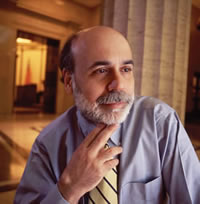

Since joining the Fed's Board of Governors in August 2002, Ben Bernanke has been the focus of intense media scrutiny. And in their search for an angle, the media frequently portray Bernanke as something of a maverick. One newspaper profile calls him the Fed's "resident free thinker"; a popular business magazine suggests he's a "firebrand" who shakes up the Fed by "pitching curves." The adjective "outspoken" is often applied.

Such descriptions are a bit puzzling. Bernanke is quite serious, very disciplined and rather soft-spoken. He's the product of Ivy League schools, a member of the National Bureau of Economic Research, a highly respected macroeconomist, the former chair of Princeton's economics department. Neither his credentials nor his manner confirms the hype of an eccentric dissident at the Fed.

Such descriptions are a bit puzzling. Bernanke is quite serious, very disciplined and rather soft-spoken. He's the product of Ivy League schools, a member of the National Bureau of Economic Research, a highly respected macroeconomist, the former chair of Princeton's economics department. Neither his credentials nor his manner confirms the hype of an eccentric dissident at the Fed.

What Bernanke does bring to the Board is intellectual leadership, verbal power and precision, and a prodigious work ethic. If he pushes the curve, it's in the sense that he continually encourages his colleagues to reexamine conventional wisdom in light of changing conditions and advances in theory. And his willingness to speak his mind stems from a conviction that clear communication is part and parcel of good monetary policy.

Bernanke's transition from the obscurity of academe to the media-saturated maelstrom of Fed policymaking may have started formally two years ago, but the unofficial change probably began somewhat earlier, in January 2000, when he co-authored a Wall Street Journal op-ed titled "What Happens When Greenspan is Gone?" In the following conversation with Minneapolis Fed Research Director Art Rolnick, Gov. Bernanke provides a glimpse of that world.

INFLATION TARGETING

Rolnick: For several years now, you've argued that inflation targeting will improve monetary policymaking by anchoring the public's inflation expectations and by improving Fed accountability. Some of us would argue that we're already practicing something like that de facto, with our public commitment to price stability. In what sense is your proposal a substantive change in policy? If we did move to an explicit target, what would be the benefits?

Bernanke: It's true that the Federal Reserve is already practicing something close to de facto inflation targeting, and I think we've seen many benefits from that. My main suggestion is to take the natural next step and to give an explicit objective, that is, to provide the public with a working definition of price stability in the form of a number or a numerical range for inflation. I believe that that step, though incremental, would have significant marginal benefits relative to current practice.

First and very importantly, such a step would increase the coherence of policy. Currently, the FOMC [Federal Open Market Committee] makes its decisions without an agreed-upon definition of price stability or of the inflation objective, and one wonders how oarsmen pulling in different directions can get the boat to go in a straight line. I think the FOMC's decision-making process would be improved if members shared a collective view of where we want the inflation rate to be once the economy is on a steady expansion path.

Second, there's a great deal of evidence now that tightly anchored public expectations of inflation are very beneficial, not only for stabilizing inflation but also in reducing the volatility of output and giving the Federal Reserve more ability in the short run to respond flexibly to shocks that may hit the economy.

Inflation expectations in the United States are better anchored than they used to be but are still too volatile for optimum performance of the economy. Announcing an actual number or range would serve to anchor public expectations of inflation more firmly and avoid the risk of "inflation scares" that might unnecessarily raise nominal bond yields.

Third, from a communications viewpoint, financial markets would be well served by knowing the medium- to long-term inflation objective of the Fed. An explicit inflation objective would help market participants accurately price long-term assets, both by anchoring long-term inflation expectations and by giving the market better information about the likely path of short-term policy as the Fed moves toward its long-term target. And fourth and finally, I think an inflation target does introduce an additional measure of accountability for the Federal Reserve, although I would put that as least important of the things I've mentioned.

