We live in a world of staggering and unprecedented income inequality. Production per person in the wealthiest economy, the United States, is something like 15 times production per person in the poorest economies of Africa and South Asia. Since the end of the European colonial age, in the 1950s and ’60s, the economies of South Korea, Singapore, Taiwan and Hong Kong have been transformed from among the very poorest in the world to middle-income societies with a living standard about one-third of America’s or higher. In other economies, many of them no worse off in 1960 than these East Asian “miracle” economies were, large fractions of the population still live in feudal sectors with incomes only slightly above subsistence levels. How are we to interpret these successes and failures?

Economists, today, are divided on many aspects of this question, but I think that if we look at the right evidence, organized in the right way, we can get very close to a coherent and reliable view of the changes in the wealth of nations that have occurred in the last two centuries and those that are likely to occur in this one. The Asian miracles are only one chapter in the larger story of the world economy since World War II, and that story in turn is only one chapter in the history of the industrial revolution. I will set out what I see as the main facts of the economic history of the recent past, with a minimum of theoretical interpretation, and try to see what they suggest about the future of the world economy. I do not think we can understand the contemporary world without understanding the events that have given rise to it.

I will begin and end with numbers, starting with an attempt to give a quantitative picture of the world economy in the postwar period, of the growth of population and production since 1950. Next, I will turn to the economic history of the world up to about 1750 or 1800, in other words, the economic history known to Adam Smith, David Ricardo and the other thinkers who have helped us form our vision of how the world works. Third, I will sketch what I see as the main features of the initial phase of the industrial revolution, the years from 1800 to the end of the colonial age in 1950. Following these historical reviews, I will outline a theoretical structure roughly consistent with the facts. If I succeed in doing this well, it may be possible to conclude with some useful generalizations and some assessments of the world’s future economic prospects.

The world economy in the postwar period

Today, most economies enjoy sustained growth in average real incomes as a matter of course. Living standards in all economies in the world 300 years ago were more or less equal to one another and more or less constant over time. Following common practice, I use the term industrial revolution to refer to this change in the human condition, although the modifier industrial is slightly outmoded, and I do not intend to single out iron and steel or other heavy industry, or even manufacturing in general, as being of special importance. By a country’s average real income, I mean simply its gross domestic product (GDP) in constant dollars divided by its population. Although I will touch on other aspects of society, my focus will be on economic success, as measured by population and production.

Our knowledge of production and living standards at various places and times has grown enormously in the past few decades. The most recent empirical contribution, one of the very first importance, is the Penn World Table project conducted by Robert Summers and Alan Heston.1 This readily available, conveniently organized data set contains population and production data on every country in the world from about 1950 or 1960 (depending on the country) to the present. The availability of this marvelous body of data has given the recent revival of mathematical growth theory an explicitly empirical character that is quite different from the more purely theoretical investigations of the 1960s. It has also stimulated a more universal, ambitious style of theorizing aimed at providing a unified account of the behavior of rich and poor societies alike.

As a result of the Penn project, we now have a reliable picture of production in the entire world, both rich and poor countries. Let us review the main features of this picture, beginning with population estimates. Over the 40-year period from 1960 through 2000, world population grew from about 3 billion to 6.1 billion, or at an annual rate of 1.7 percent. These numbers are often cited with alarm, and obviously the number of people in the world cannot possibly grow at 2 percent per year forever. But many exponents of what a friend of mine calls the “economics of gloom” go beyond this truism to suggest that population growth is outstripping available resources, that the human race is blindly multiplying itself toward poverty and starvation. This is simply nonsense.

There is, to be sure, much poverty and starvation in the world, but nothing could be further from the truth than the idea that poverty is increasing. Over the same period during which population has grown from 3 billion to 6.1 billion, total world production has grown much faster than population, from $6.5 trillion in 1960 to $31 trillion in 2000. (All the dollar magnitudes I cite, from the Penn World Table or any other source, will be in units of 1985 U.S. dollars.) That is, world production was nearly multiplied by five over this 40-year period, growing at an annual rate of 4 percent. Production per person—real income—thus grew at 2.3 percent per year, which is to say that the living standard of the average world citizen more than doubled. Please understand: I am not quoting figures for the advanced economies or for a handful of economic miracles. I am not excluding Africa or the communist countries. These are numbers for the world as a whole. The entire human race is getting rich, at historically unprecedented rates. The economic miracles of East Asia are, of course, atypical in their magnitudes, but economic growth is not the exception in the world today: It is the rule.

