The financial system in the United States experienced extreme stress and dysfunction from 2007 until the beginning of 2009, contributing to a major global economic downturn. The episode is generally believed to have been the worst economic and financial crisis since the Great Depression.

Narayana Kocherlakota, president of the Federal Reserve Bank of Minneapolis, recently described it as follows: “This was a time of tremendous uncertainty, and uncertainty … can strangle an economy. At that time, almost all believed that a horrific economic collapse—already named Depression 2.0—was possible. Indeed many believed that it was inevitable.”1 The deepest points of the crisis have passed, and although many segments of the economy are still under strain, the United States is now in the process of slow recovery.

Broad-based governmental and central bank action on various fronts was a key part of the response to the crisis. Fed Chairman Ben Bernanke summarized the Federal Reserve’s overall strategy as follows:

The Federal Reserve, like other economic policymakers, has been challenged by the unprecedented events of the past few years. We have been bold or deliberate as circumstances demanded, but our objective remains constant: to restore a more stable economic and financial environment in which opportunity can again flourish, and in which Americans’ hard work and creativity can receive their proper rewards.2

The numerous new programs devised and quickly implemented by the Federal Reserve System were specifically designed to stem the crisis by improving the functioning of various credit and funding markets, building confidence and creating extraordinary levels of liquidity. These Federal Reserve programs were described by Niel Willardson in the December 2008 Region.3 Now that the financial crisis has subsided, this article reviews those programs, describing their magnitude and current status. It also describes the significant impact they have had on the Federal Reserve System’s balance sheet.

I. Liquidity programs created to stem the crisis

The financial crisis was accelerated in large part by a liquidity shortfall in nearly all major financial markets as well as the corresponding loss of confidence in illiquid market participants. In normal times, the Federal Reserve uses two primary methods to inject liquidity into markets: open market operations and discount window lending. In the extraordinary circumstances of the financial crisis, however, these tools alone were insufficient, in both reach and magnitude, to create the liquidity and confidence needed to stabilize markets.

Therefore, the Federal Reserve created many new programs—in some cases under statutory authority that can only be invoked in “unusual and exigent circumstances”—to provide the liquidity needed to slow the crisis and prevent financial meltdown. While certain aspects of their effects may be subject to debate, it is generally believed that these programs were instrumental in averting crisis. As Kocherlakota observed: “It is clear to me that these policies worked as intended: They kept illiquid but solvent firms alive during the course of the financial crisis, while letting truly insolvent firms fail. In so doing, these policies eliminated the possibility of Depression 2.0.”4

Another measure of the success of the Federal Reserve’s slate of programs was that their timing and magnitude were carefully tailored. They were designed as temporary efforts to meet immediate, but short-term, needs. Indeed, nearly all of the programs have already ceased operation because they are no longer necessary; private markets are now meeting liquidity requirements.5

What follows is a description of the major liquidity programs implemented by the Federal Reserve, their magnitude, impact and current status.

A. Programs supporting banks

The crisis began when financial firms started becoming concerned about the financial condition of other financial firms—it was essentially a modern-day, broad-based “run.” This was due, in part, to the burst of the housing bubble, which created worries about the quality of mortgage loans that banks and other firms had made, as well as mortgage-backed securities they owned or were selling. Starting in the fall of 2007, rates of interbank loans with maturity terms of one month or longer rose to very high levels.

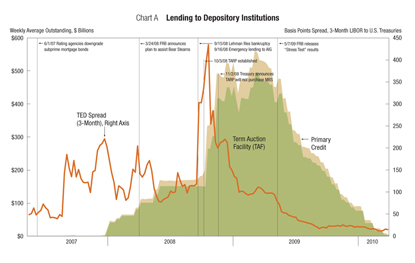

LIBOR, an interest rate at which banks lend to one another, is a market-based rate that nicely summarizes the sentiments of financial institutions’ comfort with their fellow firms; comparing it against a risk-free rate such as that on U.S. Treasury bills gives a helpful measure over time of perceived risk in lending markets. As noted in Chart A, the “TED spread”—the difference between the 3-month LIBOR and comparable U.S. Treasuries—rose from a normal level of around 50 basis points (a basis point is one-hundredth of a percentage point) to about 150 basis points and then in October 2008 to nearly 450 basis points. This 400-basis-point jump was largely due to the sharp increase in liquidity risk as well as the credit risk perceived by market participants.6 Charts A through C include key dates from the crisis period.