Rolnick: Much of what you mention we've achieved over the last 20 years without an explicit target. According to current market expectations we appear to have credibility. Inflation expectations, as best we can measure, are now pretty low. So even though there may be different oars in the water, we seem to be going in the same direction.

However, there is a rationale in the economic policy literature to justify inflation targets, that is, the problem of time inconsistency. Are you saying that an explicit inflation target is more of a commitment, harder to overturn and hence better equipped to deal with time inconsistency?

Bernanke: No, I think we have achieved a substantial degree of credibility based on the record of low inflation and that reduces the inflation bias problem already in itself. However, I think that announcing a target would strengthen our commitment to the price-stability objective and also give more emphasis to long-run considerations in policymaking. Our policy meetings are very often focused on near-term developments. Having a medium- to long-term inflation objective would force us to keep in view where we want the economy to be in the longer run.

I question, though, whether we have achieved as much as you suggest in terms of anchoring inflation expectations. In fact we see significant fluctuations in expected inflation. There are a number of research papers providing evidence that inflation expectations respond significantly to changes in actual inflation, for example, suggesting that long-term expectations are partially adaptive and not as well tied down as we would like. Bond yields are easier to understand under the hypothesis that long-term inflation expectations change significantly at times. And inflation compensation in indexed securities is higher (suggesting a large inflation risk premium) and more volatile than we would like to see it. So while we have indeed achieved a considerable improvement in the degree to which inflation expectations are anchored, more could be done, and there would be very little cost to taking this extra step to strengthen that commitment.

Rolnick: Is there any danger that once you make your inflation target explicit, the market will give it too much importance? Most misses from the target will not matter that much to the overall economy. Hence, the advantage of an implicit target.

Bernanke: Well, I don't advocate a strict inflation-targeting regime that attempts to maintain inflation at the target level all the time, by any means. Rather, I think it's worth specifying our objective for the average steady-state inflation rate over a longer period of time, understanding that the actual inflation rate would deviate around that level. Everyone understands that the Fed cannot maintain inflation at a fixed level even if it wanted to, given the shocks that buffet the economy; nor is doing so even desirable, because of short-run stabilization objectives. But I still think it would be useful additional information to know what the Fed's objective is at a medium-term horizon.

FED COMMUNICATION

Rolnick: That's certainly consistent with your views on the importance of Fed communication and transparency. Presumably, though, there is some value in maintaining a level of control over information related to FOMC deliberations: limiting miscommunication, giving the Fed room to change its mind, so to speak, recognizing the high-frequency noise. Should we think of it as a trade-off?

Or if transparency in and of itself is the right principle, shouldn't we release more information about our policy process; for example, shouldn't we release the Greenbook [which contains the Fed staff's national model and economic forecasts] after each FOMC meeting? Wouldn't releasing the Greenbook be consistent with transparency and improve the way the market responds to our policies? Or is there some point at which providing this much information is counterproductive?

Bernanke: I think that the kind of information you want to release is information that helps the market and the public achieve more accurate expectations of future policy and the future state of the economy. Not all information is beneficial. One would not want to release information that would compromise the decision-making process; for example, televising the FOMC meeting would not be productive. For the same reason, I'm not sure that releasing the Greenbook after each meeting would be productive because it would put too much emphasis on the staff's forecasts. The staff's forecasts are for the information and the assistance of the FOMC decision-making process. The FOMC, not the general public, is the client of the staff.

I am in favor of making greater use of the FOMC's central tendency forecasts for communication. In one of my earlier speeches I suggested that the FOMC release more information (for example, for longer forecast horizons) about our view of the state of the economy, with the purpose of trying to help the public and the markets better understand what our perspective is and what policy is likely to be doing in the future. That's the kind of transparency I think would be most useful. I have also advocated earlier release of the minutes of FOMC meetings, again in order to provide timely information about the views of the Committee and its appraisal of the economy.

