Abstract

How can banks and similar institutions design optimal compensation systems? Would such systems conflict with the goals of society? This paper considers a theoretical framework of how banks structure job contracts with their employees to explore three points: the structure of a socially optimal compensation system; the structure of a compensation system that is privately optimal, given the reality of government-guaranteed bank debt; and policy interventions that can lead from the second structure to the first. Analysis reveals a potential policy option: providing proper incentives to banks by charging debt default insurance premiums that depend on the compensation structure banks choose. If policymakers consider this unwise or impractical, then it may be useful for government to regulate bank compensation more directly.

As the public and policymakers seek to understand the fundamental sources of the recent financial crisis and efforts are made to design effective policy to avert future crises, a central focus has been the compensation of executives and nonexecutive employees of financial institutions. More particularly, to what extent did incentive compensation encourage employees of banks and other financial firms to take excessive risks, thereby contributing to broader financial instability? And what steps should policymakers take to ensure that future compensation systems do not encourage undue risk-taking?1 2

These are difficult questions, but fortunately, the use of some standard tools of economic theory can provide useful insights. In particular, the theory of mechanism design, whose architects were honored in 2007 with the Nobel Prize in economics, sheds light on how institutional rules can be designed to achieve best outcomes.

Mechanism design relies on the notion that rules must be “incentive compatible”—that is, the rules provided should channel people’s natural self-interest toward the institutional goal. Otherwise, people tend to game the system by withholding information or being dishonest. The tools of mechanism design are particularly germane to questions of incentive compensation—indeed, the term itself mirrors incentive compatibility.

So, what can mechanism design theory tell us about how a bank should design an incentive compensation system that will best achieve its goals, and would such an incentive system conflict with the goals of society as a whole? To address these issues we’ve considered an economic framework of how banks (and similar financial institutions) structure job contracts with bank employees.

This framework allows us to evaluate a number of relevant questions, including:3

- Should compensation be a constant salary, or should it depend on outcomes of investments made by the employee on the bank’s behalf?

- What is the best timing for incentive payments: as soon as the investment is made or deferred until investment outcomes are known?

- And how does government support for banks (through the safety net provided by deposit insurance and otherwise) affect how banks choose to compensate their employees?

The results of our analysis suggest weaknesses of current practices and policies, and also trade-offs that are inherent to the bargain made when government protection is provided for private financial institutions. Yet the analysis also reveals a potential solution to the dilemma: providing proper incentives to banks by charging debt default insurance premiums that depend on the compensation structure they choose.

In the following discussion of framework and analysis, three points are explored: the structure of a socially optimal compensation system; the structure of a compensation system that is privately optimal, given the reality of government-guaranteed bank debt; and policy interventions that can lead from the second structure to the first—that is, from privately to socially optimal compensation.

Regarding policy interventions, we note that if policymakers consider the potential solution just mentioned (charging banks insurance premiums that vary according to compensation structure) either unwise or impractical, then it may indeed be useful for government to regulate bank compensation more directly.

It should be emphasized that like all economic models, our simple framework is a very abstract version of reality. Employee motivation depends on many things in addition to financial compensation, for example, and in determining compensation systems, bank owners and managers consider factors not explicitly accounted for in our analysis. That said, we believe this analysis will prove helpful in redesigning compensation systems in the financial industry.

It should also be noted that these are preliminary findings and are the authors’ views alone, not necessarily those of the Federal Reserve.

A bank and its employees

Consider the issues facing a bank that wants to maximize its expected profits. It does so, in part, by paying its employees the minimum amount necessary to motivate them to take the job, search for potentially profitable investment opportunities and invest in good risky projects (those that can be expected to provide economic returns higher than a safe asset, like a risk-free Treasury bond) while avoiding bad risky projects that can be expected to return less.

The bank’s objective of maximizing expected return is constrained by the fact that its employees must be induced to act in the interest of the bank. That is, employees have their own goals and their own means to achieve them. They can choose to take the bank job or pursue another potentially lucrative job offer. If they take the bank job, they can choose to actively search for investment opportunities (as the bank wishes) or simply set bank funds in a risk-free Treasury bond with modest return (which involves less work). And if they actually do search for investment opportunities, they can then decide whether to fund any given opportunity they find.

