was also evidence that this weight of sovereign debt restricts a government’s ability to maneuver amid high inflation and potential recession: Investors felt a proposed U.K. tax and spending plan was unsustainable, sparking a run on gilts and Britain’s currency, the pound.

Worry over government debt can bring swift consequences, as the U.K.’s shortest-serving prime minister just discovered.

Specialists on fear and contagion

With no collateral or international bankruptcy court, loans made to governments are fundamentally built on faith. The estimated $70 trillion of global sovereign debt rests on a calculated wager by investors that (1) economic conditions won’t collapse and (2) future governments will honor debt commitments.

“Expectations and the pessimism of investors can make things very difficult, very quickly,” said Monetary Advisor Javier Bianchi, among the cadre of economists who make the Minneapolis Fed a hub of expertise on sovereign debt crises. The sudden crisis-of-confidence in the U.K. “suggests that it can happen in other advanced economies,” said Bianchi—not to mention the dozens of precarious, developing economies already distressed by heavy debt payments.

With investors, banks, and other governments around the world exposed to sovereign debt, fear and panic about one country’s debt can easily spill over to others. “Contagion is an issue,” said Minneapolis Fed Monetary Advisor Manuel Amador. Although the World Bank and the International Monetary Fund (IMF) provide a limited backstop for the poorest nations, the sovereign debt market operates largely without a safety net. “We do not have an international ‘lender of last resort,’” said Amador.

In 1995, Minneapolis Fed consultant Timothy Kehoe co-authored (with economist Harold Cole) one of the initial, seminal papers demonstrating how fear itself can, perversely, spark a “self-fulfilling” sovereign debt crisis that pushes a government into default. Twenty-five years later, those insights feel as relevant as ever. For international economists, Kehoe said the current moment is rich with research potential. “But as citizens of the world,” he added, “we are very worried about this.”

This economic specialty that might seem on the fringe in normal times is now in high demand. Bianchi, Amador, and Minneapolis Fed Assistant Director of Policy Cristina Arellano have organized a timely research conference on sovereign debt for this November at the Bank. Kehoe, meanwhile, departs on a four-country speaking tour of Latin America, where he has researched and advised governments through decades of debt and currency crises.

Sovereign debt squeezed between inflation and stagnation

To economists who model sovereign debt, the economic circumstances of 2022 present a rare and nasty profile: heavy borrowing, followed by inflation, with prospects for a global recession.

“COVID was a big shock for many nations in terms of their ability to survive such a fiscally big event,” said Amador, author of the recent book The Economics of Sovereign Debt and Default with Minneapolis Fed consultant Mark Aguiar. Governments borrowed what they could to support their economies through lockdowns and unemployment. “Now the question is, after this debt has been accumulated, can they survive this massive increase in interest rates that is building up?”

Inflation has two crosscutting effects for borrowing countries (just as it does for households). It makes existing debt more affordable; all else equal, payments become cheaper as money falls in value. Unfortunately, inflation makes new debt more expensive as interest rates rise in conjunction with efforts to contain rising prices. As existing bonds reach their maturity dates, all countries must “roll over” their debt, issuing new bonds at current rates. But this rollover effect hits sooner and harder for developing countries that are more reliant on shorter-term bonds.

The pain is compounded outside the United States by the global dominance of the dollar. Even as the U.S. experiences inflation, the dollar has strengthened almost 15 percent in 2022 against other global currencies. This makes existing debt payments more expensive for countries that borrowed in dollars (Figure 2), particularly in Latin America, where 17 percent of public debt is dollar-denominated.

The falling value of foreign currencies against the dollar also increases inflation pressure in other countries, and with it the urgency for those countries to counter inflation with higher domestic interest rates. These governments must also raise rates to continue attracting sovereign debt investors, who are otherwise tempted by rising rates in the U.S. and the perception that the U.S. is a safer haven for their money. As the dollar strengthens, foreign governments are compelled to simultaneously slow their economies and make it more expensive to borrow.

Through multiple channels, U.S. efforts to battle inflation at home can complicate matters elsewhere, particularly in global debt markets. “Whatever the United States does affects the rest of the world, big-time,” said Amador. “And this has implications for the U.S. itself when these [actions] come back to affect the U.S. economy.” A wave of destabilizing defaults and bailouts would hurt us all.