DEFLATION

Rolnick: You participated in the Minneapolis Fed's November 2003 workshop on deflation. [See the December 2003 Region.] At that workshop it was clear that there is still a serious debate over the link between deflation and depressions. Some would argue that low levels of deflation, in fact, may actually be good. China is a recent example of a country that experienced deflation and economic growth. What's your current thinking on the downside risks of deflation? Are there good deflations, bad deflations, or is deflation just a red flag that should make us more cautious?

Bernanke: The critical issue in thinking about deflation is whether or not the zero bound on nominal interest rates is binding. The lower the rate of inflation, the lower are nominal interest rates, on average. If a deflation is large and protracted, the chances are much greater that you'll be at the zero bound, the point at which nominal interest rates can no longer fall further. The combination of interest rates at the zero bound and deficient aggregate demand, a situation where the economy is in recession and producing below its productive capacity, is potentially quite dangerous, for several reasons.

First, monetary policy is unable to respond in a conventional manner by lowering interest rates to affect aggregate demand. Although, as I emphasized in my November 21, 2002 speech, there are alternative means by which monetary policy can expand the economy, we have limited experience with them and they are less well understood than the conventional interest-rate tool.

And secondly, at the zero bound there is some possibility of a downward spiral of worsening deflation. With the nominal interest rate stuck at zero and deflation intensifying, the real interest rate becomes higher. That weakens aggregate demand still further and conceivably could generate a vicious circle.

In short, my principal reason for avoiding deflation is that you need to keep short-term nominal interest rates sufficiently above zero to have some room to respond in the case that aggregate demand falls short. There are other reasons as well; for example, deflation can be very hard on the financial system by increasing the real burden of debts. You mention China as a counterexample. Generally speaking, a deflation that accompanies a productivity boom would not be serious because you would have a high real interest rate and the nominal rate would therefore be well above zero. However, the United States is a very interesting example currently of a country experiencing a productivity boom, but for some reason real interest rates don't seem to fully reflect what would appear to be a higher marginal product of capital. The nature of the productivity boom—labor-saving rather than capital-enhancing—may help explain that puzzle.

So for those reasons I think that—going back to the inflation targeting issue—if I were picking an inflation target, I would pick one that was above zero, even above zero accurately measured. The reason would be to have at least a bit of buffer so that the average nominal interest rate is sufficiently above zero that the chances of running into the lower bound are minimized.

Rolnick: In a broad class of general equilibrium models, a Friedman rule—a zero nominal interest rate and a low level of deflation—is optimal. These models seem to be fairly robust to changes in assumptions. Do you think these models are flawed? Are there better alternatives?

Bernanke: I would say that those models are deficient in at least two respects. One problem is that they focus almost entirely on so-called "shoe-leather costs," that is, the cost of minimizing cash holdings (by more frequent trips to the bank, for example) to avoid losses to inflation. But shoe-leather costs are not the only relevant costs of inflation. Even in a steady state there are many other inflation costs, such as costs of price changes and the distortions of tax and accounting rules expressed in nominal terms, which these models don't incorporate. So putting aside cyclical issues entirely and just asking what is the growth-maximizing rate of inflation, it's not evident to me at all that it would be negative.

The second issue is that these models abstract from sticky wages and prices and hence from the possibility of short-run deviations of output from full employment. They don't have any substantial role for stabilization policies. I believe that we live in a world where stabilization policy—stabilization of inflation as well as output—is sometimes needed. For reasons I have just given, the occasional need to use monetary policy for stabilization argues against having negative inflation and zero interest rates on average.

DEBT, DEFICITS AND FISCAL CONSTRAINT

Rolnick: The federal deficit has once again become a major economic concern. By some estimates, the present value of future debt is over $40 trillion. Can you envision constraints on fiscal policy that are similar to the kind of constraints you're advocating with inflation targeting? And what is the public role of the central bank on this issue? As a central bank, how should we respond to this kind of scenario?