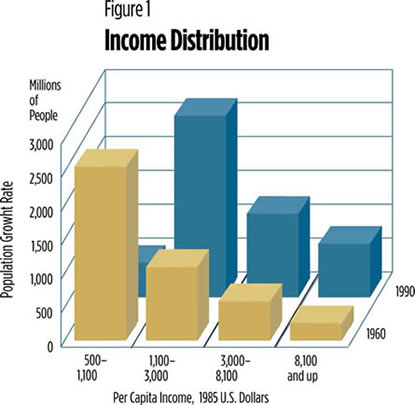

Average figures like these mask diversity, of course. Figure 1 shows one way to use the information in the Penn World Table to summarize the distribution of the levels and growth rates of population and per capita incomes in the postwar world. It contains two bar graphs of per capita incomes, one for 1960 and the other for 1990 (not 2000). The horizontal axis is GDP per capita, in thousands of dollars. The vertical axis is population. The height of each bar is proportional to the number of people in the world with average incomes in the indicated range, based on the assumption (though, of course, it is false) that everyone in a country has that country’s average income. The figure shows that the number of people (not just the fraction) in countries with mean incomes below $1,100 has declined between 1960 and 1990. The entire world income distribution has shifted to the right, without much change in the degree of income inequality, since 1960. At the end of the period, as at the beginning, the degree of inequality is enormous. The poorest countries in 1990 have per capita incomes of around $1,000 per year compared to the U.S. average of $18,000: a factor of 18. This degree of inequality between the richest and poorest societies is without precedent in human history, as is the growth in population and living standards in the postwar period.

A great deal of recent empirical work focuses on the question of whether per capita incomes are converging to a common (growing) level, or possibly diverging. From Figure 1 it is evident that this is a fairly subtle question. In any case, it seems obvious that we are not going to learn much about the economic future of the world by simple statistical extrapolation of events from 1960 to 1990, however it is carried out. Extrapolating the 2 percent population growth rate backward from 1960, one would conclude that Adam and Eve were expelled from the garden in about the year 1000. Extrapolating the 2.2 rate of per capita income growth backward, one would infer that people in 1800 subsisted on less than $100 per year. Extrapolating forward leads to predictions that the earth’s water supply (or supply of anything else) will be exhausted in a finite period. Such exercises make it clear that the years since 1960 are part of a period of transition, but from what to what? Let us turn to history for half the answer to this question.

Comparison to earlier centuries

The striking thing about postwar economic growth is how recent such growth is. I have said that total world production has been growing at over 4 percent since 1960. Compare this to annual growth rates of 2.4 percent for the first 60 years of the 20th century, of 1 percent for the entire 19th century, of one-third of 1 percent for the 18th century.2 For these years, the growth in both population and production was far lower than in modern times. Moreover, it is fairly clear that up to 1800 or maybe 1750, no society had experienced sustained growth in per capita income. (Eighteenth century population growth also averaged one-third of 1 percent, the same as production growth.) That is, up to about two centuries ago, per capita incomes in all societies were stagnated at around $400 to $800 per year. But how do we know this? After all, the Penn World Tables don’t cover the Roman Empire or the Han Dynasty. But there are many other sources of information.

In the front hall of my apartment in Chicago there is a painting of an agricultural scene, a gift from a Korean student of mine. In the painting, a farmer is plowing his field behind an ox. Fruit trees are flowering, and mountains rise in the background. The scene is peaceful, inspiring nostalgia for the old days (though I do not know when the painting was done or what time period it depicts). There is also much information for an economist in this picture. It is not difficult to estimate the income of this farmer, for we know about how much land one farmer and his ox can care for, about how much can be grown on this land, how much fruit the little orchard will yield and how much the production would be worth in 1985 U.S. dollar prices. This farmer’s income is about $2,000 per year. Moreover, we know that up until recent decades, almost all of the Korean workforce (well over 90 percent) was engaged in traditional agriculture, so this figure of $2,000 ($500 per capita) for the farmer, his wife and his two children must be pretty close to the per capita income for the country as a whole. True, we do not have sophisticated national income and product accounts for Korea 100 years ago, but we don’t need them to arrive at fairly good estimates of living standards that prevailed back then. Traditional agricultural societies are very like one another, all over the world, and the standard of living they yield is not hard to estimate reliably.