To respond to pressures in the interbank funding market, the Federal Reserve created the Term Auction Facility (TAF) (December 2007–March 2010), which allowed any depository institution eligible to borrow under the primary credit program to bid for a loan at an interest rate determined in an auction process. This facility was introduced on the heels of the introduction of term lending by the Federal Reserve, which first allowed 30-day and later 90-day loans from the discount window. The Federal Reserve has long engaged in short-term backup lending to depository institutions through its discount window. Pricing above market-based terms for lending and other factors led the window to be a contingency, rather than primary, source of funding for banks.

However, the fact that the interbank funding market was responding to negative perceptions of creditworthiness made institutions very reluctant to borrow from the Federal Reserve for fear that this would be perceived as a signal of their poor financial condition. Such a signal could further strain liquidity at these firms. Largely in response to this “stigma,” the Federal Reserve created the TAF in December of 2007 as a primary source of liquidity. Due to the perceived difference between auction bidding for discount window credit versus going directly to the discount window to get a loan, the TAF eliminated the stigma of borrowing from the Federal Reserve.

Of the numerous programs created by the Federal Reserve in response to the crisis, the TAF is considered one of the most successful. Depository institutions welcomed it, and early auctions were fully subscribed. While economic experts differ in reasoning, the consensus was that the TAF helped ease broader interbank money market liquidity concerns primarily by relieving individual financial institutions’ liquidity issues and related perceptions.7 One study showed that the TAF relieved strains in interbank money markets—a cumulative spread reduction of more than 50 basis points is associated with the TAF announcements and operations.8 Further, at extreme moments during the crisis, such as the period around the Lehman Brothers bankruptcy, the TAF served as an important liquidity backstop when the interbank market was stalled. Chart A shows the total amounts borrowed by financial institutions under the TAF and primary credit programs. As noted on this chart, TAF borrowing increased as the spread between U.S. Treasuries and 3-month LIBOR spiked and reached a peak of approximately $500 billion shortly after the Lehman Brothers and American International Group (AIG) events of September 2008. This chart also shows use of the Federal Reserve’s primary credit programs, which operated normally during the crisis, though with more attractive pricing and longer terms.

The TAF was adjusted as necessary during the crisis, with longer maturities and higher amounts being auctioned. As markets improved, the amounts bid at TAF auctions began falling short of the total offered; in mid-2009, the Federal Reserve began reducing the total funds auctioned. The final TAF auction was held on March 8, 2010.

The remainder of the special liquidity programs noted below were developed and operated under the authority of Section 13(3) of the Federal Reserve Act, a very rarely used authority that allows the Federal Reserve to make loans to all types of businesses, but only under “unusual and exigent circumstances.”

B. Programs supporting primary dealers

In March 2008, liquidity conditions in certain markets, particularly the repurchase agreements (“repos”) market, grew very strained. Repos are a form of financing in which an owner of a security sells it under an agreement to repurchase it on a future date at a fixed price; essentially, they function as loans collateralized by securities. At that time, primary dealers, which use repos and similar instruments as a major source of short-term financing, were becoming concerned with the creditworthiness of counterparties as well as the risk of the securities pledged as collateral in these transactions.9 As a result, “haircuts” (the difference between the market value of collateral and the amount that a lender will lend against it) increased significantly even for borrowers with high credit ratings and for extremely safe collateral such as Treasury securities.10

Due to this rapid jump in haircuts, some dealers had to turn to other funding sources. The situation that arose was this: If dealers could not borrow in those markets and did not have capital to fund their inventories, they would be forced to sell off holdings.11 In turn, if such sales could not be made because markets were illiquid, the dealers would likely become insolvent, which would force them into bankruptcy.12 Bear Stearns essentially faced this problem on March 13, 2008, and would have had to declare bankruptcy the next day had the Federal Reserve not extended it credit through JPMorgan Chase.13

At the height of the Bear Stearns situation, the Federal Reserve created the Primary Dealer Credit Facility (PDCF) (March 2008–February 2010) as an alternative source of liquidity. The Federal Reserve created the PDCF because it believed that the financial markets in which primary dealers traditionally finance themselves were seriously impaired.14 Thus, the PDCF was deemed necessary to help primary dealers avoid the problem experienced by Bear Stearns as well as to prevent Bear Stearns’ financial distress from spilling over to other institutions.

