If you really—we mean really—want to scare the locals next Halloween, here's an early costume idea for you or your kids: Dress up as Wal-Mart.

Yes, few things strike fear and a healthy dose of controversy into communities as does Wal-Mart, that ubiquitous purveyor of socks, soda, stereos, soap, salami, sweaters and sundry other consumer supplies. The discount chain carries the contradictory titles of most popular retailer in the United States and the entire world in terms of revenue—$344 billion in fiscal 2007—and public enemy number one, particularly in a community sense.

Wal-Mart has been fingered as the source of virtually every conceivable economic ill. It kills jobs and downtowns, say critics, and destroys community character. It's been accused of discriminating against women, using illegal immigrants, requiring work off the clock and being overly aggressive in stopping the formation of labor unions among its workers.

It's been blamed for sprawl and traffic congestion, as well as aesthetic offenses. For example, as the company upsizes from discount stores to supercenters in many towns, it often leaves behind an empty shell whose only visitors are the weeds that crop up in the unused parking lot, which might itself be in view of the new store. That new store, critics contend, probably received infrastructure upgrades that Wal-Mart strong-armed from local communities, lest it find a better offer elsewhere. The company adds a final dash of salt to the wound by repeatedly fighting (and mostly winning) property tax assessments on its stores.

Wal-Mart even scares businesses that aren't direct competitors, at least not yet. Banks, for instance, lobbied Congress hard to keep Wal-Mart from becoming an industrial loan corporation, which, in effect, would have allowed it to offer banking services.

But some argue that the company can be, and often is, a force for good. Wal-Mart's low prices are hard to dispute, and the biggest benefactors are low-income shoppers. Wal-Mart has been widely lauded for its $4 pharmacy program, which has rippled through drug and pharmacy industries to the delight of consumer advocates.

The company has received considerable attention for various environmental initiatives. It has widely replaced store lighting with energy-saving bulbs and given the bulbs prominent space on store shelves. The company announced in November that it has increased the energy efficiency of its buildings and truck fleets by 15 percent since 2005, and has committed to using solar energy at 22 sites. It also promised to cut solid waste from its U.S. stores by 25 percent by next October. Earlier in the year, the company announced a pilot program with a small number of suppliers (among its 60,000 worldwide) who will start measuring, and hopefully reducing, their carbon footprint.

One corporate entity. So many identities, so many costumes. Cities fight to keep Wal-Mart out, and folks celebrate when they succeed, even temporarily. Yet when a new Wal-Mart is approved, job applications reportedly pour in, and local high school bands literally trumpet the grand opening as cars line up in the parking lot. Wal-Mart is a death knell to some, a blessing to others. There is likely no other enterprise that engenders such strong and conflicting opinions and actions among individuals and the general public.

The company has even managed to become a swing voter: Political consultants have fashioned the "Wal-Mart mom" as someone with moderate to low income and a low education level who is politically conservative and feeling economically insecure. What other company is the subject of a musical? "Walmartopia" is a political satire that premiered in Madison, Wis., and is currently a full-fledged off-Broadway production.

Why Wal-Mart receives the attention is pretty obvious. Nearly 90 percent of the country's population lives within 15 miles of a Wal-Mart, and two-thirds of all retail stores are located within five miles of a Wal-Mart. About five of every six Americans shopped at a Wal-Mart in 2005. In fiscal year 2007, the company accounted for 6 percent of all retail and food service sales in the United States, and 7.5 percent if you take out motor vehicle sales, according to company figures and U.S. Census Bureau data. Wal-Mart's 2005 sales were larger than the combined sales of the next five biggest retailers in the country. Wal-Mart became the nation's largest grocery store in 2002, just 14 years after it opened its first supercenter.