Other, more systematic, information is also available. For poor societies—all societies before about 1800—we can reliably estimate income per capita using the idea that average living standards of most historical societies must have been very near the estimated per capita production figures of the poorest contemporary societies. Incomes in, say, ancient China cannot have been much lower than incomes in 1960 China and still sustained stable or growing populations. And if incomes in any part of the world in any time period had been much larger than the levels of the poor countries of today—a factor of two, say—we would have heard about it. If such enormous percentage differences had ever existed, they would have made some kind of appearance in the available accounts of the historically curious, from Herodotus to Marco Polo to Adam Smith.

To say that traditional agricultural societies did not undergo growth in the living standards of masses of people is not to say that such societies were stagnant or uninteresting. Any schoolchild can list economically important advances in technology that occurred well before the industrial revolution, and our increasing mastery of our environment is reflected in accelerating population growth over the centuries. Between year 0 and year 1750, world population grew from around 160 million to perhaps 700 million (an increase of a factor of four in 1,750 years). In the assumed absence of growth in income per person, this means a factor of four increase in total production as well, which obviously could not have taken place without important technological changes. But in contrast to a modern society, a traditional agricultural society responds to technological change by increasing population, not living standards. Population dynamics in such a society obey a Malthusian law that maintains product per capita at $600 per year, independent of changes in productivity.

To say that traditional agricultural societies did not undergo growth in the living standards of masses of people is not to say that such societies were stagnant or uninteresting. Any schoolchild can list economically important advances in technology that occurred well before the industrial revolution, and our increasing mastery of our environment is reflected in accelerating population growth over the centuries. Between year 0 and year 1750, world population grew from around 160 million to perhaps 700 million (an increase of a factor of four in 1,750 years). In the assumed absence of growth in income per person, this means a factor of four increase in total production as well, which obviously could not have taken place without important technological changes. But in contrast to a modern society, a traditional agricultural society responds to technological change by increasing population, not living standards. Population dynamics in such a society obey a Malthusian law that maintains product per capita at $600 per year, independent of changes in productivity.

How then did these traditional societies support the vast accomplishments of the ancient civilizations of Greece and Rome, of China and India? Obviously, not everyone in these societies was living on $600 per year. The answer lies in the role and wealth of landowners, who receive about 30 percent to 40 percent of agricultural income. A nation of 10 million people with a per capita production of $600 per year has a total income of $6 billion. Thirty percent of $6 billion is $1.8 billion. In the hands of a small elite, this kind of money can support a fairly lavish lifestyle or build impressive temples or subsidize many artists and intellectuals. As we know from many historical examples, traditional agricultural society can support an impressive civilization. What it cannot do is generate improvement in the living standards of masses of people. The Korean farmer plowing his field in the painting in my hallway could be in any century in the last 1,000 years. Nothing in the picture would need to be changed to register the passage of the centuries.

If the living standard in traditional economies was low, it was at least fairly equally low across various societies. Even at the beginning of the age of European colonialism, the dominance of Europe was military, not economic. When the conquistadors of Spain took control of the societies of the Incas and the Aztecs, it was not a confrontation between a rich society and a poor one. In the 16th century, living standards in Europe and the Americas were about the same. Indeed, Spanish observers of the time marveled at the variety and quality of goods that were offered for sale in the markets of Mexico. Smith, Ricardo and their contemporaries argued about differences in living standards, and perhaps their discussions can be taken to refer to income differences as large as a factor of two. But nothing remotely like the income differences of our current world, differences on the order of a factor of 25, existed in 1800 or at any earlier time. Such inequality is a product of the industrial revolution.

