In the seven-county Twin Cities area,1 mortgage applicants of color are more likely than their White peers to receive denials for the most common type of home-purchase loan, even after accounting for credit scores and other detailed application characteristics. According to our analysis of 30-year, conventional, home-purchase loans, Asian, Black, and Latino/a applicants were two to three times more likely to have their application denied than similar White applicants, whose denial rate was just 1.7 percent.2 Our analysis builds on previous work through the benefit of our access to confidential, newly available data on borrowers’ credit scores and more details on important loan-to-value and debt-to-income ratios from the Home Mortgage Disclosure Act (HMDA) dataset.

Recent studies have highlighted the Twin Cities area’s large racial disparities in homeownership.3 Our findings add to the understanding of those homeownership gaps by highlighting the disparity in mortgage-denial rates: observed characteristics of borrowers and loan applications explain only a portion of relatively large racial gaps in denial rates.

Analysis focuses on lowest-risk borrowers

We focus on conventional loans—the highest-volume segment of the mortgage market—for two reasons. First, analyzing conventional loans allows us to look at racial disparities among what are likely the lowest-risk applicants. All the applications in our data sample are for loans that meet underwriting criteria per government-sponsored enterprises (GSEs), including Fannie Mae and Freddie Mac. From a lender’s perspective, the risk from such loans is minimal because the loans can generally be sold to the GSEs after origination.4 Second, limiting our sample to a single loan product simplifies our analysis because loan requirements differ across loan products.