Our framework stipulates that some information and actions are private (known only to the employee) and others are public (known to the bank, the government and others). Whether the employee invests in a risky project or a safe asset, for example, is public information, but whether the employee actually searches for investment projects at all is private—after all, the employee could falsely inform the bank that he or she searched but found nothing worthwhile so simply invested in the safe asset, per bank instructions.

Further, while we assume that the bank can observe the outcome of a risky project, the employee alone knows the likelihood of any given outcome for a project prior to investing in it. This is where incentive compatibility comes in. The bank must create a compensation system that will provide incentives for employees to act in the bank’s interests: working actively, investing in those projects that should be funded by the bank (good risks) and turning down those projects that shouldn’t (bad risks).

From the bank’s perspective, arriving at the best employment contract is a question of balancing the costs and benefits of paying an employee a higher or lower wage for this outcome or that outcome, and now versus later, taking into account how these characteristics of an employment contract affect the bank’s profits and the employee’s incentives.

Fixed salary?

As with most modern economics, our framework is expressed mathematically, and analysis of its properties provides clear answers as to the nature of optimal incentive compensation.

Would a fixed payment system provide good incentives? That is, would bank employees be properly motivated by an annual salary as in a standard white-collar contract? Our analysis suggests that the simple answer is no. When finding and evaluating investment opportunities requires effort (as we assume), a fixed salary does not provide any financial motivation for an employee to do more than park funds in the safe Treasury bonds. Remember that whether employees actively search for investment projects is private information; they could avoid work by falsely telling their boss that they searched but couldn’t find anything worthwhile. In other words, a fixed payment wouldn’t be incentive compatible.

The question then is: What incentive structure will convince an employee to actually search for potential investment projects and, furthermore, to invest only in the good ones, not the bad ones?

Skin in the game

As noted, to encourage workers to pursue good investment opportunities, the bank must reward employees for not simply parking the bank’s funds in the safe asset. Would a bonus system achieve this: providing a fixed salary, but with a bonus if the employee invests bank funds in what he or she says is a worthwhile investment? Again, the answer is no; this system isn’t incentive compatible either. The bonus for finding a project would indeed give the employee a financial incentive to search for and invest in risky projects rather than risk-free bonds, but it would provide no specific motivation to avoid bad investments, as the bank wishes.

To encourage employees properly, our analysis shows, compensation must depend not only on whether the employee finds a worthwhile investment project, but also on that project’s returns. Specifically, an employee needs to be especially rewarded for those outcomes that are more likely under good projects than bad projects. By having something personal at stake (their compensation), employee incentives will be aligned with the bank’s.

But the issue is more subtle than this. If good projects are simply those with a higher probability of success, then an optimal compensation scheme will just reward successful outcomes. However, it is entirely possible that a spectacularly high return is more likely under an especially risky “shoot for the moon” bad project (which the bank would not want the employee to invest in) than it is under a good project. In that case, an optimal compensation scheme may reward reasonably good returns and punish both bad and spectacularly good returns. Overall, an optimal compensation scheme may depend on rather complicated risk characteristics of both the type of projects banks want their employees to invest in and the type that banks want them to avoid.

Delaying payment

How does this play out over time? More explicitly, how should management time the payment of incentives in order to achieve optimal results? This question goes to the policy option of “clawbacks” and other types of deferred compensation intended to ensure that employees keep an eye on long-term outcomes, not just short-run profits.

Here the answer depends on specifically what motivates employees. Bank employees care about the timing of wage payments. A job with low pay for a decade followed by large but uncertain payments is simply less desirable to an employee than one with a smoother payment schedule; to make such a job sufficiently enticing, the employee will have to receive extra compensation, on average. An optimal employment contract takes this into account. In our mathematical treatment, we show that if the employee’s desire for smoother payments over time is sufficiently strong, requiring delayed payments isn’t the optimal solution.

