Loan data suggest that homeowner households are paying non-housing-related debt obligations before making their mortgage payments during the COVID-19 pandemic.

The mortgage delinquency rate in the Ninth Federal Reserve District1 hovered steadily around 3 percent for most of 2018, 2019, and the first quarter of 2020. Then, in April 2020, approximately 30,000 more mortgages became delinquent, increasing the overall mortgage delinquency rate by about 1.7 percentage points to 4.7 percent.2 In May 2020, the delinquency rate rose further, to 5.8 percent, reflecting about 20,000 additional mortgages that became delinquent. This is the highest mortgage delinquency rate many communities have faced since 2010.3

By contrast, delinquency rates for consumers’ credit cards and automobile loans were either stable or declined slightly through April and May. Notably, credit card usage decreased relative to consumers’ credit limits, suggesting that consumers were not leaning on that particular source of short-term credit.4

The relative stability of automobile and credit card debt may reflect the impact of household-oriented policy responses like the Coronavirus Aid, Relief, and Economic Security (CARES) Act’s unemployment insurance provisions and economic impact payments that replaced lost income for many households.

The fact that mortgage delinquencies have increased but other delinquencies have not may reflect a new, pandemic-related mandate that applies to lenders. Under the CARES Act, lenders must agree to forbearance requests from borrowers who have certain federally backed mortgages and are experiencing COVID-19-related financial hardship.5 These borrowers may be able to defer payments for up to 12 months, with no credit reporting or late fees. Additionally, some lenders—possibly many lenders—are offering similar assistance and forbearance to borrowers whose mortgages are not federally backed. In our data, homeowners in forbearance plans with their lenders are still considered delinquent.