Bernanke: Well, the central bank has the responsibility to be a nonpartisan adviser on general matters of macroeconomic and financial stability. So to the extent that deficits and debt are threatening macroeconomic and financial stability, the central bank is one actor that can provide advice and counsel to the fiscal policymakers.

Ultimately, though, the determination of the fiscal debt and deficits is the responsibility of the president and the Congress. To the extent that rules or caps can be useful in forcing Congress to look at the whole budget, as opposed to each individual component and then adding them all up, I think that's certainly worth looking at. But again, that's a decision for the president and Congress to make.

Rolnick: Caps might be an analogy to inflation targeting, providing some constraint?

Bernanke: Some constraint, yes. Certainly there's a constraint that we want to have a balanced budget over a certain period of time. There's the formal constraint that the Europeans have, the Stability and Growth Pact, although experience with that pact shows that rules are not necessarily going to constrain legislators who do not wish to be constrained. Although fiscal policy is different in many ways from monetary policy, it seems to me that, nevertheless, some overall structure for making budgetary policy, some rules about linking spending and taxing decisions, might well be helpful in allowing 535 people to collectively make rational decisions about the state of the budget.

ASSET BUBBLES AND MONETARY POLICY

Rolnick: Some claim they can identify a speculative bubble in a variety of markets. The dot-com sector was viewed as an asset bubble, and then some said we have had a speculative bubble in housing. How confident can we be in identifying such bubbles, and if we can be confident, what's the role of the central bank in dealing with these events?

Bernanke: I think it's extraordinarily difficult for the central bank to know in advance or even after the fact whether or not there's been a bubble in an asset price. The mere fact that an asset price has gone up and come back down again doesn't mean that there was a bubble in the technical sense that the price movement was completely divorced from fundamentals. Moreover, if a bubble does exist, there is no guarantee that an attempt to "pop" it won't lead to violent and undesired adjustments in both markets and the economy. The central bank should focus the use of its single macroeconomic instrument, the short-term interest rate, on price and output stability. It is rarely, if ever, advisable for the central bank to use its interest rate instrument to try to target or control asset price movements, thereby implicitly imposing its view of the proper level of asset prices on financial markets. History has shown us clearly that that type of policy has more often than not led not only to a large decline in asset prices but also to a large decline in the general economy.

I do think there are several useful things that central banks can do about potential mispricing in asset markets. First, I think that many distortions in asset prices have arisen historically because of various kinds of structural regulatory problems in the underlying markets. For example, research on historical episodes suggests that large asset price increases are sometimes preceded by credit booms. In many cases, this pattern results from the fact that the country in question deregulated its banking system, giving banks extra powers, but did not enhance the supervisory structure adequately at the same time. The result is that institutions have an incentive to make economically bad investments, to take advantage of the "put" provided by the government safety net.

So you could have a situation where a badly managed deregulation of some financial market, such as in the case of our own savings and loan crisis or in episodes during the 1980s in Japan and Scandinavia, has the potential to create a one-way bet that generates a destabilizing move in asset prices. It's extremely important for central banks, or for financial supervisory agencies in those countries that have them, to ensure that the underlying microeconomic regulatory structure is such that moral hazard and misalignment of incentives are not pervasive in the system. More often than not, such moral hazard problems are the source of asset prices becoming disconnected from fundamentals. So good oversight of the banking system and of the broader financial system is one very important way in which central banks or other agencies can prevent these kinds of problems.

Secondly, of course, the central bank has a very important obligation to maintain the stability of the underlying institutions. To the extent that there are large movements in asset prices that

threaten the stability or functioning of exchanges or other institutions, the central bank may have to play a role to try to stabilize those institutions, as the Fed did in October 1987 for example.

Ultimately though, I think the main objective of the central bank is to provide macroeconomic stability, and it's neither its comparative advantage nor its objective to try to second-guess the asset price decisions of investors in asset markets.