Limited liability

The previous analysis (which we will call scenario one to contrast with later scenarios) assumed unlimited liability on the part of the bank. That is, it assumed that all the costs of investing in a project and of paying the employee are paid by the bank, and that all the benefits of a project’s return accrue to the bank. This implies that a compensation policy seen as optimal from the perspective of the bank will also be optimal for society in general.

But in current practice, of course, banks have limited liability—they don’t face all the costs. Indeed, a major motivation behind public debate over incentive compensation is the conflicts among three parties who bear different shares of the bank’s costs and benefits: stockholders (who implicitly determine compensation schemes by choosing bank directors and managers), debt holders (including bondholders and depositors) and the government, through its implicit and explicit support by way of bailouts, deposit insurance and the like.

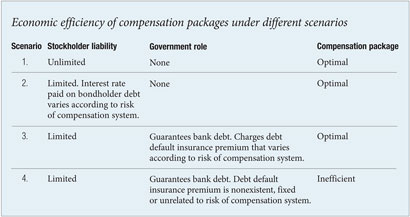

Analysis of three more scenarios with different relationships between bank stockholders and bondholders, and different roles for government, provides further insight on optimal compensation for bank employees.

Consider a second scenario in which government plays no role and bank stockholders pay interest to bondholders at a rate that varies according to default likelihood and degree. Our analysis shows that if government does not guarantee debt (implicitly or explicitly), the existence of bank debt and the limited liability it implies for stockholders would in no way inhibit stockholders from choosing the efficient employee compensation plan. That is, the bank would still choose the efficient compensation plan.

The central reason for this is that the interest rate stockholders must pay bondholders for debt not guaranteed by government will depend on the likelihood of default and on the degree of default if it occurs. If stockholders choose a compensation plan that increases the likelihood of default, or increases by how much the bank defaults, they pay the full cost of this choice by paying bondholders a higher interest rate. In essence, the company’s owners are paying the full costs of their risk-taking.

This suggests a third possible scenario, where the government guarantees bank debt, but charges an appropriate insurance premium, similar to the varying interest rate in scenario two. In this case, as well, the bank will choose the efficient compensation plan if the insurance premium is set so that the government’s expected profits from deposit insurance equal zero for any given compensation scheme.

In this scenario, if the government adjusts its insurance premium to take into account the bank’s compensation plan, it can mimic how a bank’s interest payment on its nonguaranteed debt would adjust to take into account the bank’s compensation plan. Once again, this would ensure that the company’s owners are paying the full costs of the risks they are motivating their employees to take.

A suboptimal scenario

But the situation is far different in a fourth scenario where debt is guaranteed by the government and insurance premiums are nonexistent, fixed or unrelated to incentive compensation. In this case, the bank’s bondholders (or depositors) no longer care about employee compensation because they will be paid regardless of how the bank’s investments turn out and regardless of how much or when the bank pays its employees—the government will make them whole. In particular, the interest rate on debt that bank stockholders have to pay will no longer depend on how the bank chooses to compensate its employees.

This difference in the bank’s situation (from no government protection to debt guarantee by government) can actually change the bank’s instructions to employees from discouraging to promoting the funding of bad investments. This aspect of the moral hazard problem is well known. But even if we assume that banks still instruct employees to invest only in good projects, what effect would a government guarantee of bank debt have on how they choose to compensate those employees?

What we find is that a government guarantee of debt will encourage a bank to promise higher wages to employees when default occurs than it would without such guarantees. Why? A promise to pay an employee a higher wage next year if the bank defaults on its debts costs the bank’s shareholders and bondholders nothing; should default occur, the shareholders are wiped out regardless and the bondholders are protected by the government. But the bank’s promise of a higher wage encourages the employee to take the job in the first place. In effect, promises to pay the employee in the event of default are a way of shifting the bank’s wage bill onto the government.

Perhaps more troubling is that this effect at least partially shows up before a default actually occurs, but where default appears likely to occur in the future. Again, in such a situation, the benefit to the bank of promising the employee a high wage is that it helps convince the employee to take the job. If the bank ends up not defaulting, the cost of this high wage will be paid by the stockholders. But if it does default, the wage cost will be paid by the government since high wages today mean the bank will have less money to pay off its bondholders tomorrow.