The beginnings of the industrial revolution

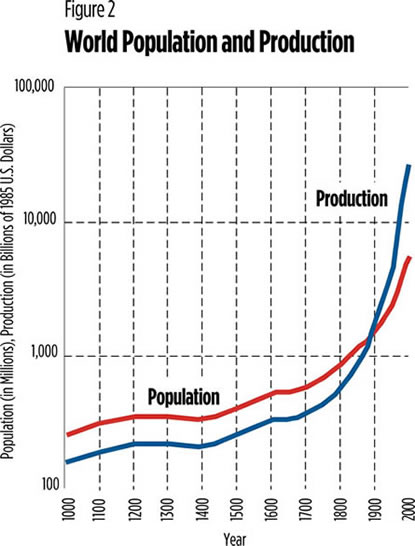

Traditional society was characterized by stable per capita income. Our own world is one of accelerating income growth. The course of the industrial revolution, our term for the transition from stable to accelerating growth, is illustrated in Figure 2, which plots total world population and production from the year 1000 up to the present. I use a logarithmic scale rather than natural units, so that a constant rate of growth would imply a straight line. One can see from the figure that the growth rates of both population and production are increasing over time. The vertical scale is millions of persons (for population) and billions of 1985 U.S. dollars (for production). The difference between the two curves is about constant up until 1800, reflecting the assumption that production per person was roughly constant prior to that date. Then in the 19th century, growth in both series accelerates dramatically, and production growth accelerates more. By 1900 the two curves cross, at which time world income per capita was $1,000 per year. The growth and indeed the acceleration of both population and production continue to the present.

Of course, the industrial revolution did not affect all parts of the world uniformly, nor is it doing so today. Figure 3, based on per capita income data estimated as I have discussed, is one way of illustrating the origins and the diffusion of the industrial revolution. To construct the figure, the countries (or regions) of the world were organized into five groups, ordered by their current per capita income levels. Group I—basically, the English-speaking countries—are those in which per capita incomes first exhibited sustained growth. Group II is Japan, isolated only because I want to highlight its remarkable economic history. Group III consists of northwest Europe, the countries that began sustained growth somewhat later than Group I. Group IV is the rest of Europe, together with European-dominated economies in Latin America. Group V contains the rest of Asia and Africa.

As shown in Figure 3, per capita incomes were approximately constant, over space and time, over the period 1750–1800, at a level of something like $600 to $700. Here and below, the modifier “approximately” must be taken to mean plus or minus $200. Following the reasoning I have advanced above, $600 is taken as an estimate of living standards in all societies prior to 1750, so there would be no interest in extending Figure 3 to the left. The numbers at the right of Figure 3 indicate the 1990 populations, in millions of people, for the five groups of countries. About two-thirds of the world’s people live in Group V, which contains all of Africa and Asia except Japan.

Reading Figure 3 from left to right, we can see the emergence over the last two centuries of the inequality displayed in Figure 1. By 1850 there was something like a factor of two difference between the English-speaking countries and the poor countries of Africa and Asia. By 1900, a difference of perhaps a factor of six had emerged. At that time, the rest of Europe was still far behind England and America, and Japanese incomes were scarcely distinguishable from incomes in the rest of Asia. In the first half of the 20th century, the inequality present in 1900 was simply magnified. The English-speaking countries gained relative to northern Europe, which in turn gained on the rest of Europe and Asia. Notice, too, that per capita income in what I have called Group V, the African and Asian countries, remained constant at around $600 up to 1950. The entire colonial era was a period of stagnation in the living standards of masses of people. European imperialism brought advances in technology to much of the colonized world, and these advances led to increases in production that could, as in British India, be impressive. But the outcome of colonial economic growth was larger populations, not higher living standards.

In the period since 1950, the pattern of world growth has begun to change character, as well as to accelerate dramatically. What was at first thought to be the postwar recovery of continental Europe and of Japan turned out to be the European and Japanese miracles, taking these countries far beyond their prewar living standards to levels comparable to the United States. (There are some miracles in my Group IV, too— Italy and Spain—that are not seen on the figure because they are averaged in with Latin America and the communist world.) The second major change in the postwar world is the beginning of per capita income growth in Africa and Asia, entirely a post-colonial phenomenon. The industrial revolution has begun to diffuse to the non-European world, and this, of course, is the main reason that postwar growth rates for the world as a whole have attained such unprecedented levels.

