The Federal Reserve Bank of Minneapolis strives to maintain a deep understanding of the economic conditions affecting communities across the Ninth Federal Reserve District.1 This understanding informs the Minneapolis Fed’s role in supervising financial institutions located in the district. That supervisory role includes evaluations of certain depository institutions under the Community Reinvestment Act (CRA).

Recently, the Minneapolis Fed embarked on a pilot project to improve our understanding of one particular area of our district. A team from multiple Minneapolis Fed departments spent a week in Billings, Montana, and on the nearby Crow Reservation talking with stakeholders from public agencies, businesses, and nonprofit organizations. We learned about the state of their region’s community development sector and heard about ways community stakeholders—including staff from the Minneapolis Fed—can strengthen local initiatives to meet community needs. This article describes the motivation for the trip and the engagement methods deployed by staff. It also provides high-level learnings drawn from the team’s week in Billings and further data analysis.

Like a CRA conversation, only not

At the start of a CRA evaluation for an individual depository institution, bank examiners complete a performance context analysis. Evaluators collect and examine “a broad range of economic, demographic, and institution- and community-specific information [in order to] understand the context in which an institution’s record of performance should be evaluated.”2

The performance context analysis includes information collected through structured conversations with local experts known as community contacts. Examples of community contacts include leaders of business organizations, community development financial institutions,3 or nonprofits. These conversations shed light on trends, nuances, challenges, and opportunities in lower-income communities.

Unlike the discussions that contribute to a performance context analysis, our conversations in Billings were not oriented around—and did not reference—specific depository institutions or their performance. As a result, the information we gathered will not be directly used for any specific CRA evaluation. Instead, we sought to develop a shared understanding of community needs and opportunities in the region. Ideally, these findings will be useful for all stakeholders in the Billings area.

A marathon of meetings

We held 26 meetings, including roundtables, small-group interviews, and public presentations. Over the course of those meetings, we interacted with more than 60 city and regional leaders about the needs, challenges, and opportunities of the area’s low- and moderate-income communities and individuals. The Billings region was selected as an intriguing pilot community for several reasons. It is the most populous metro area in Montana; it is the financial hub for eastern Montana; it sits a short distance from the Bakken oil fields and the Crow Reservation; and its economy exhibits both similar and divergent trends relative to the state and nation.

These confidential conversations with stakeholders were loosely organized around a core set of open-ended questions, including:

- From your perspective, what do you view as major challenges or barriers to improving lower-income neighborhoods and communities in the Billings region (or on the Crow Reservation)?

- Are there opportunities for banks to get more involved in the work that you’re doing in the community? If yes, what are they? If no, why not?

- Please tell us about any initiatives or programs in the community that show promise or have shown positive results in addressing the issues you identified.

- What’s something you wish the funders of your organization understood about the work you do?

What we learned

After we returned from Billings, our team reviewed and analyzed the collected information and organized it into common themes that captured the essence of the meeting discussions. We also reviewed related quantitative data, reports, and studies in order to enhance our understanding of the identified themes.

What were our key takeaways? Overall, a majority of our community contacts observed that Billings is “a city on the verge.” The sense that change is coming to the region came through in discussions about plans to rewrite the city’s zoning code, formulate a long-term vision for its urban core, and continue to grow its health care sector. However, community contacts we met with were mostly divided on the question of whether the region is planning for change in a way that will benefit all residents equitably.

As to particular needs and opportunities in the region, the following insights emerged:

- To address key issues, stakeholders may need to strengthen cross-sector collaborations. The Billings area features some community-level interventions that draw on the strengths of multiple sectors. Several cross-sector initiatives that seek to address issues like child care, housing, and community health in the region are showing promise and merit strengthening.

- Parents, child care workers, and child care operators all face challenges that may impact the broader business community. Business leaders described the lack of available child care as a barrier to filling open positions and growing their companies. Stakeholders frequently described child care providers’ own struggles to stay open and recruit and retain staff.