Rolnick: You've made an interesting point that some of these so-called bubbles may be the result of bad policy.

Bernanke: Yes, that was a theme of my very first speech as a governor. I suggested that, from a policy perspective, there are two ways to approach bubbles: One is interest rate policy, the other is micro-regulatory policy. Micro-regulatory policy is the much better approach, in my view.

THE GREAT DEPRESSION AND MORAL HAZARD

Rolnick: In 1930, the Bank of United States failed. Milton Friedman and Anna Schwartz in their work on the Great Depression argue that the failure of this bank was the pivotal point in what became the worst economic decline in U.S. history. They suggest that if the Fed had rescued this bank, the Great Depression might only have been a short, albeit severe, recession. Some of us have argued that Friedman and Schwartz provide the rationale for the policy that today is known as "too big to fail"—that there are some institutions that are so big that we can't afford to let them fail because of the systemic impact on the rest of the economy. The downside of that policy, of course, is the moral hazard problem. How do you interpret this history?

Bernanke: As a historical matter, whether that particular bank failure was pivotal or was an isolated case is quite controversial. A lot of good research has questioned the Friedman-Schwartz conclusion that that particular episode was the kickoff of the U.S. banking crisis. But certainly, the whole experience of the 1930s clearly shows some of the threats associated with large-scale and pervasive bank failures, including collapse of the money supply, disruptions of credit extension and other banking services, and blows to confidence.

The experience of the Depression led to the creation of deposit insurance, which stabilized banking but created a potential moral hazard. So we required yet another countervailing force, which is the supervisory and regulatory function of the central bank and other bank regulators. The tension between providing stability and dealing with moral hazard problems that arise from guarantees is pervasive in economic policy.

In the case of too big to fail, the question has been raised whether or not the failure of very large banks, because of the many links those banks have with other counterparties, might threaten the stability of the system. I think, generally, we shouldn't have a fixed doctrine; we should have a case-by-case analysis. The default option is that the bank should be allowed to fail. But even in those cases where the central bank and the deposit insurance corporation decide to prevent the failure of a large institution in the interest of systemic stability, there's a great deal to be done to minimize the moral hazard implications. For example, the shareholders can be forced to take losses, the management can be replaced, and other actions can be taken that greatly reduce the incentives to take unwarranted risks.

Rolnick: And uninsured depositors?

Bernanke: I would include in the previous sentence that uninsured depositors should often take some losses as well. So one could try to maintain the functioning of the bank and preserve most of its depository liabilities while still addressing the moral hazard issue. There's a trade-off there, obviously, a trade-off between ensuring the stability of the system and making sure there's enough cost felt by the shareholders, managers and uninsured depositors that the ex ante incentives to take unwarranted risks are minimized.

Rolnick: What do you think of the idea that bank regulators and the federal government should make a commitment that uninsured depositors in large banks will always face some risk? Under such a commitment, markets would price uninsured deposits accordingly, and the price signal could be used by regulators to help evaluate bank risk.

Bernanke: A number of people have suggested that we rely on uninsured, subordinated debt to provide a market signal about the quality of the bank. I think that's a very interesting idea, and I note that market signals play some role in current bank supervision and would continue to do so under the proposed reforms to the Basel capital standards. I would be reluctant to put all of our eggs in that basket, however, because banks are inherently somewhat opaque institutions, and it's not evident that the market signal would be completely informative about the state of the financial institution. So I would supplement market signals with capital requirements and various forms of direct supervision.

Rolnick: Of course, if I'm a really safe bank, I have an incentive to be more transparent.

Bernanke: That's true. These market devices are potentially helpful, and as I mentioned they are in fact part of the Basel II proposal. They should be viewed as complementary to other forms of supervision.