The PDCF provided overnight discount window loans, fully collateralized by investment-grade securities, to primary dealers. Its structure and function were similar to traditional discount window lending to depository institutions. The facility was designed to promote the orderly functioning of financial markets generally and to improve the ability of primary dealers to provide financing to participants in securitization markets.

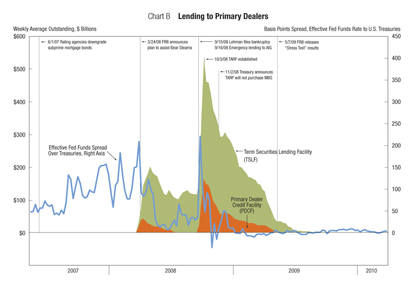

As Chart B shows, PDCF usage was high immediately, spiking to $40 billion. It then declined as the financing arrangements with Bear Stearns were concluded. Usage spiked higher yet to $150 billion in September 2008, when Lehman filed for bankruptcy and the Federal Reserve expanded PDCF-eligible collateral in response. This chart also shows the effective fed funds rate spread over comparable Treasuries. Repo market financing often closely tracks fed funds pricing, with overall rates running slightly below the fed funds market. Accordingly, using the more broadly available fed funds spread over Treasuries is a good proxy for what was taking place. Chart B shows the significant jumps in this spread during the crisis period, with noted peaks around the Bear Stearns and Lehman events. As the spread decreased to near zero, lending to primary dealers subsided.

These two spikes in activity immediately following major market disruptions suggest that the PDCF served its purpose of providing an alternate source of funding that prevented disruption from spreading among market participants.15 As market conditions improved thereafter, PDCF usage declined, reaching zero in May 2009. The PDCF was terminated in March 2010.

In addition to creating the PDCF, which was essentially a primary dealer version of traditional overnight discount window lending, the Federal Reserve created the Term Securities Lending Facility (TSLF) (March 2008–February 2010). The TSLF was a TAF-like program designed for use by primary dealers. Under this program, the Federal Reserve would lend up to $200 billion in Treasury securities to primary dealers for a period of 28 days (rather than the standard overnight borrowing). Like the TAF, the terms of these loans were created through auction-style bidding. TSLF loans were secured by securities, including federal agency debt and residential mortgage-backed securities. While the TSLF was not as fully utilized as the TAF in that the submitted bidding amount was substantially lower than the amount offered, total amounts outstanding under this program were often double the amounts outstanding under the PDCF. Once again, as Chart B indicates, the TSLF was used at the times of disruption in primary dealer markets; the two spikes in TSLF activity correspond with the Bear Stearns event and the Lehman bankruptcy.

C. Programs supporting commercial paper/money markets

As financial conditions worsened and confidence in a wide range of markets declined, investor confidence in securities, particularly asset-backed securities, also declined. Large numbers of investors began redeeming their investments in various types of funds. As a result, strains occurred in short-term debt markets as money market mutual funds struggled to sell assets to satisfy redemption requests and meet portfolio rebalancing needs. Due to these liquidity pressures, money market mutual funds and other investors became reluctant to purchase commercial paper, especially at longer-term maturities, which led to further strains in those markets. The Lehman failure also led to significant disruption.

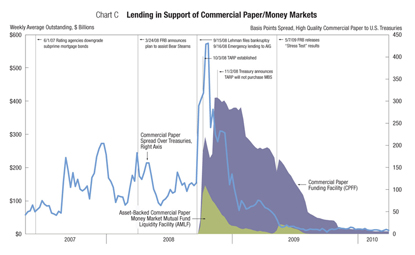

In September 2008, the Federal Reserve created the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF) (September 2008–February 2010) to help ease these strains in markets affected by money market mutual funds. Under this program, the Federal Reserve extended nonrecourse loans (that is, loans on which the lender can recover no more than the collateral pledged) at the primary credit rate to U.S. depository institutions, bank holding companies, and U.S. branches and agencies of foreign banks to finance their purchases of high-quality asset-backed commercial paper (ABCP) from money market mutual funds. This was intended to assist mutual funds holding ABCP in meeting demands for investor redemptions and to foster liquidity in ABCP markets and broader markets.

