A Native Entrepreneur does business during a 2015 Indian Business Alliance conference

Since 2006, the Minneapolis Fed has supported the development and growth of Indian Business Alliances (IBAs) in five of the six states comprising the Fed’s Ninth District—Minnesota, Montana, North Dakota, South Dakota, and Wisconsin. In our recent blog (January 10, 2018) Indian Business Alliances: Rooted in Entrepreneurship, Growing Native Economies, we shared the history and framework of the IBAs. This article delves deeper into their shared strategies and accomplishments.

Over the last decade, the five Indian Business Alliances have accrued a number of accomplishments that have improved the environment for Native entrepreneurs on and near the reservations they represent. At times, the Alliances have unintentionally replicated methods, activities, and achievements, demonstrating that there are shared features to making entrepreneurship work in Native communities. The Alliances have also had many opportunities to learn from each other and share best practices.

All of the Alliances have strived to elevate the work of entrepreneurs on and off reservations, and in so doing, emphasize the importance of private small business development. The Alliances believe that independently-owned businesses need to take their place beside traditional economic pathways on reservations, which include employment in tribal government and tribally-owned businesses or subsidiaries of the government. As the Alliances have pursued the goal of creating an independent business sector, they have collectively exhibited a number of shared methods:

- Raising public awareness

- Increasing access to capital

- Strengthening relationships with state and federal governments

Raising Public Awareness

The Alliances have reached out to tribal leaders and reservation residents, to entrepreneurs themselves, to philanthropic foundations, and to the broader public to raise awareness and build support for Native entrepreneurship as a viable economic strategy.

To involve tribal leaders and residents, most IBAs have held on-reservation meetings that allow tribal leaders to highlight the economic development efforts they have undertaken on behalf of their tribes, ranging from the development of water systems to the construction of housing, community centers, and agricultural enterprises. The North Dakota Alliance (NDIBA) organized several large on-reservation meetings involving leaders of the Standing Rock Tribe and multiple organizational partners, to plan for an economic future that moves beyond the recent struggles over the Dakota Access Pipeline (for more information, see report on Standing Rock planning sessions). These meetings also offered the opportunity to exchange perspectives on the role of entrepreneurship and its potential for improving the well-being of tribal members. For example, attendees discussed the need for the following businesses in their communities: laundromat, funeral home, theater, and Native arts retail spaces. They also discussed the opportunities for independent businesses to fill these gaps and the potential for a strip mall to accommodate these diverse businesses.

To connect with Native entrepreneurs, the Minnesota Alliance (MNIBA) held meetings around the state to discuss the entrepreneurs’ needs and perspectives on strategies that would be most helpful to their businesses. These meetings resulted in the Entrepreneurial Listening Sessions Report (2016), which list a number of recommendations:

- Enhance reporting on detailed data on American Indians

- Strengthen “Buy Indian – Targeted Business” procurement policies and procedures

- Increase visibility of Indian-owned businesses

- Develop physical infrastructure

- Build a strong, unified, and uncompromised voice for American Indian-owned business

- Increase access to supportive business resources and networks

- Improve the coordination of advocacy and educational efforts

To engage the broader public, most of the Alliances have held large statewide conferences that celebrated local entrepreneurs and featured developments in financing, public policy, training, and research. The South Dakota Alliance’s (SDIBA)’s 2015 conference offered a seven-session financing track that included discussions on successful partnerships between banks and Native CDFIs, the role of guaranteed loan programs in securing business loans, and how the New Markets Tax Credit program works. The conference also featured an evening gala that gave Native artists an opportunity to describe their businesses and products and sell their merchandise on-site, as well as a Policy Roundtable that enabled attendees to share ideas on policies that could expedite business growth.

All of the Alliances operate dynamic websites that spotlight local businesses, announce funding and training opportunities, and report on workshops and events they have co-sponsored.

|

|

|

|

|

Improving Access to Capital

In addition to raising public awareness, the Alliances have focused significant effort on securing more financing for Native American businesses. One important aspect of the need for more capital is the demand on Native CDFIs by small business owners who want to start or expand their businesses—a demand that often outstrips the NCDFIs’ ability to meet it. In addition, some Native CDFIs offer Credit Builder loans that could benefit from a capital infusion; these loans enable business owners to improve their credit while they also take classes from the NCDFI in the nuts-and-bolts of operating a business. Access to capital is a key issue affecting the ability of Native businesses to start, grow, and thrive, and the Alliances have undertaken various strategies to address this issue.