It adds up to a simple case of Wal-Mart being in everybody's proverbial grill. According to a 2005 survey by Pew Research Center for the People and the Press, 24 percent of people think Wal-Mart is bad—bad—for the country, and 31 percent had an unfavorable view of the company, "which is a considerably higher negative rating than is accorded to many other major corporations," the survey said. In a bit of cognitive dissonance, among those living near a Wal-Mart, the same survey found that 81 percent said it was a good place to shop.

Wal-Mart, we love to hate thee—ooh, is that a sale on Pampers?

Argument framing, aisle2

What's it all mean? After all the debate, the finger-pointing and myriad opinions, what's the bottom line on Wal-Mart? Is it good, bad or innocuous for Wal-Mart to come to your town, and how do you know?

Good question. The company has been the focus of a lot of research and analysis (see sidebar). While that research has come to an array of conclusions—virtually all of them disputed in some fashion—much of the analysis is faceless in terms of geography.

So the fedgazette decided to take a closer look at the matter, attempting to answer a seemingly straightforward question: What economic effect does Wal-Mart have on local communities in the Ninth District? Conventional wisdom suggests that Wal-Mart's economic influence is significant and obvious. If that's indeed the case, then we should see palpable change in measures commonly used as proxies for community health—things like jobs, firms, income, population and poverty.

So the fedgazette looked at 40 small counties in the district that saw Wal-Mart come to town between 1986 and 2003 and compared them with 49 similarly sized non-Wal-Mart counties in the district (see methodology). The fedgazette then looked at these familiar benchmarks—jobs, firms, population, income and poverty—from 1985 to 2005 to see if Wal-Mart counties performed differently than non-Wal-Mart counties.

Readers should understand that all results come with a host of caveats (again, see methodology for examples). The point of this research is not to offer the last word on whether Wal-Mart is helpful or harmful—it is clearly both, though which it is depends on the circumstances. In fact, in this matter Wal-Mart is no different from any new business—large or small—coming to town and competing with incumbent businesses for finite spending in a community. Wal-Mart just competes for a larger share of it, and within a bigger geographic area. As a result, the hope of this research is to better frame the friend-or-foe debate over Wal-Mart.

Given the terror that Wal-Mart is purported to inflict on communities, the fedgazette's findings of the firm's economic influence are almost mundane. Despite its kill-them-all reputation, Wal-Mart is not the threat that many fear, at least in terms of economic benchmarks commonly associated with healthy, growing communities.

For example, Wal-Mart is widely believed to destroy local firms and jobs and to have a dampening effect on wages. But fedgazette findings suggest the opposite: Firm growth, employment and total earnings were somewhat stronger in Wal-Mart counties and, in some cases, even in the retail sector. The research does suggest that retail earnings per job fell in virtually all counties studied. But they actually fell by less in Wal-Mart counties.

But neither has Wal-Mart been a boon for local communities. Poverty rates, for example, declined in most counties during the period studied, but they declined by less (poverty rates didn't improve as much) in Wal-Mart counties. By other measures, Wal-Mart had no noticeable effect. Overall, counties with and without Wal-Mart had similar growth in population and income per person.

It should be emphasized that there are big differences in population, income and employment growth rates among the counties studied. Some counties with a Wal-Mart had strong growth, and other Wal-Mart counties had slow growth. Similarly, there were fast and slow growers among non-Wal-Mart counties. The point here is that Wal-Mart's presence explains little of this disparity pattern. Still, some notable outcomes did show through in the study.

In sum, fedgazette findings suggest that Wal-Mart has a slightly positive effect on counties where the retailer decides to set up shop. But the effects are small; one could call the results mostly a wash. As a result, maybe the most concrete—and surprising—conclusion is that Wal-Mart's presence (or lack thereof) has little or no predictive power regarding the economic success or failure of a county.

Start at the beginning

First, let's look at some characteristics of the 40 Wal-Mart counties and the 49 non-Wal-Mart counties. About two-thirds of the Wal-Mart counties being studied had their store in place by the early 1990s.