Data reveal big changes in Ninth District metro areas

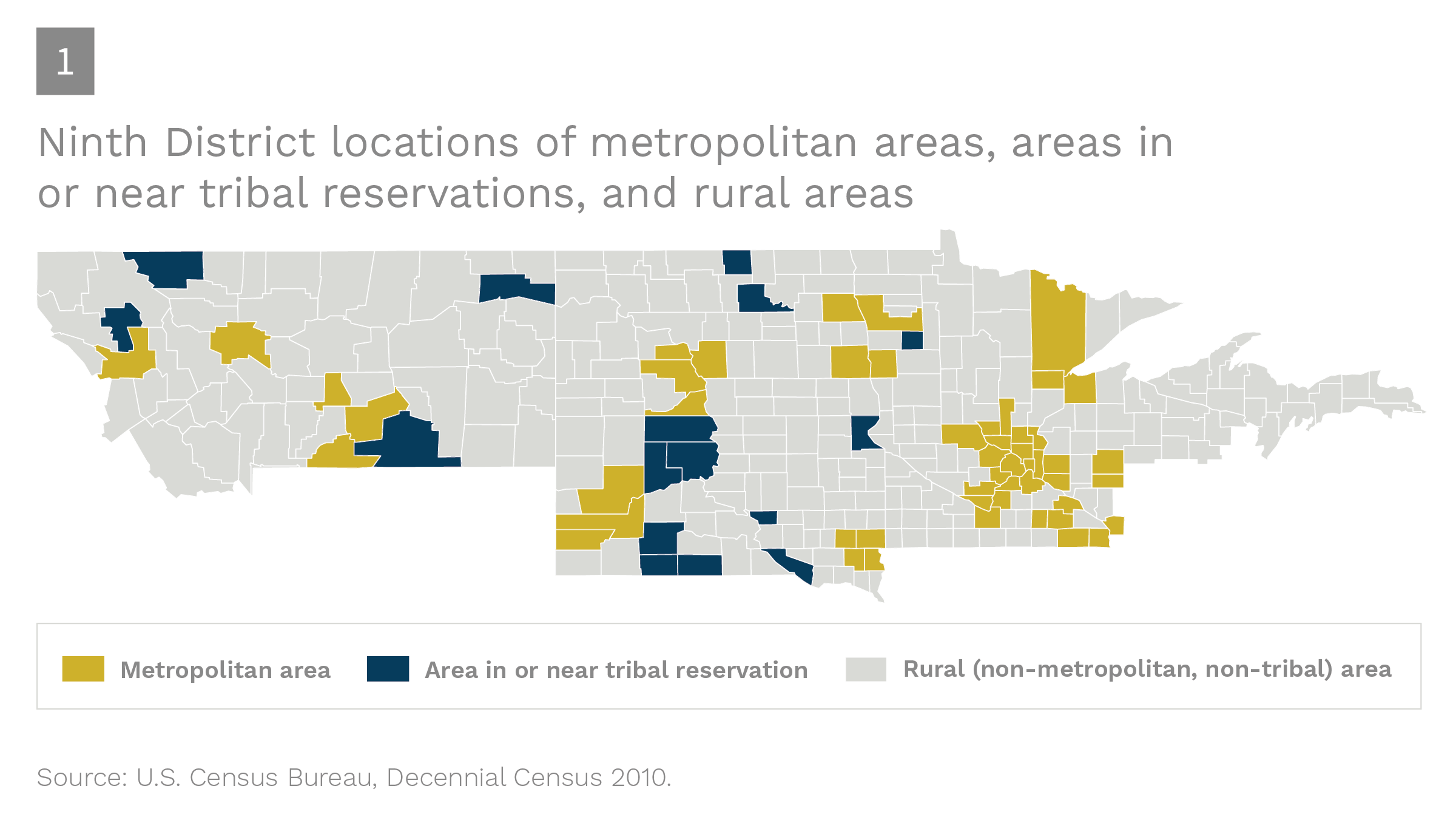

The Federal Reserve System tracks monthly data on individuals’ credit usage; in this analysis, we aggregate the data for the Ninth District to the county level and group them into three categories: metropolitan areas, areas in or near tribal reservations, and rural areas (i.e., areas that are non-metropolitan and non-tribal).6 Figure 1, above, shows where these communities are located within the Ninth District, while the table below lists some key demographic and economic differences among the county groups we track.

| Metropolitan areas | Areas in or near tribal reservations | Rural (non-metropolitan, non-tribal) areas | |

|---|---|---|---|

| Population | 5,889,496 | 146,385 | 3,323,771 |

|

% White, non-Latinx |

80.1 | 39.3 | 88.8 |

|

% of individuals below 150% of federal poverty level |

17.0 | 42.3 | 21.4 |

| Median household income | $72,858 | $44,384 | $54,678 |

| Median monthly housing cost | $1,161 | $510 | $776 |

Perhaps surprisingly given the differences among these counties, recent trends in delinquency rates have been roughly similar across the groups. Figure 2 shows delinquency trends for mortgages, auto loans, and credit card debts across the county types from March 2020 through May 2020. Auto loan delinquency rates fell slightly—and credit card delinquency rates remained relatively stable—for each group. By contrast, the mortgage delinquency rate for metro areas rose sharply, increasing by 3 percentage points in two months. The mortgage delinquency rate rose by 2.1 percentage points in rural areas and in areas in or near tribal reservations.7

As mortgage delinquency rates increased in the Ninth District, auto and credit card delinquencies remained stable and credit card usage declined

- Overall

- Metropolitan area

- Area in or near tribal reservation

- Rural (non-metropolitan, non-tribal) area

Source: Authors’ calculations using Federal Reserve Bank of New York Consumer Credit Panel/Equifax Data and Black Knight McDash Data.

Note: Delinquency is defined as 30 or more days past due. Delinquency rate is the number of delinquent lines of credit divided by the total number of lines of credit. Fully paid or foreclosed mortgages and bankrupt lines of credit are excluded. We define credit limit usage for an individual as the total credit card balance divided by the available credit limit; we then calculate the person-weighted average of credit limit usage within a given county group (the percentage point change in which is displayed in the figure).

The agencies producing these data are updating their statistics more frequently to provide real-time information during the pandemic. The Minneapolis Fed plans to continue monitoring delinquency rates for various types of consumer credit, with the goal of shedding light on the ways that different communities are experiencing the ongoing recession.

Endnotes

1 The Ninth District includes Minnesota, Montana, North Dakota, South Dakota, the Upper Peninsula of Michigan, and northwestern Wisconsin.

2 Authors’ calculation using Black Knight McDash Data and Federal Reserve Bank of New York Consumer Credit Panel/Equifax Data. All data are anonymous.

3 For definitions of delinquency and delinquency rate, see the note accompanying Figure 2.

4 For a definition of credit limit usage, see the note accompanying Figure 2.

5 Borrowers’ rights to forbearance and foreclosure protection under the CARES Act are outlined in a May 15, 2020, consumer guide from the Conference of State Bank Supervisors. According to a May 1, 2020, blog post by Black Knight, “as of April 30, more than 3.8 million homeowners are in forbearance programs with their lenders.”

6 Tribal communities are defined as counties in which at least 50 percent of the population are from a tribal nation. The estimation of tribal population by county is adopted from a working paper by the Center for Indian Country Development at the Minneapolis Fed.

7 We analyzed differences between higher- and lower-income rural areas and found them to be minimal (results not shown).