LESSONS FROM THE GREAT DEPRESSION

Rolnick: I would like to come back to the research on the Great Depression of the 1930s and its causes. My view is that the profession has made a lot of progress in understanding this period in our economic history. But it still bothers me that we are far from an agreement as to what caused the Great Depression. We have some understanding of why it may have lasted for 10 years, but even that is controversial. You're clearly one of the leading experts in this area. What's your view? What are the lessons we should learn from the Great Depression? What do you as a governor of the Federal Reserve System take away from that calamity?

Bernanke: The Depression was a very complicated event, a global event with both political and economic causes. For those reasons I'm sure we'll never have a complete understanding or complete agreement about its sources. I do think though that the degree of consensus on the cause of the Depression is probably greater now than it has ever been. And that consensus includes not necessarily an exclusive role but a very important role for both monetary and financial factors.

The collapse of the money supply that was engendered by the combination of mistaken monetary policies in the United States and a few other countries, and the transmission of those policies throughout the world by a gold standard that in many ways had a bias toward deflation built into it, seems clearly to have been the major single cause of the Depression. The evidence for this view—for example, the fact that whether a country adhered to the gold standard after 1931 or not explains much of the difference in cross-country experience—is very strong.

Simultaneously, the world was also afflicted with a great deal of financial instability. Banking crises were not unique to the United States. They were experienced in many other countries, as were exchange rate crises, stock market crashes and the like. Many of these had their roots in the political and economic instability of the 1920s. Many scholars have traced how financial instability can engender bad outcomes in the real economy.

So in terms of the causes, again, I think there's not a full consensus and there never will be, but I think at this moment there is a fairly broad view that these monetary factors and perhaps to a lesser extent financial factors were crucial.

The lessons one learns from that are, first, that monetary stability and price stability are incredibly important for generating overall macroeconomic stability, and second, that financial stability also is of major importance. Because financial instability can generate real instability, maintaining a sound and stable financial system should be a high priority for the central bank and the government.

Those are the two broadest lessons I would draw from it. I think it's important to understand that the deepest cause of the Depression, as [Massachusetts Institute of Technology economic historian] Peter Temin once said, was World War I and the Peace of Versailles that followed it. These left the world not only in an economically fragmented and unbalanced situation but also in a highly contentious political situation. Powerful political forces prevented the kinds of economic cooperation that might have prevented some of the problems that later occurred. So there was a confluence of political and economic factors that made the Depression as severe as it was. But again, if I had to narrow it to two main lessons, I would stress the crucial importance of both monetary and financial stability.

OUTSOURCING CONTROVERSY

AND

ECONOMIC LITERACY

Rolnick: The outsourcing of jobs to India, China and elsewhere has become a huge controversy in the United States. Most economists would say such job flows are a normal and healthy phenomenon. And as you indicated in a recent speech, outsourcing abroad accounts for a very small fraction of total job loss in the United States each year—perhaps a bit more than 1 percent.

Does this controversy indicate that the economics profession has failed to educate the public about international trade in particular and economics more generally? What can be done to improve economic literacy?

Bernanke: As I argued in my recent speech, there is an overwhelming case that trade increases economic welfare. With respect to jobs, it is true that trade promotes structural change that displaces some jobs, but trade creates many opportunities for increased employment as well, including high-wage employment. While recently many people have been concerned specifically about the outsourcing of business services, few are aware that the United States runs a healthy trade surplus in services—that is, there is considerably more (and higher-value) "insourcing" to the United States than there is outsourcing from the United States abroad. Employment of Americans by foreign-owned firms, such as foreign automobile manufacturers, is a major source of domestic employment as well.

With respect to economic literacy, I have no magic bullet; responsible economists just have to keep getting the word out. Specifically with respect to trade, though, I think there is a legitimate issue arising from the fact that you can't buy insurance against losing your job to new foreign competition, so that workers who are displaced by trade bear most of the associated costs, rather than society at large. We should consider expanded support and retraining for workers displaced for any reason. I think if people were a bit less fearful of the impact of change on their own financial well-being they might be more amenable to arguments that trade is highly beneficial to the economy as a whole.