One month later, two companion programs were created as additional methods of easing strains in short-term debt markets. The Commercial Paper Funding Facility (CPFF) (October 2008–February 2010) was created to complement existing liquidity facilities by providing liquidity to term funding markets. The commercial paper market was under considerable strain in September and October 2008 as money market mutual funds—again, largely because of their own liquidity pressures—and other investors became increasingly reluctant to purchase commercial paper, especially at longer-dated maturities. The CPFF had a unique structure since it supported a private sector initiative to provide liquidity to money market investors; it provided financing to a special-purpose vehicle (that is, a corporation established in the private sector for this specific purpose), which used those funds to purchase 3-month commercial paper, both unsecured and asset-backed, directly from issuers.

Similarly, the Money Market Investor Funding Facility (MMIF) (October 2008–October 2009) was created to purchase eligible money market instruments. This program was similar to the CPFF in that it was designed to make loans to special-purpose vehicles, which in turn were to use this financing to purchase eligible money market instruments. However, unlike the CPFF and the AMLF, the MMIF was never utilized and was one of the first programs to be terminated.

Chart C shows usage levels for the AMLF and the CPFF. As the chart shows, AMLF and CPFF use was high immediately upon creation and peaked within a matter of months. CPFF use, for example, peaked a mere three months after its inception; AMLF peaked even more quickly, followed by a steep drop-off. Throughout 2009, usage of both programs steadily decreased as markets returned to normal. Again, market information is instructive—spreads between high-quality commercial paper and comparable Treasuries spiked just prior to operation of these programs, gradually moderated and eventually returned to normal levels.

Interestingly, at its peak, the CPFF’s portfolio was primarily composed of financial commercial paper, but during 2009, its composition tilted toward asset-backed paper.16 This illustrates not only that initial usage was tied to a significant market disruption but also that the markets in asset-backed paper have been slower to recover. Research to date indicates that both programs helped to bring stability to their respective markets. One study found that the CPFF had the intended stabilizing effect; at its peak, it held over 20 percent of all outstanding commercial paper, but by early 2010, it held only 1 percent.17 Likewise, Fed researchers, using a set of loans extended under the AMLF as well as historical data for commercial paper transactions, were able to conclude that the program stabilized asset outflows from money market funds, restored liquidity to the commercial paper market and drove down credit spreads.18

D. Programs assisting market participants more broadly

As mentioned above, the financial crisis began when the housing bubble burst and investors lost confidence in firms holding large quantities of asset-backed securities (ABS), particularly those backed by mortgages. The loss of confidence in these markets became clear in September 2008 with a month-long decline in activity, followed by a near halt in October. At that time, the interest rate spreads on AAA-rated tranches (classes or portions differentiated by risk level) of ABS rose to unprecedented levels, reflecting extreme-risk premiums.

To combat this problem, the Federal Reserve created the Term Asset-Backed Securities Loan Facility (TALF) (November 2008–June 2010). Under the TALF, the Federal Reserve Bank of New York was authorized to lend up to $200 billion on a nonrecourse basis to holders of AAA-rated ABS backed by newly and recently originated consumer and small business loans. The TALF was intended to support the issuance of ABS collateralized by student loans, auto loans, credit card loans and loans guaranteed by the Small Business Administration, which in turn supports economic activity by providing credit to households and small businesses.

The first TALF auction issued $4.7 billion in loans; the second auction only $1.7 billion. The TALF’s largest auction occurred less than three months later on June 2, 2009, and resulted in $11.5 billion in loans. Although some thought that initial borrowing levels were not high enough to revive securitization markets, there is strong evidence that the TALF had a positive effect. As TALF operations got under way, most markets, but notably not the commercial mortgage-backed securities (CMBS) market, began to show signs of recovery.19 By mid-2009, issuance of consumer ABS was gradually rising and spreads on AAA-rated credit card ABS had significantly narrowed.20 Due to continued strains in the CMBS market, the Federal Reserve expanded the scope of the TALF in May 2009 to make highly-rated CMBS eligible for the program. Shortly thereafter, the risk spread on the AAA-rated CMBS began a fairly steady decline. This, in combination with the fact that lower-rated CMBS (not TALF-eligible) showed little or no improvement, is evidence of the TALF’s effectiveness.