“Not going to grow our way out”

In economic models, one factor can break the spiral toward sovereign debt default: economic growth.

“Our work indicates that with long-term debt, two factors make self-fulfilling default highly likely,” wrote Minneapolis Fed Senior Research Economist Juan Pablo Nicolini in 2016, reflecting on the European debt crisis of 2012. “First … the total value of debt; second, the prospect of economic stagnation.”

Both conditions appear satisfied in 2022. After rising steadily for years, pandemic borrowing drove global public debt levels to nearly 100 percent of world gross domestic product (GDP), a level only matched in modern times in the aftermath of the two World Wars.

And the outlook for growth is discouraging. The IMF projects global economic growth to slow from 6 percent annually in 2021 to 2.7 percent by 2023. While the slowdown in GDP growth will be most pronounced in the U.S., Europe, and China, many lower-income countries rely on exports to the rest of the world to service their sovereign debt loads. According to the United Nations Conference on Trade and Development (UNCTAD), “global financial conditions … put already fragile debt sustainability in many, though not all, developing countries in further and acute peril.” Middle- and low-income countries nearly across the board have seen a worsening in their ratios of debt-to-exports, and a growing number now spend more than 20 percent of government revenues just to service their debt.

The weak economic outlook generally depresses confidence and the risk perceived by investors, which further pushes up the interest rates on new sovereign bonds for countries expected to struggle. “We’re not going to grow our way out of this,” said Minneapolis Fed consultant Kehoe. “We could, but it’s not looking good right at the moment.”

Ten years later, lessons and limitations of the European crisis

From 2009–2012, a succession of sovereign debt scares in Europe caught nearly everyone off guard. “That was shocking,” said Amador, as the panic spread beyond Greece to Ireland, Spain, Portugal, and Italy. “That was a time that, for academics, we realized that this is a problem that can occur in many places.”

“That event was a critical moment that reminded us that the old view—that basically sovereign debt crises and currency crises were largely accidents along the way of development for emerging-market economics—was misplaced,” said Minneapolis Fed Research Director Andrea Raffo.

For better and for worse, 2022 is not 2012. Importantly, the public debt contagion in Europe was intimately connected to private real estate and banking crises, which led to massive government bailouts. It unfolded during a period of recession and sluggish recovery. Today’s economy features a much different mix of inflation and strong labor markets. Unlike 2012, there are no evident seeds of a wider banking crisis (although a recent report from the Fed tracks other elements of “elevated” risks to financial system stability).

On the other hand, today’s sovereign debt levels are higher, by a huge margin, than those that framed the eurozone debt crisis. “Back in 2012, the debt level in Spain was 30 percent of GDP. Now it is 120 percent,” said Bianchi. “If Spain got into trouble at just 30 percent of GDP, one could imagine that at current levels it is also very vulnerable, especially if interest rates keep rising.”

Similarly, Italy’s sovereign debt is around 150 percent of GDP. Yet “somehow, it has very low spreads” over bonds from countries like Germany or the U.S., Bianchi said, suggesting that the market does not appear to expect a default from Spain or Italy despite their high debt and fiscal challenges. Bianchi points out that real interest rates—the true cost of credit after inflation—remain extremely low.

Investors also “think the ECB will step in if there’s a confidence crisis,” Bianchi said. In July 2012, European Central Bank President Mario Draghi effectively halted the crisis with his now-famous “whatever it takes” speech, assuring a global audience that the ECB would buy the bonds of eurozone countries in whatever quantities were required to restore confidence. “And believe me,” Draghi continued, “it will be enough.”

In a recent paper, Bianchi and economist Jorge Mondragon Minero found that nations in a currency union like the eurozone are more vulnerable to a rollover crisis—more likely to default—because they lack the ability, in times of stress, to stabilize their economies with an independent monetary policy. This makes the ECB a crucial actor as debt levels rise.

With today’s rampant inflation, however, policymakers would have less room to maneuver in a crisis, since any large-scale rescue purchase of government bonds could undermine efforts to contain the rising price level. Instead, the ECB has rolled out a nuanced policy called the Transmission Protection Instrument (TPI). Under the TPI, the ECB could purchase a nation’s bonds in a targeted fashion “to counter unwarranted, disorderly market dynamics”—in other words, to counter an emerging pressure on a eurozone country’s debt that the ECB judges to be irrational and unwarranted.