If we use growth in per capita income as the defining characteristic of the industrial revolution, then it is clear from Figure 3 that the revolution did not begin before the late 18th century. If we use growth in total product, reflecting improvements in technology, as the defining characteristic, then Figure 2 makes it clear that the beginnings of the revolution must have been centuries earlier (or, that there must have been important, earlier revolutions). What occurred around 1800 that is new, that differentiates the modern age from all previous periods, is not technological change by itself but the fact that sometime after that date fertility increases ceased to translate improvements in technology into increases in population. That is, the industrial revolution is invariably associated with the reduction in fertility known as the demographic transition.

If we use growth in per capita income as the defining characteristic of the industrial revolution, then it is clear from Figure 3 that the revolution did not begin before the late 18th century. If we use growth in total product, reflecting improvements in technology, as the defining characteristic, then Figure 2 makes it clear that the beginnings of the revolution must have been centuries earlier (or, that there must have been important, earlier revolutions). What occurred around 1800 that is new, that differentiates the modern age from all previous periods, is not technological change by itself but the fact that sometime after that date fertility increases ceased to translate improvements in technology into increases in population. That is, the industrial revolution is invariably associated with the reduction in fertility known as the demographic transition.

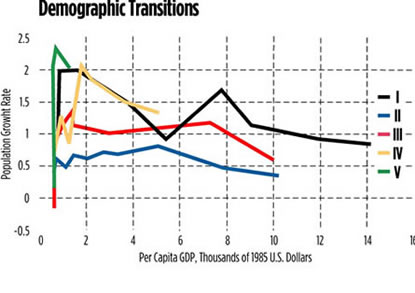

Figure 4 provides a rough description of the demographic transitions since 1750 that have occurred and are still occurring. The figure exhibits five plotted curves, one for each country group. Each curve connects 10 points, corresponding to the time periods beginning in 1750 and ending in 1990, as indicated at the bottom of Figure 3. (Note that the periods are not of equal length.) Each point plots the group’s average rate of population growth for that period against its per capita income at the beginning of the period. The per capita GDP figures in 1750 can just be read off Figure 3, from which it is clear that they are about $600 for all five groups. Population growth rates in 1750 average about 0.4 percent and are well below 1 percent for all five groups. For each group, one can see a nearly vertical increase in population growth rates with little increase in GDP per capita, corresponding to the onset of industrialization. This, of course, is precisely the response to technological advance that Malthus and Ricardo told us to expect. Then, in groups I to IV a maximum is reached, and as incomes continue to rise, population growth rates decline. In group V—most of Asia and Africa—the curve has only leveled off, but does anyone doubt that these regions will follow the path that the rest of the world has already worn?

Theoretical responses

I have brought the story of the industrial revolution up to the present. Where are we going from here? For this, we need a theory of growth, a system of equations that makes economic sense and that fits the facts I have just reviewed. There is a tremendous amount of very promising research now occurring in economics, trying to construct such a system, and in a few years we will be able to run these equations into the future and see how it will look. Now, though, I think it is accurate to say that we have not one but two theories of production: one consistent with the main features of the world economy prior to the industrial revolution and another roughly consistent with the behavior of the advanced economies today. What we need is an understanding of the transition.

One of these successful theories is the product of Smith, Ricardo, Malthus and the other classical economists. The world they undertook to explain was the world on the eve of the industrial revolution, and it could not have occurred to them that economic theory should seek to explain sustained, exponential growth in living standards. Their theory is consistent with the following stylized view of economic history up to around 1800. Labor and resources combine to produce goods—largely food, in poor societies—that sustain life and reproduction. Over time, providence and human ingenuity make it possible for given amounts of labor and resources to produce more goods than they could before. The resulting increases in production per person stimulate fertility and increases in population, up to the point where the original standard of living is restored. Such dynamics, operating over the centuries, account for the gradually accelerating increase in the human population and the distribution of that population over the regions of the earth in a way that is consistent with the approximate constancy of living standards everywhere. The model predicts that the living standards of working people are maintained at a roughly constant, “subsistence” level, but with realistic shares of income going to landowners, the theory is consistent as well with high civilization based on large concentrations of wealth.