Not surprisingly, Wal-Mart tends to locate in larger counties. In general, the larger the county's population (using the study's start date of 1985), the more likely Wal-Mart would eventually locate there. For example, about 20 percent of counties with populations between 10,000 and 20,000 in 1985 had a Wal-Mart by 2005, but the rate was close to 60 percent for counties between 20,000 and 30,000 people, rising to 80 percent for counties between 30,000 and 40,000. Every county in the district with a population over 40,000 had a Wal-Mart by 2005. On the other end of the spectrum, none of the 144 counties with a population under 10,000 in 1985 saw Wal-Mart come to town over the next 20 years.

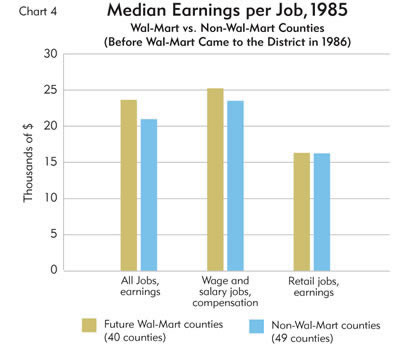

In 1985, before any Wal-Marts appeared on the scene, counties that would be getting a Wal-Mart sometime in the coming two decades tended to have higher levels of population and employment, as well as higher employment ratios (jobs to population) relative to non-Wal-Mart counties. Retail sectors were larger in those counties that would later get a Wal-Mart. But per capita income levels were basically even between Wal-Mart and non-Wal-Mart counties (see Chart 1), and retail earnings per job were also similar (see Chart 4 ).

(See data sources for charts.)

All dollar values are constant 2000 dollars.

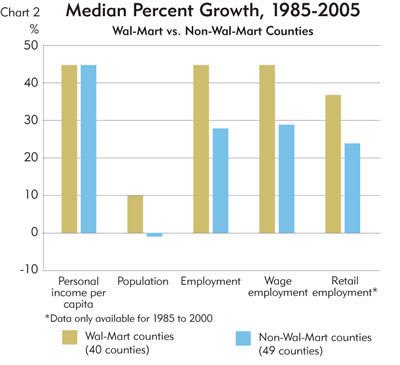

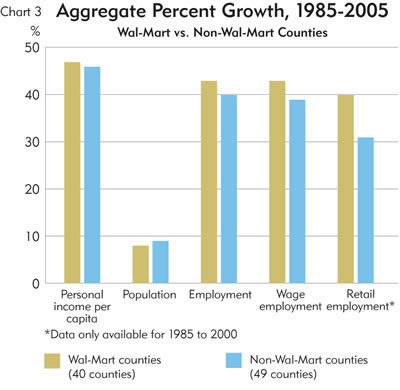

Now fast-forward 20 years and take a look back at the growth of these same categories since 1985. Generally speaking, Wal-Mart counties saw stronger growth through 2005 by both median and aggregate (all counties combined) measures (see Charts 2 and 3).

All dollar values are constant 2000 dollars.

All dollar values are constant 2000 dollars.

Personal income growth over two decades was virtually identical in Wal-Mart and non-Wal-Mart counties, both in median and aggregate terms. Population growth was a mixed bag. Wal-Mart counties saw much higher median population growth. However, this appears to be a case of meager growth in the small non-Wal-Mart counties, which are somewhat overrepresented in the comparison group; median growth of non-Wal-Mart counties with populations over 20,000 was similar to Wal-Mart counties, as was aggregate population growth in both study groups (see Chart 3 above).

That's not much of a victory for Wal-Mart fans, nor much grist for the critics' mill; such similarity of group results, yet volatility across all counties, suggests that Wal-Mart's presence had little influence on population in either direction. In fact, the lock step growth in income similarly suggests that Wal-Mart had little influence there as well.

