A New Nation | The First Bank of the United States | The Second Bank of the United States | "Free" Banks | National Banks| Laying the Groundwork | The Federal Reserve: 1913-present

Prelude

Nearly every country around the world, and certainly every developed industrial nation, has a central bank. Most serve one or more of the following functions: acting as a bank for bankers, issuing a common currency, clearing payments, regulating banks and acting as a “lender of last resort” for banks in financial trouble. The one thing they all do is serve as banker to their own governments.

But even though these central banks have common functions, each still operates in distinct ways, and those distinctions largely stem from the banks’ historical foundations. If you want to understand the nature of a modern central bank, you have to study its history and relationship to commerce and government. This is especially true of the United States, where the Federal Reserve System’s unique structure has been shaped by this country’s earlier experiments with central banking, and by the political response to those experiments. Indeed, the Federal Reserve itself has changed in profound ways since it was signed into law in 1913.

Still, as you will see, the Federal Reserve has similarities to the country’s first attempt at central banking, and in that regard it owes an intellectual debt to Alexander Hamilton. “There is scarcely any point in the economy of national affairs of greater moment than the uniform preservation of the intrinsic value of the money unit,” Hamilton wrote in 1791, one week after the Senate approved his bank bill, and sounding like a modern-day Fed chairman. “On this, the security and steady value of property essentially depend.”

A New Nation: 1775-1790

To finance the American Revolution, the Continental Congress printed the new nation’s first paper money. Known as “continentals,” the notes were originally intended to be redeemable on demand in specie. However, the congress reneged on its promise and issued notes in such quantity that they led to inflation, which, though mild at first, rapidly accelerated as the war progressed. Eventually, people lost faith in the notes, and the phrase “not worth a continental” came to mean “utterly worthless.”

After the Revolutionary War ended, the nation had substantial debt, a significant portion of which was issued by the individual states. There was no common currency, as many states printed their own money. These were two of the chief financial problems facing the nation’s founders around the time the Constitution was written. Alexander Hamilton thought having the federal government take over the states’ war debts would be a good way to fix these problems while establishing federal power preeminent over that of the states, another of his goals.

The First Bank of the United States: 1791-1811

The Constitution itself prohibited state governments from issuing their own currency. The Bank of the United States was conceived in 1790 to deal with the war debt and to put the government on sound financial footing. It was intended to help fund the government’s debt and issue currency notes. Hamilton, then President George Washington’s Treasury secretary, was the architect of the Bank, which he modeled after the Bank of England.

The Bank was to have start-up capital of $10 million, financed by selling stock. This was quite a large sum at the time. The federal government would own $2 million, giving it substantial control, with the remainder owned by private investors. In addition to the main office in Philadelphia, the Bank had eight branches, one in each of the nation’s major cities.

Though the intent of the Bank was to facilitate government finances, Hamilton had another goal in mind—to function as a commercial bank. At the time of the revolution, there were barely any banks in the colonies; Britain had used its authority to protect its own banks and prevent the development of financial rivals. Hamilton’s vision was to create a central source of capital that could be lent to new businesses and thereby develop the nation’s economy. So while in some ways the First Bank prefigured the Federal Reserve, it also differed from it significantly by offering commercial loans, which the Fed, along with most modern central banks, does not do.

The Bank can be largely judged a success both in paying off war debts and in its commercial operations, which were much larger than its public activities. However, from the beginning, there were those who argued that the Bank was unconstitutional. The Constitution granted power to tax and print money to Congress, not a private corporation, critics argued. Also, with the war debt largely taken care of, many no longer saw the need for a national bank. So in 1811, when faced with the decision to renew the Bank's charter, Congress refused, by one vote, to renew it, and the bank ceased operations.

The Second Bank of the United States: 1816-1836

With the War of 1812, federal debt began to mount again. At the same time, most state-chartered banks, which were issuing their own currency, suspended specie payments. So public opinion again became favorable toward the idea of a national bank, and Congress chartered a new one, charged primarily with promoting a uniform currency by getting banks to resume specie payments. The Second Bank functioned as a clearinghouse; it held large quantities of other banks’ notes in reserve and could discipline banks that it was concerned were over-issuing notes with the threat of redeeming those notes. In this way, it functioned as an early bank regulator, a crucial function of the modern Fed.

The Second Bank was similar in structure to the First Bank, but bigger; it had capital of $35 million, with the government again holding one-fifth of the shares. Like the First Bank, it was headquartered in Philadelphia; over the time it operated, it had offices in 29 major cities around the country. Unlike the First Bank, however, the Second Bank was poorly managed at its outset and was on the verge of insolvency within a year-and-a-half after it opened. But after a congressional inquiry into the Second Bank’s problems, Langdon Cheves was brought in as president in 1819 and saved it from collapse. Cheves was succeeded by Nicholas Biddle in 1822, and the Second Bank is generally considered to have operated effectively under their leadership.