This classical theory is not inconsistent with the enormous improvements in knowledge relevant to productivity that occurred long before the 18th century, improvements that supported huge population increases and vast wealth for owners of land and other resources. Increases in knowledge over the centuries also stimulated a large-scale accumulation of productive capital: shipbuilding, road and harbor construction, draining of swamps, and breeding and raising of animal herds for food and power. Capital accumulation, too, played a role in supporting ever larger populations. Yet under the Malthusian theory of fertility, neither new knowledge nor the capital accumulation it makes profitable is enough to induce the sustained growth in living standards of masses of people that modern economists take as the defining characteristic of the industrial revolution.

The modern theory of sustained income growth, stemming from the work of Robert Solow in the 1950s, was designed to fit the behavior of the economies that had passed through the demographic transition.3 This theory deals with the problem posed by Malthusian fertility by simply ignoring the economics of the problem and assuming a fixed rate of population growth. In such a context, the accumulation of physical capital is not, in itself, sufficient to account for sustained income growth. With a fixed rate of labor force growth, the law of diminishing returns puts a limit on the income increase that capital accumulation can generate. To account for sustained growth, the modern theory needs to postulate continuous improvements in technology or in knowledge or in human capital (I think these are all just different terms for the same thing) as an “engine of growth.” Since such a postulate is consistent with the evidence we have from the modern (and the ancient) world, this does not seem to be a liability of the theory.

The modern theory, based on fixed fertility, and the classical theory, based on fertility that increases with increases in income, are obviously not mutually consistent. Nor can we simply say that the modern theory fits the modern world and the classical theory the ancient world, because we can see traditional societies exhibiting Malthusian behavior in the world today. Increases since 1960 in total production in Africa, for example, have been almost entirely absorbed by increases in population, with negligible increases in income per capita. Understanding the progress of the industrial revolution as it continues today necessarily entails understanding why it is that Malthusian dynamics have ceased to hold in much of the contemporary world. Country after country has gone through a demographic transition, involving increases in the rate of population growth followed by decreases, as income continues to rise. Some of the wealthiest countries—Japan and parts of Europe—are just about maintaining their populations at current levels. People in these wealthy economies are better able to afford large families than people in poor economies, yet they choose not to do so.

If these two inconsistent theories are to be reconciled, with each other and with the facts of the demographic transition, a second factor needs to work to decrease fertility as income grows, operating alongside the Malthusian force that works to increase it. Gary Becker proposed long ago that this second factor be identified with the quality of children: As family income rises, spending on children increases, as assumed in Malthusian theory, but these increases can take the form of a greater number of children or of a larger allocation of parental time and other resources to each child. Parents are assumed to value increases both in the quantity of children and in the quality of each child’s life.4

Of course, both the quality-quantity trade-off in Becker’s sense and the importance of human capital are visible well before the industrial revolution. In any society with established property rights, a class of landowners will be subject to different population dynamics due to the effect their fertility has on inheritances and the quality of lives their children enjoy. Such families can accumulate vast wealth and enjoy living standards far above subsistence. For the histories of what we call civilization, this deviation from a pure Malthusian subsistence model is everything. For the history of living standards of masses of people, however, it is but a minor qualification. Similarly, in any society of any complexity, some individuals can, by virtue of talent and education, formal or informal, acquire skills that yield high income, and as the Bachs and the Mozarts can testify, such exceptions can run in families. For most societies, though, income increases due to what a modern economist calls human capital are exceptional and often derivative, economically, from landowner wealth.

For a landless family in a traditional agricultural economy, the possibilities for affecting the quality of children’s lives are pretty slight. If there is no property to pass on, an additional child does not dilute the inheritance of siblings. Parents could spend time and resources on the child’s education in the attempt to leave a bequest of human capital. All parents do this to some degree, but the incentives to do so obviously depend on the return to human capital offered by the society the parents live in. Where this return is low, adding the quality dimension to the fertility decision may be only a minor twist on Malthusian dynamics. In short, neither the possibility of using inheritable capital to improve the quality of children’s lives nor the possibility of accumulating human capital needs to result in fundamental departures from the predictions of the classical model.