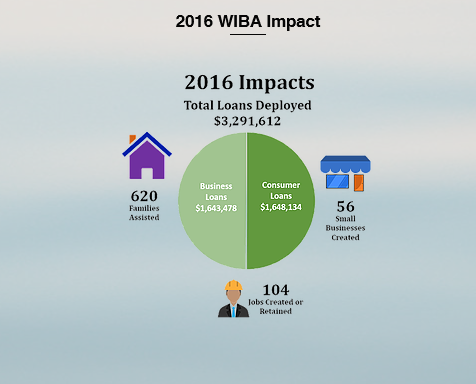

The Wisconsin Alliance (WIBA) is primarily comprised of four Native Community Development Financial Institutions (NCDFIs). In addition to providing technical assistance and capital to entrepreneurs, they are exploring innovative ways to finance NCDFIs in their state. For example, they are examining the potential for Wisconsin NCDFIs to receive an allocation from the state’s pool of funds generated by tribal gaming revenues (distributed through revenue-sharing compacts between the state and the tribes). Currently, funding is allocated through the state budgeting process and has not yet reached Native CDFIs. To make their case, the individual NCDFIs, through WIBA, have developed a joint reporting method that promotes understanding of their combined impact on the economic well-being of tribes and individual tribal members.

The Montana Alliance (MIBA) held a large community forum in 2011 on issues related to access to capital.1 MIBA went on to spearhead the development of an Indian Equity Fund, which provides seed capital to mostly early-stage entrepreneurs. MIBA was also involved with a number of community partners, particularly the Native American Development Corporation (a Native CDFI), which played a leading role in securing the Montana Native American Collateral Support Program, in partnership with the State of Montana. This program operates a funding pool that is able to supply collateral for entrepreneurs who lack it and are seeking to secure loans for their businesses.

The South Dakota Alliance, in partnership with Four Bands Community Fund (a Native CDFI) and Citibank, launched a pilot Native Entrepreneurship Investment Fund, to provide loans and technical assistance to entrepreneurs throughout the state, particularly on reservations or in urban areas that did not have ready access to a Native CDFI. Citi provided an initial investment to launch the fund. SDIBA also has a Community Reinvestment Committee that focuses on strategies to increase access to capital, particularly for South Dakota’s Native CDFIs. Multiple partners are involved, including the three banking regulators (FDIC, OCC, and the Minneapolis Fed), banks, Native CDFIs, and staff from pertinent federal agencies.

Interior of Keya Café, a Native-owned social enterprise on the Cheyenne River reservation, South Dakota

Strengthening Relationships with State and Federal Government

The Alliances have pursued better relationships with state and federal government and changes to public policies to create fertile ground for entrepreneurs and small businesses to thrive. One major achievement was the joint filing compacts that the Minnesota, Montana, and South Dakota Alliances helped secure between tribes and their Secretaries of State, which followed the tribes’ adoption of a uniform commercial code.2 Other examples of collaborative work between the Alliances and their state governments include:

- Support for a Native business policy agenda that included the establishment of a Cabinet-level position in South Dakota—the Secretary of Tribal Relations—which had not existed before SDIBA’s engagement.

- Securing funding and technical assistance from the Wisconsin Economic Development Corporation (state economic development agency) for WIBA.

- Support for the Indian Equity Fund from the Montana Department of Commerce, as well as the creation of online economic profiles of Montana’s reservations that were developed in collaboration with the University of Montana.

- Co-sponsorship of the “Strengthening Government-to-Government Relationships and Partnerships Conference” by NDIBA and the North Dakota Indian Affairs Commission in January 2018.

In addition to the topic areas mentioned above, the IBAs are involved in training workshops and research projects. Training workshops address subjects including workforce readiness, profit mastery, and uniform commercial codes. Examples of research the IBAs disseminated include a webinar on undercounting Native populations in the U.S. Census, undertaken in collaboration with South Dakota State University, and a report on the status of Native entrepreneurship on South Dakota’s nine reservations, undertaken in collaboration with the Corporation for Enterprise Development (CFED: South Dakota Entrepreneurship Report).

Conclusion

The unique purpose, structure, and approach of the Indian Business Alliances has enabled them to make noticeable gains in advancing Native entrepreneurship in Indian Country. An alignment of efforts and products has emerged from the trajectories of the individual IBAs that draws all of them into a common bond.

This alignment points to the existence of a common set of issues that are inherent in attempting to build an independent Native business sector on and near reservations. Moreover, it reflects the creativity that has been unleashed among organizations and individuals who are pursuing a visionary goal intended to better the lives of those in their communities.

Sandy Gerber is the Coordinator of Indian Business Alliances for the Minneapolis Fed.

Endnotes

1 See http://www.mibaonline.org/download_pdf/miba_capital_access_report_february2011.pdf

2 See http://www.uniformlaws.org/Shared/Docs/MTSTA/Final%20UCC%20Compact.pdf.