Results are a bit stronger, and more favorable to Wal-Mart, when it comes to employment and earnings. Median employment growth was notably higher in Wal-Mart counties than in non-Wal-Mart counties. The difference shrinks for aggregate employment. This is due in part to five booming non-Wal-Mart counties (out of 49) that saw employment growth exceed 100 percent over this period; all but one border a metro county. In contrast, only one Wal-Mart county experienced employment growth of more than 100 percent.

Again, these results demonstrate the wide range of county performances, but also show that overall results for non-Wal-Mart counties are pulled up considerably by a small handful of fast-growing counties, most of which are near metro counties that already have a Wal-Mart. The same performance-enhancement effect is not true for the pool of 40 Wal-Mart counties.

Growth in job earnings offers another interesting angle. In 1985, overall earnings per job were higher in counties that would get a Wal-Mart in the future. However, wages in the retail sector in 1985 were almost identical in Wal-Mart and non-Wal-Mart counties (see Chart 4).

All dollar values are constant 2000 dollars.

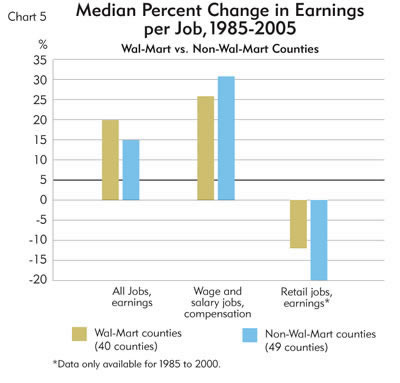

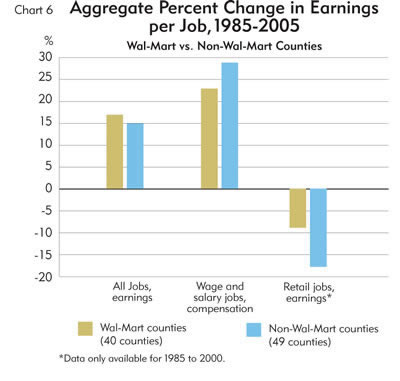

From 1985 to 2005, earnings per job grew faster in Wal-Mart counties by both median and aggregate measures. In the retail sector, earnings per job actually fell in Wal-Mart counties over this period—but they fell by even more in non-Wal-Mart counties (see Charts 5 and 6).

All dollar values are constant 2000 dollars.

All dollar values are constant 2000 dollars.

One of the few areas where non-Wal-Mart counties saw stronger growth was in total compensation—wages plus benefits like health care and retirement contributions—for wage and salary workers. Though the difference was not particularly large, it fits with the long-term trend of firms offering workers more (and more expensive) benefits over time, while Wal-Mart has been chastised for its employee benefits. However, a better apples-to-apples comparison (which was not available in the data) would be growth of income and benefits just in the retail sector, which historically offers fewer benefits than most other sectors of the economy.

Pricing out the competition?

Wal-Mart is often accused of trampling the local business sector. But data on county establishments don't support such a notion, at least not in the Ninth District. The most obvious place to look is at general merchandise establishments in a county (a business classification that includes Wal-Mart). Much higher levels of business closures might be expected to show up in Wal-Mart counties, but the data don't bear that out.

Several limitations prevent any strong conclusions regarding general merchandise stores. For example, the number of firms in this category is comparatively small at the county level. The time frame for observations also is limited by the fact that the federal government converted to a new business classification system (Standard Industrial Classification to North American Industry Classification System) in 1997. Creating a methodologically sound bridge between the two systems (to ensure we're still measuring the same thing, in the same way) is shaky when total firms in question are small. What we can say is that from 1985 to 1997, general merchandise stores declined by similar amounts—about half-a-store on average—in non-Wal-Mart counties and in the 31 Wal-Mart counties that had a Wal-Mart by 1996.