However, the Second Bank still had powerful opponents, primarily in the form of President Andrew Jackson. Jackson hadn’t forgotten the lessons from the early years of the Bank’s existence—that such a powerful private institution was susceptible to corruption and would be difficult to control. At the time Jackson was elected, the Bank was operating successfully and was one of the most powerful organizations in the country. Jackson made his opposition to the Bank clear from the beginning. When Bank President Nicholas Biddle heard Jackson intended to close the Bank, he began to use the Bank’s resources against Jackson, which ignited a bitter struggle. When Jackson refused to renew the Bank's charter in 1832 and later began to pull federal deposits from its vaults, it was effectively crippled and withered until the charter expired in 1836.

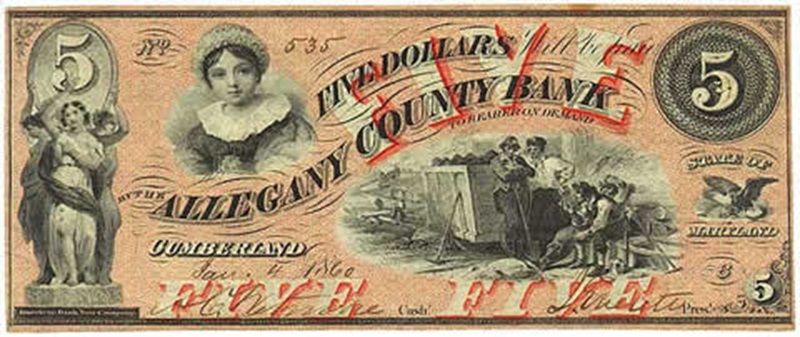

“Free” Banks: 1837-1863

While there had always been state-chartered banks in the United States, with loss of the Second Bank’s charter, there was a need for more banking. Consequently, during the period from 1837 to the Civil War, commonly known as the free banking era, states passed “free bank laws,” which allowed banks to operate under a much less onerous charter. While banks were regulated, they were relatively free to enter the business by simply depositing government bonds with state auditors.

These bonds were the collateral backing the notes free banks issued. In addition, free banks were required to redeem their notes on demand in specie. As a result of the free banking laws, hundreds of new banks opened their doors, and free bank notes circulated around the country, often at a discount: The discount on a given bank note varied in part with the distance from the issuing bank and in part with the perceived soundness of the bank.

Over this period a private institution, known as the Suffolk Bank in New England, took on some of the roles typical of a central bank, such as clearing payments, exchanging notes and disciplining banks that were over-issuing their notes. Also, in response to a rising volume of note and check transactions beginning in the late-1840s, the New York Clearinghouse Association was established in 1853 to provide a way for the city’s banks to exchange notes and checks and settle accounts.

National Banks: 1863-1913

The outbreak of the Civil War and the need to finance it led again to a renewed interest in a national bank. But this time, with the lessons of the Second Bank, the designers took a different approach, modeled on the free banking system. In 1863, they established what is now known as the “national banking system.”

The new system allowed banks to choose between a national charter and a state charter. With a national charter, banks had to issue government-printed bills for their own notes, and the notes had to be backed by federal bonds, which helped fund the war effort. In 1865, state bank notes were taxed out of existence. Thus, in spite of all previous attempts, this was the first time a uniform national currency was established in the United States.

Panic! 1873, 1893, 1907

While the national banking system served its role in financing the war and establishing a uniform currency, it was fraught with at least one bank panic in every decade after the Civil War. A bank panic would often begin when depositors would learn that their bank was unable to meet withdrawal requests. This, in turn, caused a “run” on the bank, in which a large number of depositors attempted to pull out their money, causing an otherwise solvent bank to fail. Seeing this, depositors at other banks were led to withdraw their funds, causing a systemwide panic. In 1893, a bank panic coincided with the worst depression the United States had ever seen, and the economy stabilized only after the intervention of financial mogul J. P. Morgan. After another particularly bad panic and ensuing recession in 1907, bankers and the Congress decided it was time to reconsider a centralized national bank.

Laying the Groundwork: 1908-1912

This reconsideration led to the Aldrich-Vreeland Act of 1908, which provided for emergency currency issues during crises. The act also established the National Monetary Commission to search for a long-term solution to the nation’s banking and financial problems. The 1912 election of Democrat Woodrow Wilson replaced the Republican Aldrich plan, with what was to emerge as the Federal Reserve Act of 1913.

Though not personally knowledgeable about banking and financial issues, Woodrow Wilson solicited expert advice from Virginia Rep. Carter Glass, soon to become the chairman of the House Committee on Banking and Finance, and from the Committee’s expert adviser, H. Parker Willis, formerly a professor of economics at Washington and Lee University. Throughout most of 1912, Glass and Willis labored over a central bank proposal, and by December 1912 they presented Wilson with what would become, with some modifications, the Federal Reserve Act.