However, the tool hardly promises to do “whatever it takes.” It states that any bond-buying activities “would be conducted such that they cause no persistent impact on the overall Eurosystem balance sheet and hence on the monetary policy stance.” Trying to strike this delicate balance—targeted easing to help a single country amid broader monetary tightening for the whole eurozone—underscores the challenge for policymakers of forestalling a debt crisis at a time of inflation.

Different debts, different dangers

While nearly all countries have sovereign debt, the pressures it creates and the potential path to crisis look very different.

The current stew of economic conditions is pushing many lower-income, over-extended countries closer to outright default. The IMF judges that 60 percent of low-income and 30 percent of “emerging market” countries are “at or near debt distress.” Examples come from everywhere: In Africa, where 60 percent of countries are in debt distress, Angola’s public debt rose to 136 percent of GDP in 2020, with nearly 60 percent of government revenues now going to service debt payments. In Asia, Sri Lanka has already defaulted in 2022 after years of profligate spending—funded by borrowing in U.S. dollars and from China—left it with a full-blown economic crisis and no foreign currency to make payments. The sovereign debt of Argentina has ballooned in the past five years and is projected to exceed $20,000 per Argentine by 2025.

The role of China is a global X-factor, as both a debtor and a creditor. China’s own debt service payments have tripled since 2015, at the same time as its economy is slowing. China has also emerged as a massive lender to developing countries that might be headed for trouble—although data on debts owed to China are far from transparent. “We don’t know how much debt to China some of these countries really have,” said Amador. “How is it going to be renegotiated? How long is that going to take?”

For low-income countries, the IMF warns that existing international structures are not enough to contain the potential string of debt defaults. A pandemic-era agreement to suspend debt payments for some low-income countries expired in 2021. The Paris Club is a long-standing group of 22 wealthy countries that coordinate to relieve debts of low-income countries, but its power is limited given the widening use of Chinese and nonpublic sources of credit. “Policymakers need to take a cooperative approach to ease the debt burdens of the most vulnerable countries, foster greater debt sustainability, and balance the interests of debtors and creditors,” the IMF wrote in a recent blog post.

Countries like the U.S. and U.K., on the other hand, may carry debt above 100 percent of GDP without raising concerns of default. The constraint instead, as the recent U.K. gilt meltdown showed, is a reduced space for expensive tax and spending policies and the prospect of tighter belts tomorrow. “When we borrow today, it means we have to cut down on spending in the future,” said Bianchi. “It’s an intertemporal trade-off.”

An alternate danger is that governments and citizens come to expect or depend on persistent, embedded inflation to reduce the real value of debt payments, known as “monetizing the debt.” Economists Francesco Bianchi and Leonardo Melosi laid out just such a scenario for Fed policymakers in a paper for this year’s Jackson Hole symposium: “When the fiscal authority is not perceived as fully responsible for covering the existing fiscal imbalances, the private sector expects that inflation will rise to ensure sustainability of national debt. As a result, a large fiscal imbalance combined with a weakening fiscal credibility may lead trend inflation to drift away from the long-run target chosen by the monetary authority.”

Although U.S. policymakers flirt with the notion of default with each congressional battle to raise the debt ceiling, the likelihood that the U.S. would fail to meet its obligations feels remote—even as the federal debt surpasses a new height of $31 trillion. Nonetheless, Minneapolis Fed economists continue to model and measure, imagining the unimaginable.

“The U.S. has this amazing credit record. Everybody is very credible and committed to repay the debt and their house is in order,” said the Minneapolis Fed’s Cristina Arellano. “But if there was a situation where that changes, then you want to have the right people [to provide policy advice]. All of us who work on sovereign debt, who have the background on what sovereign debt crises look like—this is something that we study, and the Minneapolis Fed would be the perfect ‘Fed’ to think about these conditions.”

Jeff Horwich is the senior economics writer for the Minneapolis Fed. He has been an economic journalist with public radio, commissioned examiner for the Consumer Financial Protection Bureau, and director of policy and communications for the Minneapolis Public Housing Authority. He received his master’s degree in applied economics from the University of Minnesota.