All other special Federal Reserve programs were terminated at the end of 2009 or the beginning of 2010, as their respective markets stabilized, but the TALF, initially scheduled to terminate at the end of December 2009, was extended to address continued strains in specific markets. For newly issued ABS and legacy CMBS, the TALF continued through March 31, 2010, and for newly issued CMBS, it is scheduled to continue until June 30, 2010. This extended duration is due, at least in part, to the fact that the TALF supports issuance of ABS, the market that experienced the greatest disruption.

Another program, central bank swaps, was aimed at improving global bank liquidity by bringing down interbank rates worldwide. Through this program, the Federal Reserve made dollars available to other central banks, which posted their own currency as collateral. These swap lines peaked at nearly $600 billion in December 2008, and on February 1, 2010, the program was terminated. An April 2010 New York Fed study of the program noted that it smoothed disruptions in overseas dollar funding markets. Further, the swaps program was also closely tailored to the need. According to the study’s authors: “Pricing of funds offered through the swap lines gave institutions an incentive to return to private sources of funding as market conditions improved.”21

On May 9, 2010, in response to the reemerging strains in U.S. dollar short-term funding markets in Europe, various central banks announced reconstituted temporary U.S. dollar liquidity swap facilities. Like the swap arrangements that expired on February 1, 2010, these facilities enable central banks to conduct tenders of U.S. dollars in their local markets at fixed local rates for full allotment.

What were the losses associated with all of these special liquidity programs? To date, the Federal Reserve has not incurred a single loss on any of them. Many programs reported significant income, which ultimately is turned over to the U.S. Treasury after Federal Reserve expenses are paid. Also, because of the manner in which arrangements are structured, the Federal Reserve bears no foreign exchange risk or credit risk on the swaps program.

E. Firm-specific lending efforts—Bear Stearns and AIG

In addition to the creation of the liquidity programs described above, the Federal Reserve System used its emergency lending powers to prevent the disorderly failure of two systemically important firms, Bear Stearns and AIG. This was done to prevent spillover to the U.S. financial system and the economy more broadly.

In the strained funding conditions of March 2008, Bear Stearns—which had been operating on such a highly leveraged basis that it did not have sufficient capital to fund its inventories—found itself unable to borrow enough to meet its needs and in a market too illiquid to sell off its holdings. Without intervention, it would have had to file for bankruptcy on March 14, 2008. To prevent this, the Federal Reserve used its emergency lending powers to lend $29 billion to assist in the acquisition of Bear Stearns by JPMorgan Chase; this money was loaned to a special-purpose vehicle, Maiden Lane LLC, which holds as collateral for the loan a portfolio of Bear Stearns assets. Chairman Bernanke stated that this was a necessary step since the damage caused by a Bear Stearns bankruptcy would be “severe and extremely difficult to contain.” A Bear Stearns default, observed Bernanke, would have led to a “chaotic unwinding” of the firm’s investments and “the adverse impact … would not have been confined to the financial system, but would have been felt broadly in the real economy through its effects on asset values and credit availability.”22

Similarly, AIG faced a liquidity crisis shortly thereafter when it, too, was unable to fund its operations in illiquid markets. AIG was also beginning to suffer losses stemming from its activities dealing with subprime mortgages: AIG had a significant securities lending program that dealt in mortgage-backed securities, and it issued credit default swaps funded through investments in mortgage-backed securities. By September 2008, AIG was faced with the dilemma of having to sell large amounts of its holdings in securities to raise sufficient capital in a market where the value of such securities had plummeted. AIG would have had to sell those holdings at a significant loss and, as such, may not have been able to raise sufficient capital to remain solvent. The failure of AIG would have had significant spillover effects and intensified the already severe crisis, worsening global economic conditions. To prevent this from occurring, the Federal Reserve agreed to make loans to AIG to give it the necessary liquidity to allow it to sell its assets over time so that their value could be maximized. As part of the transaction, the Federal Reserve received a 79.9 percent equity interest in AIG, as well as a pledge and later transfer of asset-backed securities, which are held in other special-purpose vehicles, Maiden Lane LLC II and III.

These rescues, which were heavily coordinated with government officials, were extraordinary actions for a central bank and were not without controversy. Certainly, it would have been preferable not to have had to make these types of emergency rescues; yet in those particular circumstances, it was thought necessary in order to avoid major disruptions of institutions directly connected to Bear Stearns and AIG, as well as the indirect connections to the entire financial system. The goals of these programs included their being managed and liquidated in a manner consistent with taxpayers’ best interests. The amount of assets held by the Federal Reserve under these programs has remained relatively stable since the time the loans were first made; as of the end of first quarter 2010, their assets totaled approximately $115 billion.