Scenario review

The incentive distortion caused by government guarantees is seen clearly through a brief review of these four scenarios (see table below).

The original scenario was one of no debt and unlimited liability for stockholders. That resulted in an optimal compensation scheme because the bank paid its full costs and accrued its full benefits.

The second scenario was one of limited stockholder liability, but where debt was not guaranteed by government and the interest rate stockholders must pay to bondholders for this nonguaranteed debt depended on the likelihood of default and on the degree of default if it occurs. Here again, the bank paid its full costs and accrued its full benefits, and therefore chooses an efficient compensation plan.

The third scenario was one with limited stockholder liability and government guaranteed debt, but where the government charged a varying insurance premium depending on the compensation plan chosen by the stockholders. Again, in this third scenario, the bank chooses the efficient compensation scheme.

It is only in the fourth scenario, a government guarantee of bank debt with default insurance premiums that are fixed, nonexistent or unrelated to compensation, that the bank’s stockholders will choose an inefficient compensation scheme because government essentially subsidizes employee wages, and does so more when things go badly than when things go well.

At the root of the incentive compensation problem, then, is government guarantee of bank debt. In the two scenarios without government guarantees, the stockholders, bondholders, managers, and employees of the bank reach an optimal solution. With the government safety net, compensation structures are distorted toward excessive risk-taking.

However, if government charges banks an insurance premium that depends on the compensation structure banks choose, then optimal compensation packages and a government safety net are compatible.

Thus, proper incentive compensation structures can best be achieved not through direct government regulatory oversight of incentive compensation packages, but by government providing proper incentives to banks through risk-varying debt default insurance premiums.

Key points

Economic theory provides discipline for intuition, and mechanism design theory can thus provide useful intellectual structure for designing incentive compensation systems that lead to better outcomes for banks, and thereby society. As regulations are considered regarding these compensation structures, some lessons from our analysis may prove useful. Here then, in summary, are some of the key findings provided by our simple economic framework:

- To be motivated sufficiently, employees must be exposed financially to the outcome of the investment projects they choose to invest bank funds in. A fixed salary, or even a base salary plus bonus, would not prevent employees from investing in bad projects.

- To encourage workers to pursue good investment opportunities and avoid bad investments, contracts must especially reward employees for outcomes that are more likely under good projects than bad projects. Such efficient contracts may depend on rather complicated risk characteristics of both the type of projects banks want their employees to invest in and the type that banks want them to avoid.

- Delaying compensation to prevent focus on short-term outcomes alone may not be a good solution.

- Government guarantees of financial institution debt may perversely encourage dangerous levels of risk-taking and the offloading of employee compensation to the government.

- If government charges banks a varying insurance premium that reflects the risk levels of bank employee investment choices, then optimal compensation packages and a government safety net are compatible.

- If policymakers consider charging banks insurance premiums that vary according to compensation structure either unwise or impractical, then it may be useful for government to regulate bank compensation more directly.

- Government regulators should pay particular attention to situations where a bank not in default is likely to be so in the future. In such cases, the optimal compensation package from the bank’s standpoint will pay the employee more than is socially optimal.

Endnotes

1 The Federal Reserve has recently undertaken several steps in this regard, including two supervisory initiatives designed to ensure that the incentive compensation policies of banking organizations do not undermine the safety and soundness of their organizations. See Board of Governors of the Federal Reserve System (2009), “Federal Reserve Issues Proposed Guidance on Incentive Compensation” press release, Oct. 22. See also Governor Daniel Tarullo’s Nov. 2 speech, “Incentive Compensation, Risk Management, and Safety and Soundness”.

2 The Financial Stability Board, an international body of financial authorities and institutions, has also issued principles “intended to reduce incentives towards excessive risk taking that may arise from the structure compensation schemes.” See FSF Principles for Sound Compensation Practices, 2 April 2009, followed by Implementation Standards, 25 September 2009.

3 For the technical basis of the current article, see Christopher Phelan, “A Simple Model of Bank Employee Compensation,” Working Paper 676, Federal Reserve Bank of Minneapolis, December 2009.