But these additional features do offer the possibility of non-Malthusian dynamics, and the possibility has promise because the process of industrialization seems to involve a dramatic increase in the returns to human capital. People are moving out of traditional agriculture, where the necessary adult skills can be acquired through on-the-job child labor. More and more people are entering occupations different from their parents’ occupations that require skills learned in school as well as those learned at home. New kinds of capital goods require workers with the training to operate and to improve upon them. In such a world a parent can do many things with time and resources that will give a child advantages in a changing economy, and the fewer children a parent has, the more such advantages can be given to each child.

It is a unique feature of human capital that it yields returns that cannot be captured entirely by its “owner.” Bach and Mozart were well paid (though neither as well as he thought he deserved), but both of them provided enormous stimulation and inspiration to others for which they were paid nothing, just as both of them also gained from others. Such external effects, as economists call them, are the subject matter of intellectual and artistic history and should be the main subject of industrial and commercial history as well. These pervasive external effects introduce a kind of feedback into human capital theory: Something that increases the return on human capital will stimulate greater accumulation, in turn stimulating higher returns, stimulating still greater accumulation and so on.

On this general view of economic growth, then, what began in England in the 18th century and continues to diffuse throughout the world today is something like the following. Technological advances occurred that increased the wages of those with the skills needed to make economic use of these advances. These wage effects stimulated others to accumulate skills and stimulated many families to decide against having a large number of unskilled children and in favor of having fewer children, with more time and resources invested in each. The presence of a higher-skilled workforce increased still further the return to acquiring skills, keeping the process going. Wouldn’t such a process bog down due to diminishing returns to skill-intensive goods? Someone has to dig potatoes, after all. It might, and I imagine that many incipient industrial revolutions died prematurely due to such diminishing returns. But international trade undoubtedly helped England attain critical mass by letting English workers specialize in skill-demanding production while potatoes were imported from somewhere else.

Whatever the importance of human capital accumulation in the original industrial revolution, there is no doubt that rapid improvement in skills is characteristic of its diffusion in the modern world economy. Nancy Stokey estimates that the major stimulus of the North American Free Trade Agreement to economic growth in Mexico will be not the inflow of physical capital (though that is considerable), but the increased accumulation of human capital that will be stimulated by the higher rate of return the new physical capital will induce.5 Post-NAFTA Mexico is increasingly an economy that assigns high rewards to training and technological skills.

Generalizations from experience

Economically, the 60 years since the end of World War II have been an extraordinary period. The growth rates of world population, production and incomes per capita have reached unprecedented heights. As a result of the combination of poor countries with very little income growth and wealthy countries with sustained growth, the degree of income inequality across societies has reached unprecedented levels. None of this can persist. This, I think, is the main lesson of the broader history of the industrial revolution, as viewed by modern growth theory.

I have interpreted this period as the beginning of the phase of the diffusion of the sustained economic growth that characterizes the European industrial revolution to the former colonies of the non-European world. The rapid growth of non-European nations (and some of the poorer European ones) is mainly responsible for the extraordinarily rapid growth of world production in the postwar era. But enough other societies have been largely left out of this process of diffusion that the degree of inequality among nations remained about the same in 1990 as it was in 1960. As those economies that have joined the modern world catch up to the income levels of the wealthiest countries, their growth rates of both population and income will slow down to rates that are close to those that now prevail in Europe. We have seen these events occur in Japan; they will follow in country after country.

At the same time, countries that have been kept out of this process of diffusion by socialist planning or simply by corruption and lawlessness will, one after another, join the industrial revolution and become the miracle economies of the future. The income growth rates in these catch-up economies may be very high, but as fewer and fewer countries remain in this category, the effect on world averages will shrink. If so, then world population growth will attain a peak and begin shrinking toward less than 1 percent, and world production growth will similarly cease to rise and will fall back toward 3 percent. In other words, we will see a world that, economically, looks more and more like the United States.

What do history and economic theory have to say about factors that will accelerate this process of catching up? What policies for Pakistan or Nigeria would materially affect the likelihood of an economic miracle? For backward economies, dealing on a day-to-day basis with more advanced economies is the central element in success. No successes have been observed for autarchic, produce-everything-ourselves strategies (though such strategies can possibly work well for a few years: think of Russia in the 1920s or India in the 1950s). Trade has the benefit of letting a smaller country’s industries attain efficient scale, but I think an even more important factor is the need to get up to world standards, to learn to play in the big leagues. The only way learning and technology transfer can take place is for producers to compete seriously internationally. Learning-by-doing is perhaps the most important form of human capital accumulation.