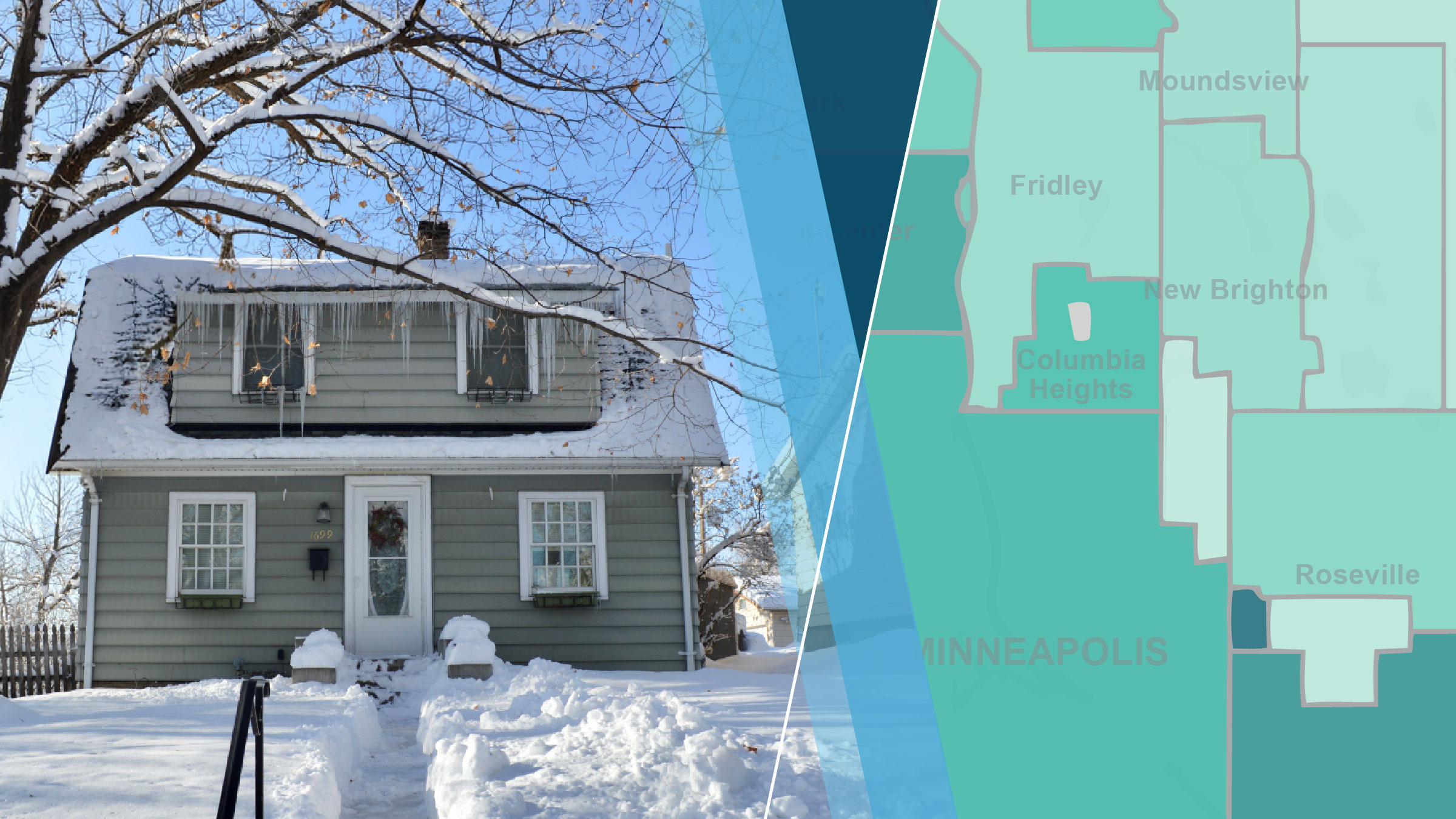

The portion of the HMDA dataset that we use includes information on nearly 100,000 completed, conventional-mortgage applications for home purchases in the seven-county Twin Cities area from 2018 through 2020. These loan applications amounted to 56 percent of the home-purchase mortgage applications in the Twin Cities area over that period. The applications are for owner-occupied, single-dwelling homes secured by a first lien.5 About one in five of the applications were for properties in Minneapolis or St. Paul; the rest were in surrounding communities.

Racial gaps in mortgage-denial rates are pervasive

In our data sample, denial rates for Asian, Latino/a, and Black applicants were 3.5, 4.2, and 5.5 percent, respectively—or roughly two, two-and-a-half, and three times greater than the denial rate for White applicants, which was 1.7 percent.6 Some of these disparities may be explained by differences in applications across racial groups. For example, borrowers of color tend to have lower credit scores than White applicants. They tend to have lower incomes and wealth as well. In the Twin Cities area, the median Black household income of $38,000 is less than half the median White household income of $87,000. In Minnesota, the median Black and Latino/a households hold $0 and $18,000 in wealth, respectively, compared to $211,000 for the median White household.7 Because they are less likely to have the household financial resources White borrowers have, borrowers of color tend to apply for loans with higher loan-to-value ratios (that is, loans that are larger compared to a property’s value) and higher debt-to-income ratios (that is, loans with payments that are higher relative to borrowers’ incomes).

After adjusting for differences in borrower and loan characteristics, such as credit scores, incomes, loan-to-value ratios, debt-to-income ratios, and other observed factors, we find that Asian, Black, and Latino/a applicants in the Twin Cities area are still more likely than White applicants to have their mortgage applications denied.8 For example, our analysis suggests that Black applicants’ denial rate would be 2.6 percentage points higher, or roughly two-and-a-half times higher than White applicants’ denial rates, even if credit scores, loan-to-value and debt-to-income-ratios, and other observed factors were the same between Black and White applicants. We find that observed application characteristics explain 21 percent of the gap between Asian and White applicants, 33 percent of the overall gap in denial rates between Black and White applicants, and 38 percent of the gap between Latino/a and White applicants.

Racial gaps in mortgage-denial rates persist across geographies

We also tested whether, after accounting for application-level characteristics, the remaining disparities are tied to neighborhood-level racial/ethnic composition. For example, are the racial gaps in denials larger or smaller in neighborhoods with a greater share of residents of color? We find that Asian, Black, and Latino/a applicants experienced similar disparities in mortgage-application denials regardless of the racial composition of the neighborhoods where the properties they were applying to purchase are located.

However, neighborhood characteristics might still contribute to disparities. Our limited sample size, with low denial rates overall, means that racial disparities must be fairly large to be clearly identified. In addition, some may wonder whether all applicants are more likely to be denied in neighborhoods with a high concentration of people of color. When we look at denial rates for White applicants—again adjusting for application characteristics—we find no difference in denial rates across neighborhoods that have different shares of people of color.