JAPAN'S ECONOMY

Rolnick: Beginning in about 1992, Japan lost a decade of growth. Was poor monetary policy the cause of Japan's stalled economy? If not, what was the cause?

And last year, by contrast, growth in Japan was rapid-per capita GDP grew by over 4 percent. Does better monetary policy account for this dramatic improvement?

Bernanke: Japan's lost decade had a number of causes, including the severe difficulties of its financial system and structural rigidities in its economy (except for its strong export sector). Excessively cautious monetary policy did play a role in the lost decade, however, because it did not do all that it could have done to arrest and reverse the deflation. Recently, monetary policy in Japan has been more proactive. Together with a long-delayed strengthening of the Japanese banking system, I think that monetary policy has played a role in the economic improvement we have seen in Japan. Deflation seems to be moderating. It is certainly too early to declare victory, however, and I hope that expansionary monetary policy, financial reform and structural reform will continue to be vigorously pursued in Japan.

THE ROLE OF ACADEMIC RESEARCH

Rolnick: What role does academic research have in an institution like the Fed? The System employs hundreds of economists. They do a variety of work, from forecasting the economy to developing theoretical models of how the economy works. What do you see as the role of research at the Board and at the district banks? And how should policymakers in the Federal Reserve System use this research?

Bernanke: I think research plays a critical role in the Federal Reserve System for at least two distinct reasons. One is that we need to have highly trained and highly competent economists to do our analysis, and given that we must compete in an academic job market, we're able to attract the best and the brightest only by allowing them some freedom to supplement their day-to-day analyses with the pursuit of individual research objectives. So part of it is simply attracting the best talent.

The more important reason is that the research itself provides an important long-run perspective on the issues that we face on a day-to-day basis. Speaking for myself, most of what I know about monetary policy has come out of academic research. There is a great deal of excellent work out there, both theoretical and empirical, that addresses fundamental practical issues of policymaking. Having done academic research myself, I think I can separate the more useful from the less useful. The best work has had a profound effect on how we think about policy.

In short, a strong research department ensures that you'll have high-quality economists to address the issues you're facing on a day-to-day basis with the best, most current tools. Moreover, the research that is produced allows policymakers to take a broader perspective on the issues that we face. The presence of research departments in Reserve banks is also very important. First, because all the presidents participate in FOMC discussions, they need staff support and guidance on making decisions about monetary policy; likewise, research provides important support in other policy areas such as bank supervision and consumer compliance. Also, historically, having separate research departments in the Reserve banks has allowed for some heterogeneity of opinion and viewpoint. St. Louis, for example, with its traditional monetarist perspective, has for decades provided a different viewpoint than others in the System. So the distribution of research groups across the country has provided some antidote to potential groupthink in the viewpoints expressed across the FOMC table.

Rolnick: The counterargument, of course, is that people on the outside are looking in and seeing economists disagreeing and debating on a variety of key issues. Policymakers need answers but economists can't seem to agree. So the outsider's view is: How can you operate in such a controversial environment?

Bernanke: Well, economics has many substantive areas of knowledge where there is agreement but also contains areas of controversy. That's inescapable. You're much better off knowing what the controversies are, what the issues are and what the arguments are on both sides than you are operating in a vacuum or in ignorance.

Economics is a very difficult subject. I've compared it to trying to learn how to repair a car when the engine is running. The economy is always changing, our knowledge of it is very incomplete, and our ability to predict it is not impressive. Nevertheless, I think that having good data, good statistics—and the United States generally has better macroeconomic statistics than most countries—and having good economists to interpret those data and present the policy alternatives, has a substantially beneficial effect on policymaking in the United States, not only in monetary policy but in other areas as well. I think in the end good economic policy research makes a very big difference to the welfare of the average person.

Rolnick: Thank you, Gov. Bernanke.

More About Ben Bernanke

Previous Positions

In Academe

Awards and Affiliations

Publications

Education

|