II. The Federal Reserve’s balance sheet

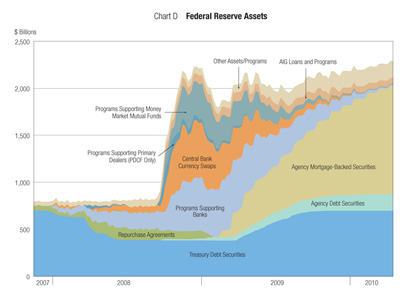

The unprecedented size of the Federal Reserve’s balance sheet is a tangible reminder of the stress imposed by the financial crisis. As of the end of first quarter 2010, the size of the Federal Reserve’s balance sheet remains at historically high levels with slightly over $2.3 trillion in assets; it has remained between this amount and $1.85 trillion since December 2008. Although the size of the balance sheet has remained rather steady during this time, the underlying composition of assets has shifted significantly. Chart D shows the changes in Federal Reserve asset holdings during the past several years.

Up until September 2008 or so, the level of securities held outright by the Federal Reserve declined as it sold Treasury securities to accommodate its aggressive implementation of liquidity facilities. This period was marked by unprecedented expansion of nontraditional programs and assets such as primary dealer loans, the TAF and central bank swap lines, among others.

But in early to mid-2009, demand for new loans through these special liquidity programs dropped substantially. At that time, the Federal Reserve began a large-scale asset purchase program, buying Treasury securities, federal agency securities and government agency-guaranteed mortgage-backed securities. The loans that now remain on the Federal Reserve’s balance sheet can largely be tracked to the extraordinary institution-specific arrangements with Bear Stearns and AIG.

The securities holdings currently on the Federal Reserve’s balance sheet are remarkable in two respects. The first is their sheer size—the Federal Reserve owns about $1.1 trillion in agency-guaranteed mortgage-backed securities and about $170 billion in agency debt. Those two categories now account for more than half of the Federal Reserve’s current total asset holdings; before the crisis, they accounted for a negligible fraction of the total.

Second, unlike the Treasury securities typically on the Federal Reserve’s balance sheet, these securities were issued by housing finance agencies (mostly Fannie Mae and Freddie Mac). That said, since these agency securities, like Treasuries, are guaranteed by the U.S. government, they have no default risk for the Federal Reserve (although they do have interest rate and prepayment risk).

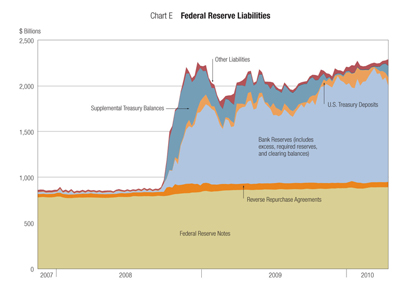

While the liability side of the Federal Reserve’s balance sheet does not have as many components as the asset side, it also has seen significant compositional changes due to the crisis (see Chart E). In particular, after the Federal Reserve began to pay interest on reserves in October 2008 (when it gained statutory authority to do so), the Federal Reserve’s balance sheet was no longer constrained by monetary policy considerations, and the size of programs such as the TAF and central bank swaps could increase as necessary.23

While currency outstanding (“Federal Reserve Notes” in chart) remained relatively stable during the crisis, bank reserves rose dramatically, from about $10 billion in August 2008 to $1.2 trillion in February 2010. The last major component of liabilities, supplemental Treasury balances, also has fluctuated as necessary to assist the Federal Reserve in funding its special liquidity programs.

III. Conclusion

The financial crisis left an indelible mark on the nation’s economy and will continue to shape policy going forward. The Federal Reserve’s emergency liquidity programs played an important part in reestablishing financial stability, and most are no longer necessary. Therefore, nearly all of the new liquidity programs targeted to banking, primary dealer and money markets have been terminated. The TAF was the most recent to close, conducting its final auction on March 8, 2010. The primary credit term program reverted to an overnight program, also in March 2010. Of all these broader programs, only the TALF continues to operate; it will complete its final loans on June 30, 2010, and its lending is currently limited to loans backed by commercial mortgage-backed securities.