Macroeconomic policy, however, does not appear to be of central importance to growth. Korea, Brazil and Indonesia have all enjoyed rapid growth under inflationary policies (though others—Argentina, Chile and, again, Brazil—have had the opposite experience). Of course, in all these cases, inflation has arisen from monetary expansion to cover fiscal deficits. Certainly, I do not want to endorse inflation—it is an unnecessary waste of resources with no positive side effects—but this seems to be a largely separate issue from growth. It is always a mistake to think of everything as interconnected (though, of course, everything is, in some sense): I think it is more fruitful to break a problem down into manageable pieces and address the pieces one at a time.

Of the tendencies that are harmful to sound economics, the most seductive, and in my opinion the most poisonous, is to focus on questions of distribution. In this very minute, a child is being born to an American family and another child, equally valued by God, is being born to a family in India. The resources of all kinds that will be at the disposal of this new American will be on the order of 15 times the resources available to his Indian brother. This seems to us a terrible wrong, justifying direct corrective action, and perhaps some actions of this kind can and should be taken. But of the vast increase in the well-being of hundreds of millions of people that has occurred in the 200-year course of the industrial revolution to date, virtually none of it can be attributed to the direct redistribution of resources from rich to poor. The potential for improving the lives of poor people by finding different ways of distributing current production is nothing compared to the apparently limitless potential of increasing production.

About the AuthorIn this essay, Robert E. Lucas Jr. continues a discussion featured in his 2002 book Lectures on Economic Growth, published by Harvard University Press. In 1995 Lucas received the Nobel Memorial Prize in Economic Sciences. He is a past president of the Econometric Society and the American Economic Association, a fellow of the American Academy of Arts and Sciences and the American Philosophical Society and a member of the National Academy of Sciences. See also:

|

Recommendations for Further Reading

For a good introduction to the way economists today are using theory to measure the importance of different sources of economic growth, see Stephen L. Parente and Edward C. Prescott, Barriers to Riches (Cambridge: MIT Press), 2000. I’ve used this book in class at Chicago, with good success. My students also enjoyed the more anecdotal treatment in William Easterly, The Elusive Quest for Growth: Economists’ Adventures and Misadventures in the Tropics (Cambridge: MIT Press), 2002. [See review in the September 2003 Region.]

Michael Kremer’s 1993 paper “Population Growth and Technological Change: One Million B.C. to 1990,” Quarterly Journal of Economics (107: 681–716) stimulated everyone who thinks about economic growth. So did Lant Pritchett’s “Divergence, Big Time” in the 1997 Journal of Economic Perspectives (11: 3–18) and Jeffrey D. Sachs and Andrew Warner, “Economic Reform and the Process of Global Integration,” Brookings Papers on Economic Activity, (1995): 1–118. Though published in professional journals, all of these papers have much to offer the nontechnical reader.

—Robert Lucas

Endnotes

1 A good description is available in: Robert Summers and Alan Heston, “The Penn World Table (Mark 5): An Expanded Set of International Comparisons, 1950–1988.” Quarterly Journal of Economics, 105 (1991): 327–368. The latest versions of the tables are available at pwt.econ.upenn.edu.

2 The sources for these and many other figures cited in this section are given in Chapter 5 of my Lectures on Economic Growth (Cambridge: Harvard University Press), 2002.

3 Robert M. Solow, “A Contribution to the Theory of Economic Growth.” Quarterly Journal of Economics, 70 (1956): 65–94.

4 Gary S. Becker, “An Economic Analysis of Fertility.” In Richard Easterlin, ed., Demographic and Economic Change in Developed Countries. Princeton: Princeton University Press, 1960. See also Robert J. Barro and Gary S. Becker, “Fertility Choice in a Model of Economic Growth.” Econometrica, 57 (1989): 481–501.

5 Nancy L. Stokey. “Free Trade, Factor Returns, and Factor Accumulation.” Journal of Economic Growth, 1 (1996): 421–448.