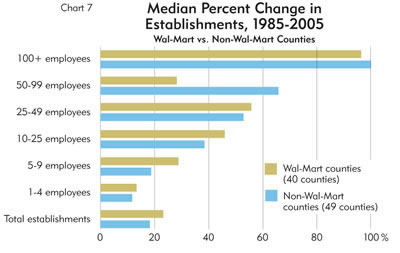

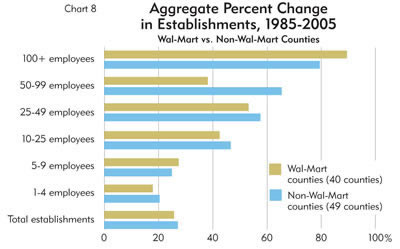

Trends in total county firms also go against the popular notion that Wal-Mart is laying waste to local businesses. Even among establishments with fewer than 10 employees, there was discernibly little Wal-Mart effect.

Median establishment growth in Wal-Mart counties, for example, was stronger than in non-Wal-Mart counties, particularly among smaller employers. In terms of aggregate establishment growth, non-Wal-Mart counties saw stronger growth (see Charts 7 and 8). However, as mentioned earlier, establishment growth among non-Wal-Mart counties is heavily influenced by a small number of booming counties; if the top five counties are removed from both study pools, aggregate establishment growth is higher for Wal-Mart counties.

Various other conclusions regarding establishment growth can be gleaned in favor of either Wal-Mart or non-Wal-Mart counties. But probably the most accurate conclusion from these data: The presence or absence of Wal-Mart is neither an obvious anchor nor a hot air balloon for business growth in a county.

Sales tax data offer another window on Wal-Mart's economic effect. Wal-Mart likely attracts shoppers from neighboring counties, and wider selection might also induce more frequent shopping. But a new store might also squeeze out other local retailers.

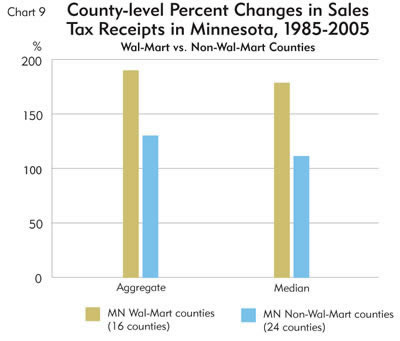

Taxable retail sales for 1985 and 2005 were gathered for Wal-Mart and non-Wal-Mart counties in Minnesota, North Dakota, South Dakota and Wisconsin. (Data weren't combined across states because tax rates and items eligible for sales tax are different among states and changed over this period. Also, Wisconsin data were from 1991 and 2005.)

Wal-Mart counties in each state saw mostly similar or faster growth in taxable sales compared with non-Wal-Mart counties. For example, taxable sales for Wal-Mart counties grew faster in North Dakota; in South Dakota and Wisconsin, average taxable sales were slower, but only by a couple of percentage points. But buyer beware; the number of observations in each of these states is small, which introduces some uncertainty.

In Minnesota, which had easily the largest number of county observations of any state, both median and aggregate county tax receipts grew much faster in Wal-Mart counties (see Chart 9). While the results are not conclusive, at least in Minnesota there seems to be a correlation between faster growth in taxable sales and the presence of a Wal-Mart.

Sales tax data are in nominal dollars.

How about a different angle?

The fedgazette also looked at shorter time periods, and the general findings were little changed. Over a two-year window—one year before store opening and one year after opening—Wal-Mart had little effect on average personal income or population; employment increased in Wal-Mart counties relative to non-Wal-Mart counties, especially in retail; and growth rates in earnings per job were generally similar, but were higher in retail for Wal-mart counties. Those findings held steady when the time frame was widened to six years (one year before opening, five years after opening).

Lastly, the fedgazette looked at Wal-Mart counties six years prior to the store opening, and these counties showed little evidence of having stronger income growth leading into the opening of the Wal-Mart. In other words, it's not obvious that Wal-Mart was able to ride the coattails of strong county economies and hide any potentially negative local effects.