From December 1912 to December 1913, the Glass-Willis proposal was hotly debated, molded and reshaped. By December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law, it stood as a classic example of compromise—a decentralized central bank that balanced the competing interests of private banks and populist sentiment.

The Federal Reserve: 1913-present

In the intervening 70 years since the Second Bank closed, central banks in other countries such as England began to take on new roles. Their preferred status as the government’s banker caused others to view them as more secure, which led to their holding deposits and serving as a “banker’s bank.” That, along with an expanded role in payments and lending, led to their taking on a regulatory role, since they needed to ensure the quality of banks with which they were doing business. And finally, their power over the issuing of currency and tremendous capital holdings led to the development of monetary policy, for which central banks are now best known.

In designing the new Bank, Glass and Willis took lessons from the First and Second banks. They removed the private role of the bank in commercial lending, so that the new bank would be a largely public institution. Profits in excess of cost were handed over to the U.S. Treasury. In addition, the Fed was given authority over the nation's payments system. Financial transfers and check processing that were handled by private clearinghouses would now be conducted by the Fed, with the fees for such services going to run the Bank.

Wary of repeating a battle like the one between Jackson and Biddle, the Federal Reserve’s founders designed a decentralized central bank to prevent the concentration of power. There was concern that the new central bank would be run by, and for, Wall Street, and so it was important to the founders that the Bank not be focused on New York. Thus, the system was decentralized into District Banks, which operated independently, and with an oversight board located in Washington, D.C. Each District Bank issued its own money, backed by the promise to redeem this money in gold. After Congress passed and President Wilson signed the Federal Reserve Act in 1913, Congress established 12 District Banks to reflect the distribution of population and banking in the country. (For more on the Federal Reserve’s history, visit FederalReserveEducation.org.)

Today, the Federal Reserve is best known for making monetary policy. But that wasn’t one of its main roles originally. At its founding, the Fed’s main role was to prevent future bank panics by providing liquidity in the form of loans to member banks and by supervising those banks. However, the Fed did have some tools for conducting monetary policy, which it would put to use later.

The Great Depression was the Federal Reserve’s first great test as a central bank—and it failed. The Fed was stymied by outdated economic theories that treated recessions as painful but necessary, and the gold standard limited the bank’s ability to expand the money supply. Monetary policy matured when the U.S. abandoned the gold standard in 1933. The nation began explicitly using fiat money for the first time, and a formal authority became necessary to ensure that policy would be carried out responsibly. In 1935, Congress created the Federal Open Market Committee as the Fed’s monetary policy arm.

Like its predecessors, the Federal Reserve has had a sometimes stormy relationship with the executive office and Congress over the years. The federal government took more control of the Federal Reserve during the Great Depression and World War II, but since 1951—and the resolution of a power struggle with the Treasury Department—the central bank has operated largely independent of the political process. Still, the Federal Reserve regularly reports to Congress and must answer questions and address issues important to the House and the Senate.

The Federal Reserve’s next great test was the stagflation of the 1970s and early 1980s. As the nation wrestled with high inflation and high unemployment, Congress formally gave the Fed a “dual mandate”: Use monetary policy to stabilize prices and maximize employment. Under the leadership of Chairman Paul Volcker, the Federal Reserve raised interest rates to new heights to tame inflation. This move proved unpopular because it slowed the economy down and increased unemployment. But prices did eventually stabilize, and unemployment fell.

Since the 1980s, the Federal Reserve has frequently used its role as a provider of liquidity to limit the damage of economic crises. During the stock market crash of 1987, for example, the Fed encouraged private banks to provide credit to brokerage firms under financial stress by stating that it was ready to support the banks if needed. During the Great Recession, the Fed started a plethora of lending programs supporting certain financial markets. And in the recent recession that accompanied the COVID-19 pandemic, the Fed again started lending programs to support not only financial firms but also small businesses and local governments.

Conclusion

While it’s clear from this chronology that central banking in the United States has evolved over time, a shared motivation throughout this history is also apparent—to better serve commerce and government. That was the inspiration behind Alexander Hamilton’s campaign to establish the First Bank of the United States, behind the efforts of the Second Bank and the banking legislation that followed, and the core purpose behind the Federal Reserve Act. And those objectives will certainly continue to motivate Congress and the Federal Reserve as they contemplate future changes in the operations of the nation’s central bank. While Hamilton would not recognize many functions of modern central banking, he would certainly recognize its goals.

Currency images courtesy of the American Currency Exhibit, Federal Reserve Bank of San Francisco. For larger images and more information, please visit the American Currency Exhibit.