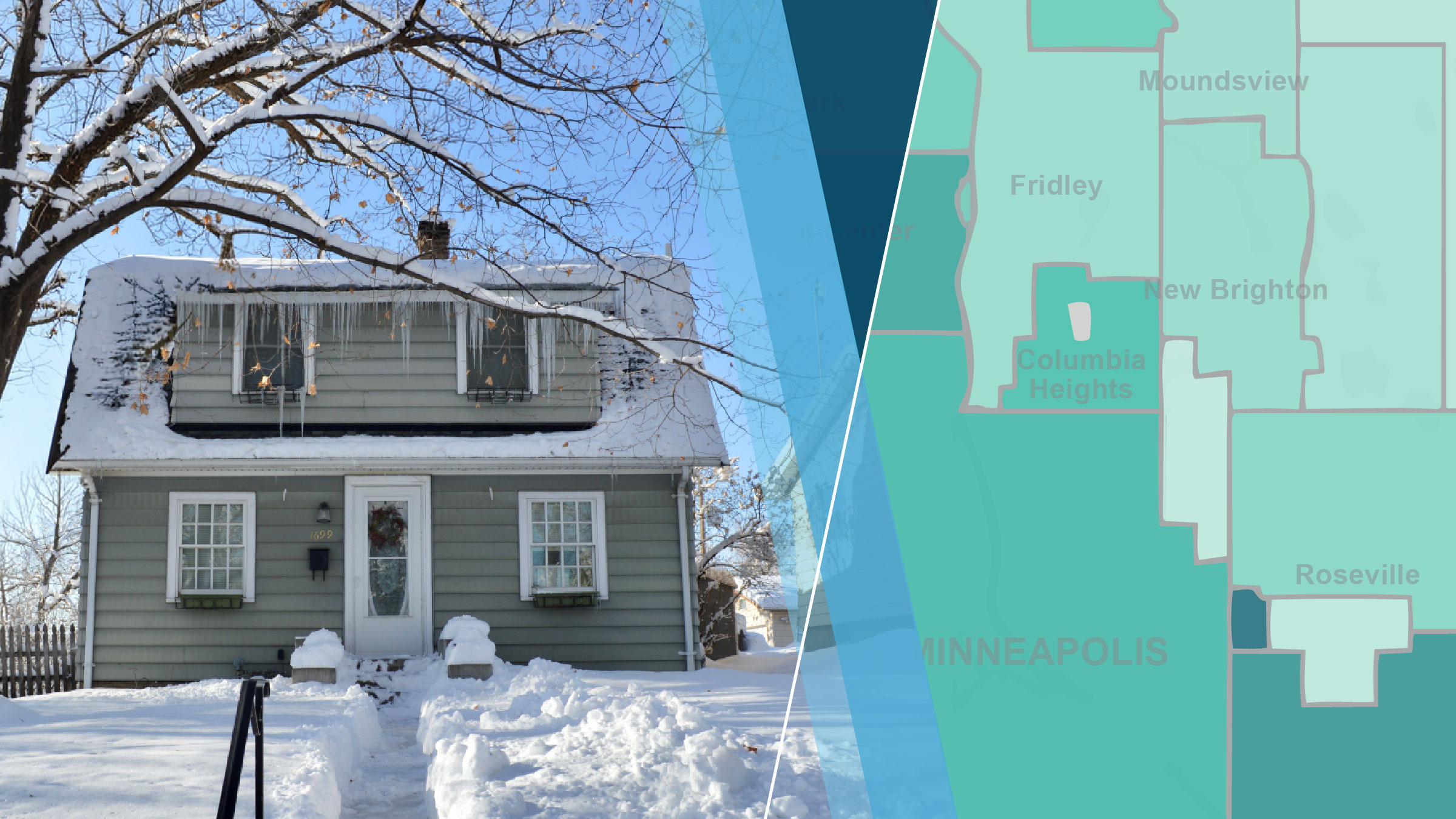

- Lower-income renters face challenges in their attempts to find affordable housing. Overall, about two-fifths of the renters in Billings spend at least 30 percent of their income on housing expenses. Lower-income renters in the region face greater cost burdens; about three-quarters of them spend more than 30 percent of their income on housing, including about 44 percent that spend more than half of their income on housing.4

- Lower-income households, especially households of color, face financial stability challenges. These challenges include higher levels of growth in low-wage employment sectors, a higher incidence of unemployment for non-white populations, limited access to transportation, and limited access to unrestricted savings or affordable credit for emergencies. Their impact may be particularly felt by Billings’ large Native American population, whose poverty rate is double that of Billings’ white population. Some local stakeholders are working in partnership with Native leaders to develop targeted approaches to the challenges Native American households face.

As big as some of these challenges may seem, our conversations with local leaders gave the impression that they are rolling up their sleeves and working on creative solutions. As an example, in a related article, we discuss some of the efforts underway to improve Billings’ early care market.

What’s next?

In addition to conducting our analysis of needs and opportunities in the region, we hope to help nurture cross-sector collaborations in and around Billings through continued outreach, dialogue, engagement, and targeted events. For example, Minneapolis Fed President Neel Kashkari will visit Billings on September 26 to meet with business, civic, and nonprofit leaders and hold a public town hall event at Montana State University Billings.

The Minneapolis Fed also plans to host an Investment Connection session in Billings in the near future. Investment Connection is an event series where community and economic development organizations propose project ideas to an audience of potential funders, including foundations and depository institutions. The ultimate goal of activities like Investment Connection is to build partnerships among community development actors in the Ninth District.

Explore more features related to our community engagement trip to Billings:

Early care market may be an economic-mobility barrier in Billings

Where the child care and energy markets meet: A conversation with Dan Carter of ExxonMobil

Endnotes

1 The Minneapolis Fed’s district includes Montana, North and South Dakota, Minnesota, Northwestern Wisconsin, and the Upper Peninsula of Michigan.

2 See Community Reinvestment Act; Interagency Questions and Answers Regarding Community Reinvestment.

3 Community development financial institutions (CDFIs) are specialized entities that provide financial products and services, such as small business loans and technical assistance, in markets not fully served by traditional financial institutions. For more information, visit our CDFI Resources web page.

4 Cost-burden statistics are based on custom tabulations of U.S. Census Bureau data available from the U.S. Department of Housing and Urban Development (HUD) Comprehensive Housing Affordability Strategy. Lower-income refers to households earning 50 percent or less of the HUD Area Median Family Income for Billings. The data can be accessed via the HUD User data portal.

Casey Lozar is a Minneapolis Fed vice president and director of our Center for Indian Country Development, a research and policy institute that works to advance the economic self-determination and prosperity of Native nations and Indigenous communities. Casey is an enrolled member of the Confederated Salish and Kootenai Tribes and he’s based at our Helena, Mont., Branch.