The relatively quick winding down of these programs is a strong indicator that the programs were well-tailored to meet short-term needs during a time of crisis. The liquidity problems at which each was directed have largely been resolved, and financial markets that had seized up during the crisis have been restored to near normalcy.

The assets related to the financial crisis that remain on the Federal Reserve’s balance sheet consist of the special arrangements with AIG and Bear Stearns, the TALF, and federal agency debt and agency securities.

The United States, and many other nations, have emerged from the recent financial crisis with body blows—depressed economic growth, significant unemployment and decreased household wealth.

These blows to the U.S. economy have been felt deeply by individual households and citizens, and they will continue to have serious consequences for some time to come.

Nonetheless, there is little doubt that outcomes could have been much, much worse. As a major part of the international effort to stabilize financial markets and avert a greater financial meltdown, the Federal Reserve implemented a broad set of traditional and nontraditional programs. These innovative programs provided critical liquidity to markets and played an important role in restoring confidence and stability to the U.S. economy.

For additional information about Federal Reserve System liquidity programs, see http://www.newyorkfed.org/markets and http://www.federalreserve.gov/monetarypolicy/bst.htm.

Data sources for charts are the Federal Reserve and Bloomberg.

Endnotes

1 Kocherlakota, Narayana. “The Economy and Why the Federal Reserve Needs to Supervise Banks.” Allied Executives Business and Economic Outlook Symposium. Minneapolis, Minn. March 2, 2010.

2 Bernanke, Ben S. Remarks at the Nomination of Ben S. Bernanke for Chairman of the Federal Reserve. Oak Bluffs, Miss. Aug. 25, 2009.

3 Willardson, Niel. “Actions to Restore Financial Stability: A Summary of Recent Federal Reserve Initiatives.” The Region. Federal Reserve Bank of Minneapolis. December 2008.

4 Kocherlakota, Narayana, supra.

5 Bernanke, Ben S., “Federal Reserve’s Exit Strategy.” Prepared Remarks for Testimony before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C. Feb. 10, 2010.

6 McAndrews, James, Asani Sarkar and Zhenyu Wang. “The Effect of the Term Auction Facility on the London Inter-Bank Offered Rate.” Staff Report 335. Federal Reserve Bank of New York. July 2008.

7 Wu, Tao. “On the Effectiveness of the Federal Reserve’s New Liquidity Facilities.” Research Department Working Paper 0808. Federal Reserve Bank of Dallas. May 2008.

8 McAndrews, James, supra.

9 Adrian, Tobias, Christopher Burke and James McAndrews. “The Federal Reserve’s Primary Dealer Credit Facility.” Current Issues in Economics and Finance 15, no. 4. August 2009.

10 Id.

11 Id.

12 Id.

13 Id.

15 Adrian, Tobias, supra.

16 Adrian, Tobias, Karin Kimbrough and Dina Marchioni. “The Federal Reserve’s Commercial Paper Funding Facility.” Staff Report 423. Federal Reserve Bank of New York. January 2010.

17 Id.

18 Duygan-Bumpt, Burcu, Patric M. Parkinson, Eric S. Rosengren, Gustavo A. Suarez, and Paul S. Willen. “How Effective Were the Federal Reserve Emergency Liquidity Facilities? Evidence from the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility.” Working Paper QAU10-3, Federal Reserve Bank of Boston. April 29, 2010.

19 Robinson, Kenneth. “TALF: Jump-Starting the Securitization Markets.” Economic Letter—Insights from the Federal Reserve Bank of Dallas 4, no. 6. August 2009.

20 Dudley, William C. “A Preliminary Assessment of the TALF.” Remarks at the Securities Industry and Financial Markets Association and Pension Real Estate Association’s Public-Private Investment Program Summit. New York City. June 4, 2009.

21 Fleming, Michael J. and Nicholas J. Klagge. “The Federal Reserve’s Foreign Exchange Swap Lines.” Current Issues in Economics and Finance 16, no. 4. Federal Reserve Bank of New York. April 2010.

22 Bernanke, Ben S. “The Economic Outlook.” Congressional Testimony. April 2, 2008.

23 Dudley, William C. “The Economic Outlook and the Fed’s Balance Sheet: The Issue of ‘How’ versus ‘When’.” Remarks at the Association for a Better New York. New York City. July 29, 2009.

Related Content

Related Content