Improved data still have limitations

HMDA data capture many aspects of mortgage applications that lenders evaluate. However, HMDA data do not include some factors that also influence lenders’ decisions, such as an applicant’s employment history or their savings. (And though the data include credit scores, they do not include credit histories.) HMDA data also do not enable us to study discrimination that people of color may face before and during the home-buying process. For example, systemic, racialized barriers in housing policy and the job market contribute to the disparities in income and wealth levels described earlier.

Simply put, our analysis using HMDA data cannot account for every factor in a lender’s decision or an applicant’s homeownership journey. It does, however, provide insight into existing racial gaps in conventional-mortgage approvals by enabling us to conduct comparisons that are more apples-to-apples than was previously possible.

Understanding the drivers of the racial disparities

Conventional mortgages represent one of the safest lines of business for many lenders, and approval requirements are largely standardized. And yet, even in our sample of conventional-mortgage applications in the Twin Cities area, large racial disparities in denial rates remain.

These unexplained racial disparities come with costs for mortgage applicants of color. For example, a denial for a conventional mortgage may drive some borrowers to unnecessarily seek out (or be led to) other, more costly mortgage products.

Lenders should examine their mortgage-application processes to understand how they may unintentionally contribute to racial disparities. For example, applicants of color may be more likely than White applicants to receive income from independent contracting or other, more variable income sources. While such income does not necessarily inhibit creditworthiness, it can require more work on the part of lenders and potential borrowers to verify. The approaches lenders take to such applicants may contribute to racial disparities.

Both lenders and policymakers should also evaluate whether home-buyer support is reaching all of the potential borrowers who stand to benefit the most. Such assistance could be formal, such as down-payment assistance; or informal, such as when a loan officer makes an extra call to ensure an applicant submits required materials on time. Our analysis suggests that such an evaluation must consider the higher denial rates applicants of color face.

Thank you to Trent Bowman for his insights on the lending process.

Endnotes

1 We focus on the seven-county Minneapolis-St. Paul region, which contains Anoka, Carver, Dakota, Hennepin, Ramsey, Scott, and Washington counties.

2 When compared to the denial rate for White applicants, our disparity estimates suggest applicants of color are two to three times more likely to receive denials under the assumption that their loan characteristics looked like those of White applicants. If, instead, we compared denials as if White applicants had similar characteristics to applicants of color, then applicants of color would be roughly two times more likely to receive denials. We focus on analyses that identified statistically significant racial disparities in mortgage denials in the Twin Cities area. The available data do not allow us to examine potential disparities with precision in particular communities—for example, among Native Americans or particular ethnic communities within the Twin Cities area’s Asian, Black, and Latino/a populations. More detail at a national level is available in our working paper.

3 See, for example, the reports Who Owns the Twin Cities? and Explaining the Black-White Homeownership Gap: A Closer Look at Disparities Across Local Markets from the Urban Institute and the article “Systemic racism haunts homeownership rates in Minnesota” from our team at the Federal Reserve Bank of Minneapolis.

4 Credit-score and loan-to-value-ratio loan requirements can be found on Fannie Mae’s website. Although all applications in the sample meet these minimum GSE requirements, they may still be ineligible to be sold to GSEs. Additionally, some lenders choose to keep these loans and their associated risks on their balance sheets.

5 We also limit the sample to site-built properties, which excludes mortgage applications for manufactured homes.

6 These low denial rates reflect the sample selection our analysis focuses on, which includes the most standardized pool of loans with lower risks to lenders, as explained earlier. For comparison, the denial rates among home-purchase mortgage applications that are not included in our sample for Asian, Black, Latino/a, and White applicants are 12.5, 17.3, 14.6, and 7.9 percent, respectively.

7 Survey of Income and Program Participation (SIPP) 2014 Panel Data and authors’ calculations. As SIPP sample sizes are small at the state level, these estimates are necessarily imprecise.

8 See our working paper.