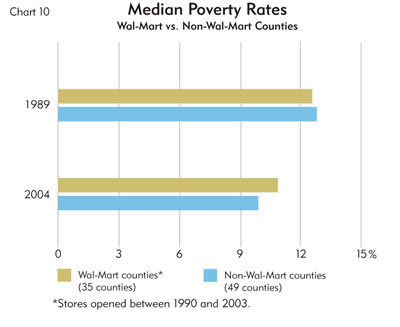

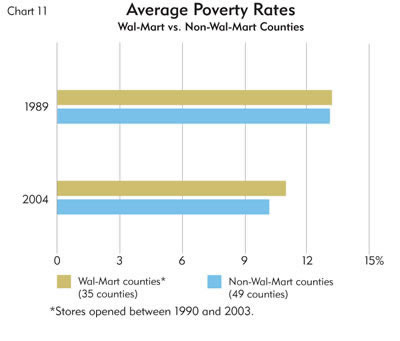

One finding not favorable to Wal-Mart has to do with poverty. From 1989 to 2004, poverty as a whole dropped across the Ninth District. Despite positive associations with some basic economic measures, Wal-Mart counties saw their poverty rates drop much less than non-Wal-Mart counties, both in median and average terms (see Charts 10 and 11). Counties with supercenters fared better, but poverty in those counties still did not improve as much as in those counties without a Wal-Mart.

The fedgazette investigated whether immigrant population flows had any relationship to the poverty trends. Immigrants are more likely to be poor than the native population, and it was hypothesized that Wal-Mart counties might attract more immigrants given the availability and visibility of new jobs and/or the cost-savings potential of living near a Wal-Mart. However, the data show little evidence that changes in the foreign-born population play a major role in the differential change in poverty within the two sets of counties.

So, friend or foe?

Regardless of predisposition to Wal-Mart—whether a vocal critic or a live-and-let-live advocate—none of these fedgazette findings can be considered the last word on the Wal-Mart effect because they are not "causal" in nature; that is, we cannot say that Wal-Mart is directly responsible for any particular outcome—positive or negative—in the counties investigated. This analysis merely offers correlated facts. Proving a causal relationship between Wal-Mart and local economic trends is rife with complications. Indeed, such complexity is one of the reasons controversy continues to swirl around the company.

With that caveat, findings from this fedgazette analysis suggest that much of the conventional wisdom regarding Wal-Mart's nefarious effects on local communities is off base, at least in relation to measures that the public and policymakers often use to gauge community health. The analysis is also absent any discussion of the savings local consumers realize by having Wal-Mart in town (see further discussion).

But neither does the analysis assume that Wal-Mart is a boon to counties. Though the balance of findings is, in sum, more positive than negative toward Wal-Mart, all of the measured effects were small. Given some positive and some negative outcomes, it's probably safest to say that Wal-Mart's net imprint on a county's health appears to be smaller than most perceive.

If that's surprising, maybe it shouldn't be. County economies—even small ones—are dynamic entities, constantly changing and extending well beyond their retail borders. Firms, jobs and people come and go with regularity, and for lots of different reasons. It could be that the economic idiosyncrasies of local communities—education levels, infrastructure investments, entrepreneurial culture, local business mix, geographic good fortune—play a larger role in determining the long-run growth prospects for the 89 counties studied here than whether the bogyman dressed as Wal-Mart showed up at the community door.

Description of Data Used in fedgazette Wal-Mart Analysis

See also related fedgazette article: Thomas J. Holmes on Wal-Mart's location strategy, March 2006. Holmes describes Wal-Mart's location strategy and possible implications for the Ninth District.

Ron Wirtz is a Minneapolis Fed regional outreach director. Ron tracks current business conditions, with a focus on employment and wages, construction, real estate, consumer spending, and tourism. In this role, he networks with businesses in the Bank’s six-state region and gives frequent speeches on economic conditions. Follow him on Twitter @RonWirtz.